BlackLine has had an impressive run over the past six months as its shares have beaten the S&P 500 by 18.9%. The stock now trades at $61.53, marking a 28.6% gain. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in BlackLine, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about BlackLine. Here are three reasons why we avoid BL and a stock we'd rather own.

Why Is BlackLine Not Exciting?

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ: BL) provides software for organizations to automate accounting and finance tasks.

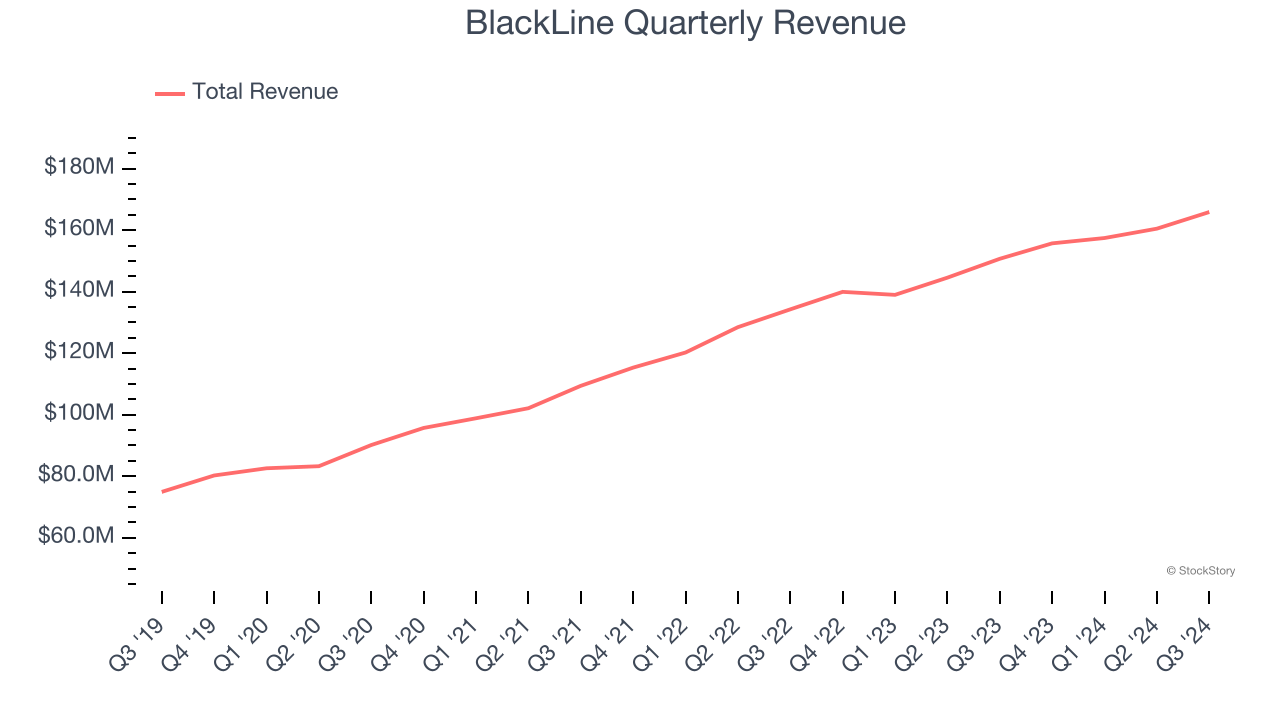

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, BlackLine grew its sales at a 16.3% annual rate. Although this growth is solid on an absolute basis, it fell slightly short of our benchmark for the software sector.

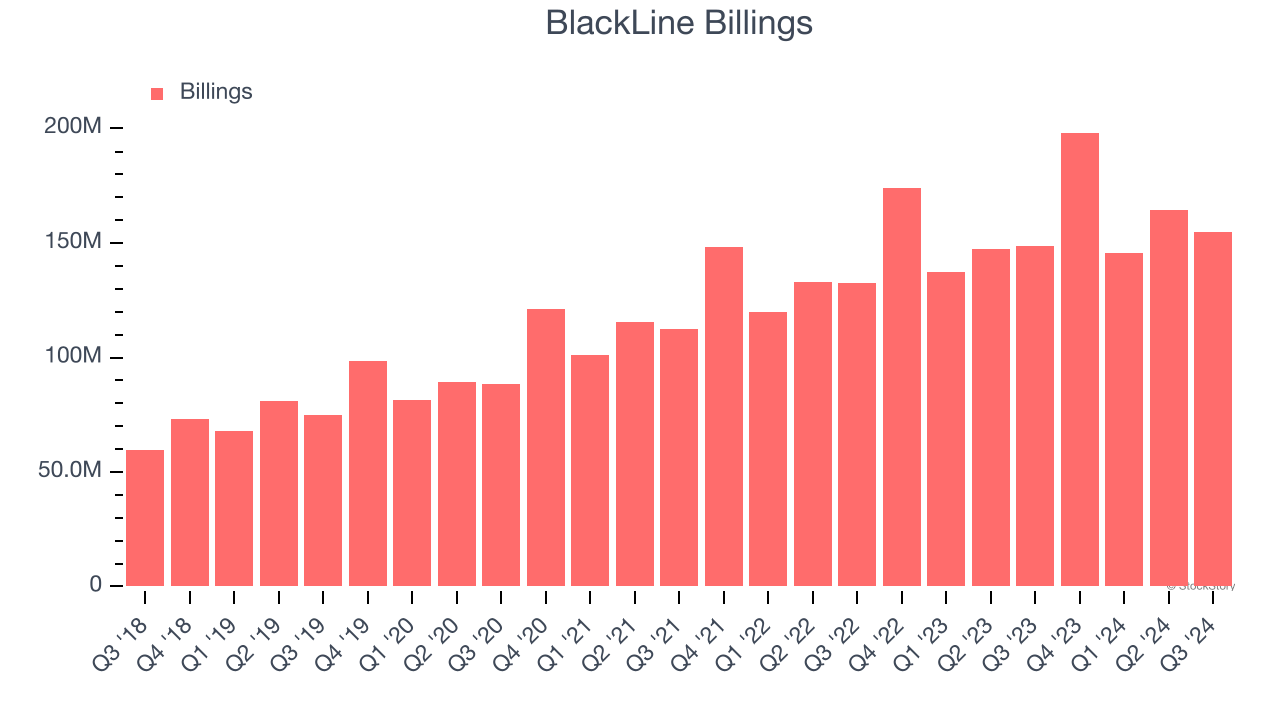

2. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

BlackLine’s billings came in at $154.9 million in Q3, and over the last four quarters, its year-on-year growth averaged 9%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

3. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict BlackLine’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 25.5% for the last 12 months will decrease to 21.4%.

Final Judgment

BlackLine isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 6.7× forward price-to-sales (or $61.53 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than BlackLine

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.