CarGurus’s 38.7% return over the past six months has outpaced the S&P 500 by 29.4%, and its stock price has climbed to $35.01 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy CarGurus, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we don't have much confidence in CarGurus. Here are three reasons why CARG doesn't excite us and a stock we'd rather own.

Why Is CarGurus Not Exciting?

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

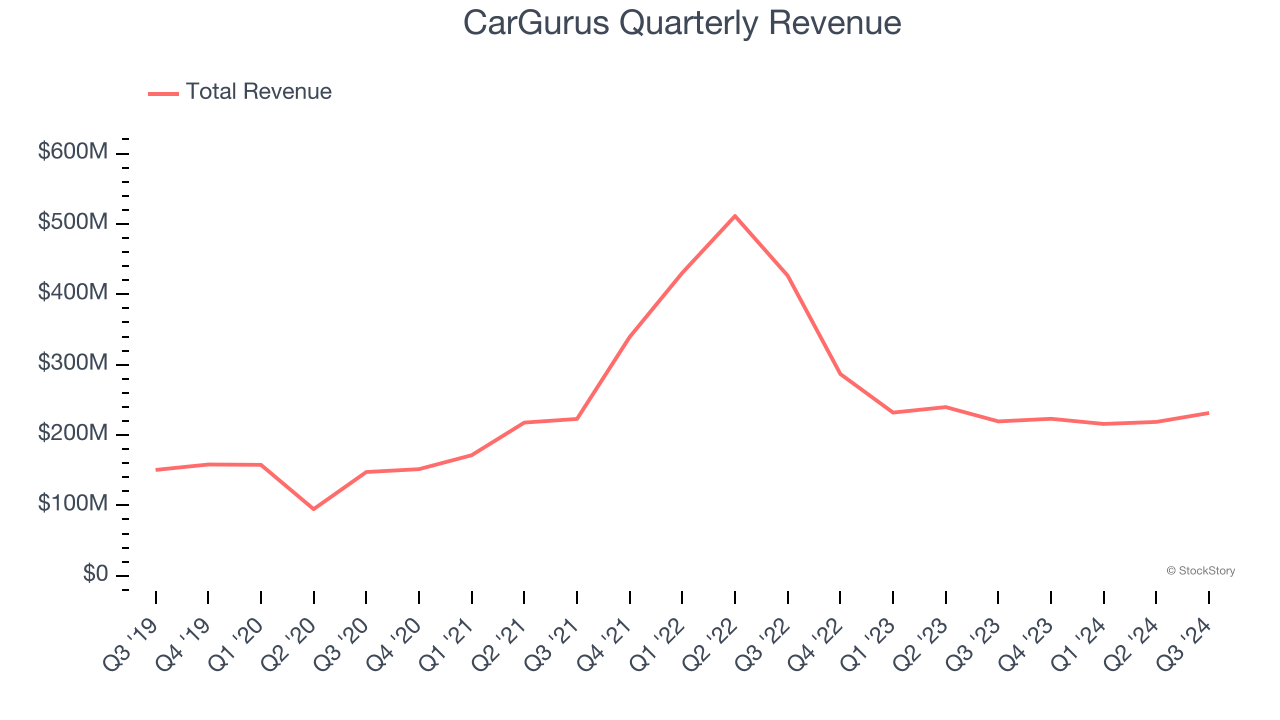

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, CarGurus grew its sales at a sluggish 5.2% compounded annual growth rate. This fell short of our benchmark for the consumer internet sector.

