Since June 2024, Teladoc has been in a holding pattern, posting a small return of 0.6% while floating around $9.38. The stock also fell short of the S&P 500’s 8.8% gain during that period.

Is there a buying opportunity in Teladoc, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in Teladoc. Here are three reasons why you should be careful with TDOC and a stock we'd rather own.

Why Is Teladoc Not Exciting?

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE: TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

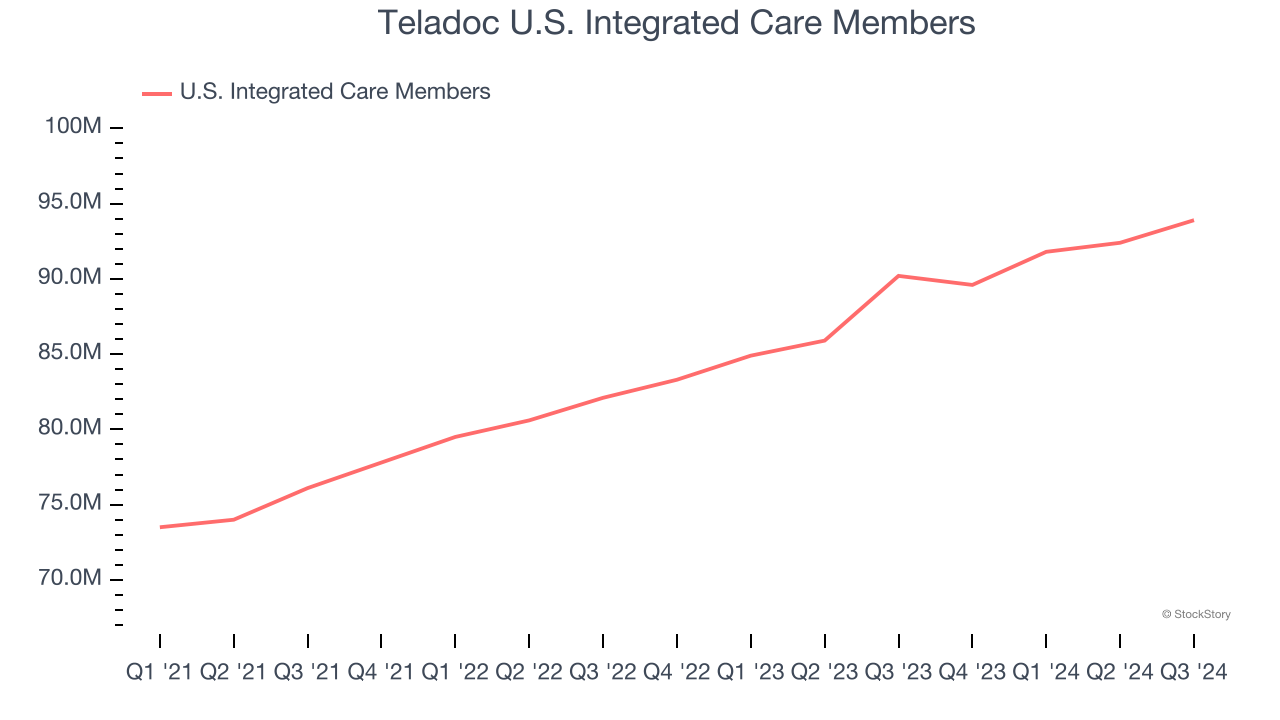

1. Change in U.S. Integrated Care Members Points to Soft Demand

As an online marketplace, Teladoc generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Teladoc’s u.s. integrated care members, a key performance metric for the company, increased by 7.2% annually to 93.9 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Teladoc wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