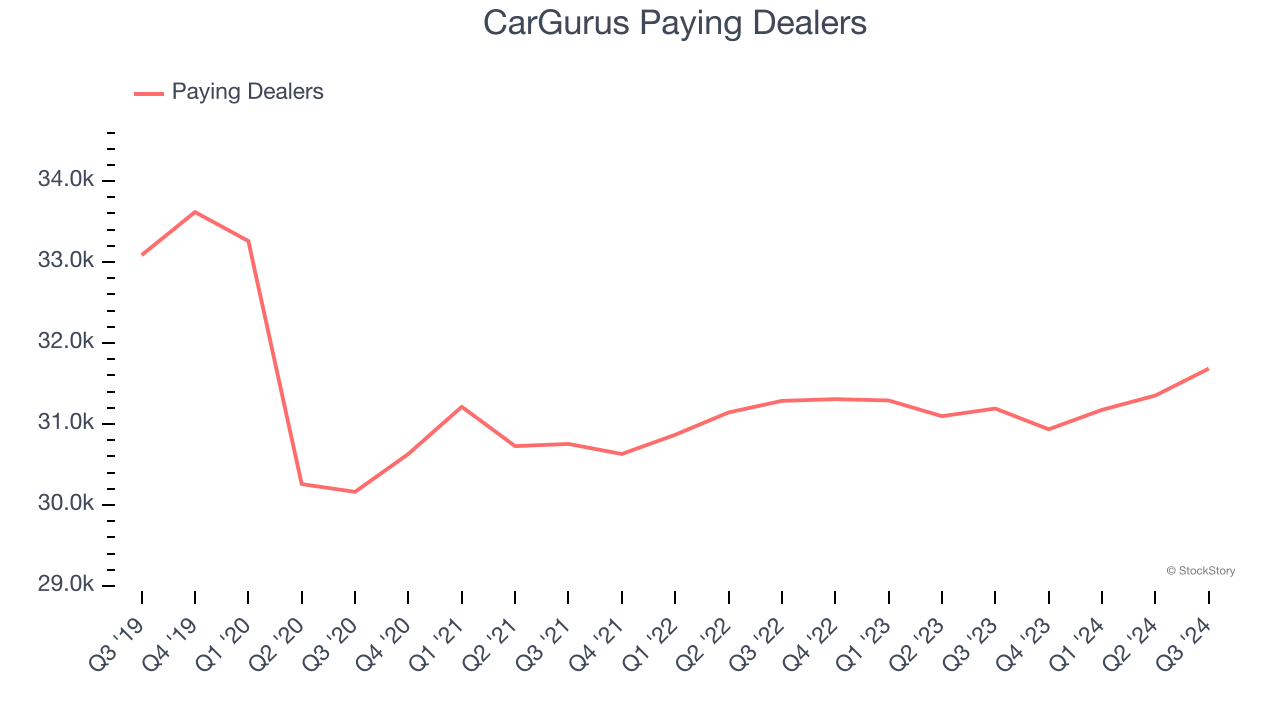

2. Paying Dealers Hit a Plateau

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

CarGurus struggled to engage its paying dealers over the last two years as they have been flat at 31,684. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If CarGurus wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

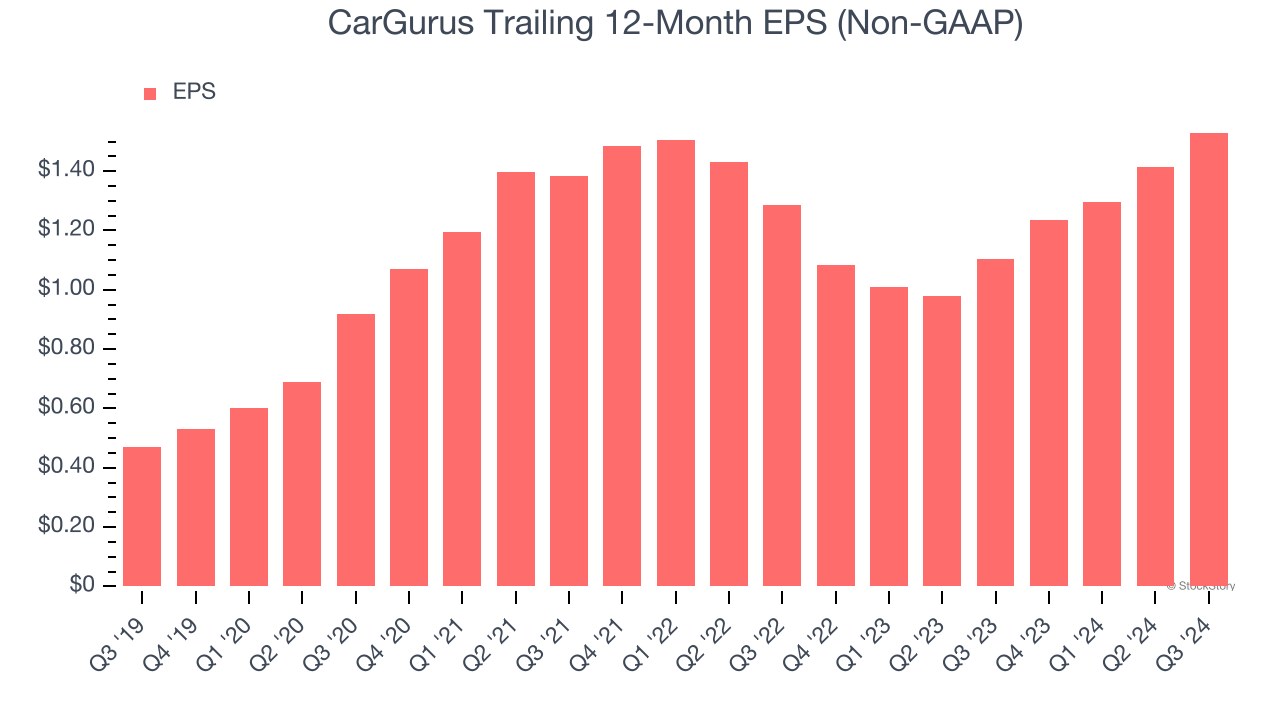

3. EPS Barely Growing

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CarGurus’s EPS grew at a weak 3.4% compounded annual growth rate over the last three years, lower than its 5.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

CarGurus isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 15× forward EV-to-EBITDA (or $35.01 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than CarGurus

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.