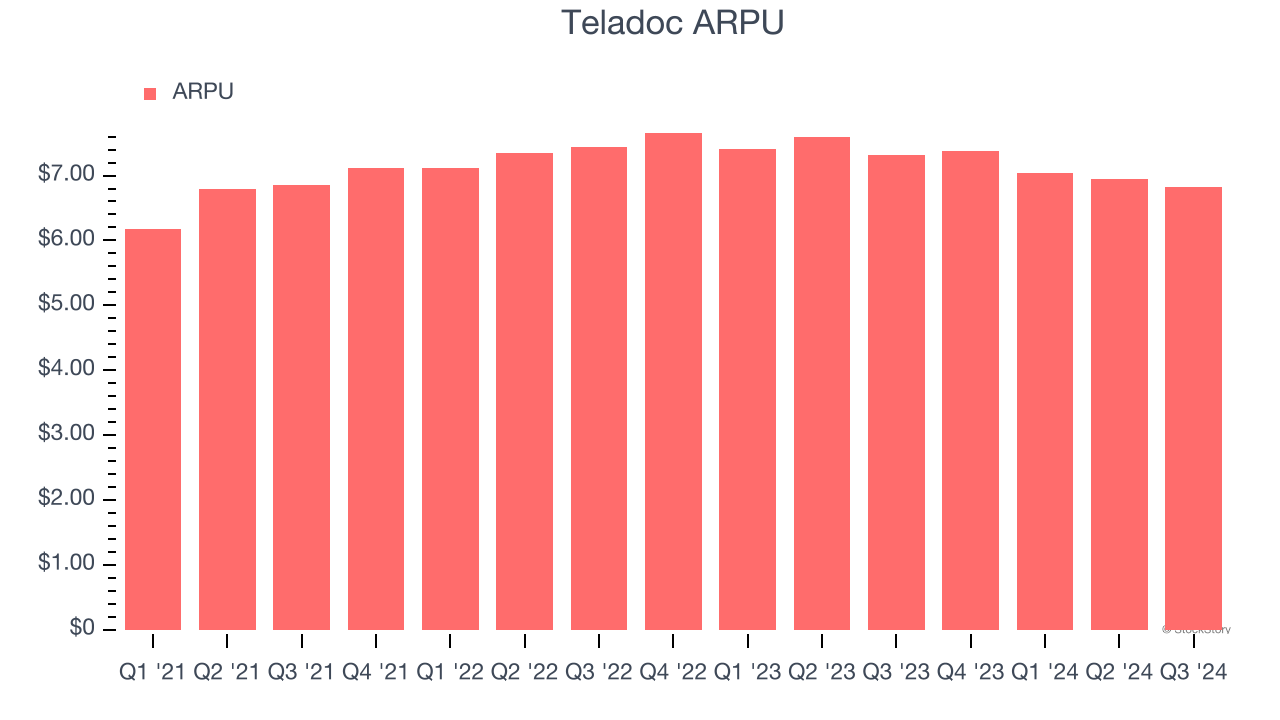

2. Customer Spending Decreases, Engagement Falling?

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like Teladoc because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Teladoc’s take rate, or "cut", on each order.

Teladoc’s ARPU fell over the last two years, averaging 1.3% annual declines. This isn’t great when combined with its weaker u.s. integrated care members performance. If Teladoc tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether user growth would be sustainable.

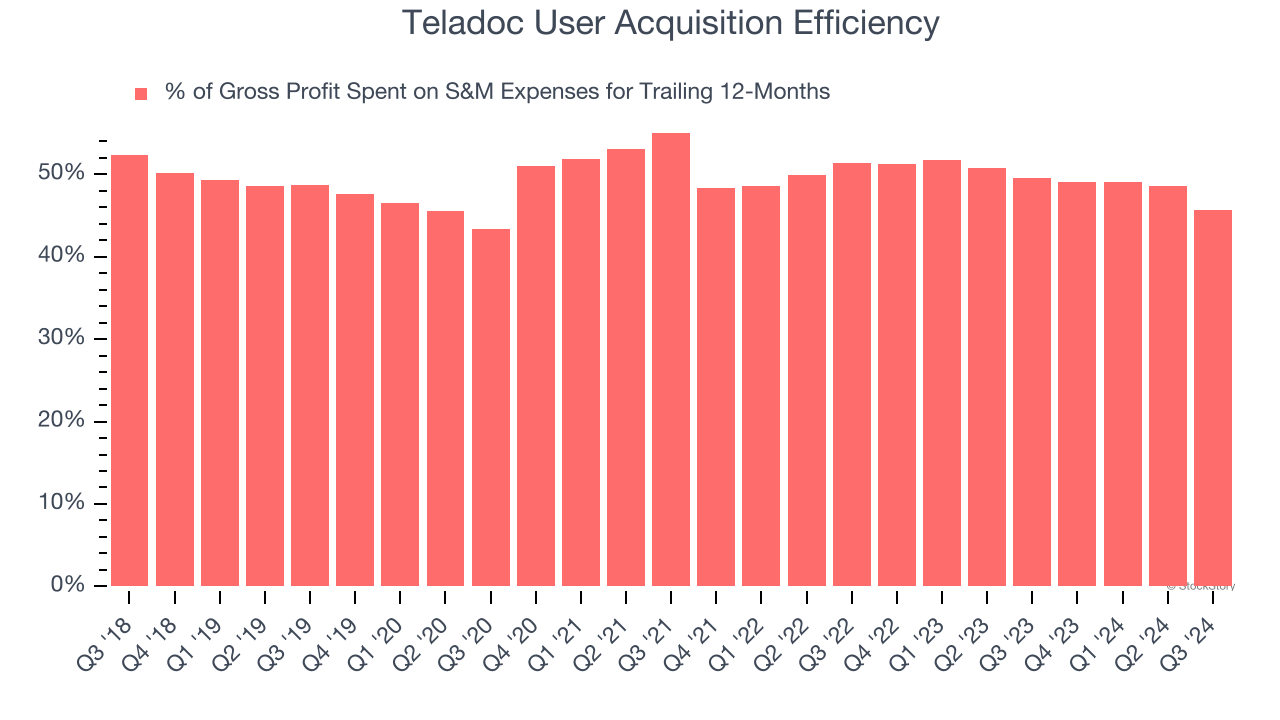

3. Inefficient Marketing Strategy Eats Into Profits

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Teladoc grow from a combination of product virality, paid advertisement, and incentives.

It’s relatively expensive for Teladoc to acquire new users as the company has spent 45.7% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Teladoc operates in a competitive market and must continue investing to maintain an acceptable growth trajectory.

Final Judgment

Teladoc isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 4.6× forward EV-to-EBITDA (or $9.38 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Teladoc

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.