DraftKings currently trades at $37.48 per share and has shown little upside over the past six months, posting a middling return of 1.5%. The stock also fell short of the S&P 500’s 7.3% gain during that period.

Is now the time to buy DraftKings, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're swiping left on DraftKings for now. Here are two reasons why there are better opportunities than DKNG and a stock we'd rather own.

Why Is DraftKings Not Exciting?

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

1. Operating Losses Sound the Alarms

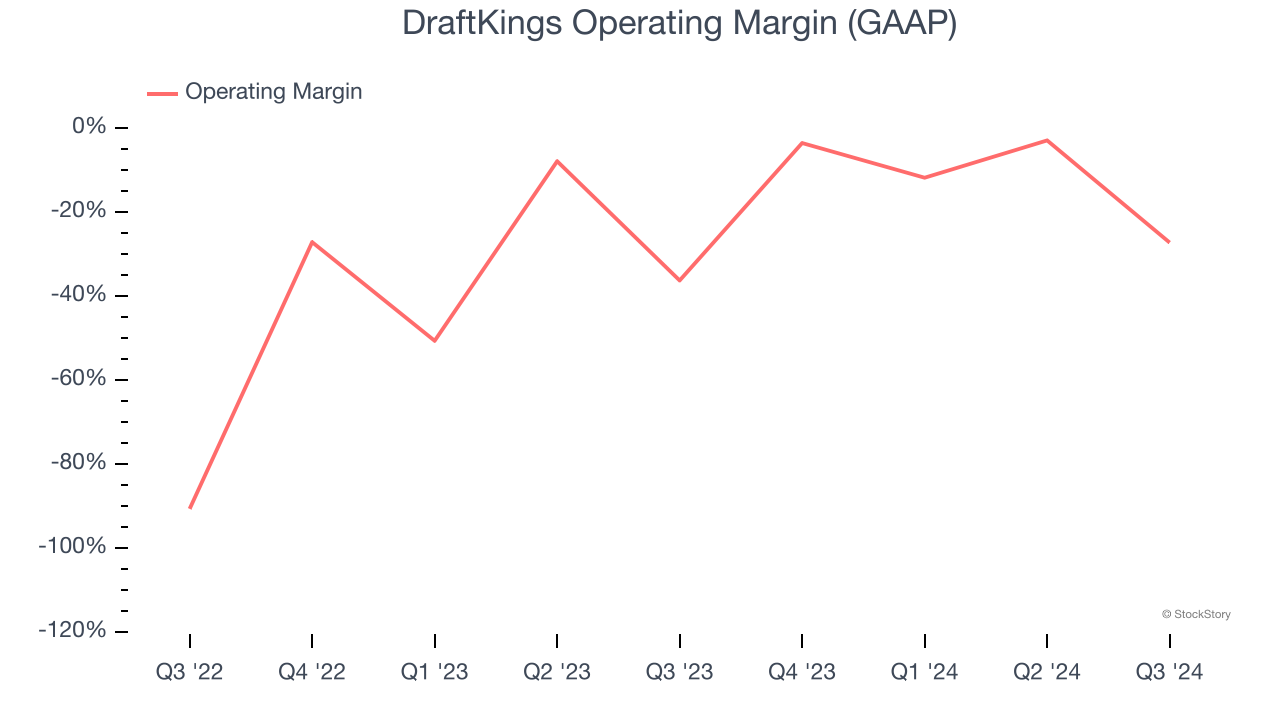

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

DraftKings’s operating margin has risen over the last 12 months, but it still averaged negative 18.9% over the last two years. This is due to its large expense base and inefficient cost structure.

2. Cash Burn Ignites Concerns

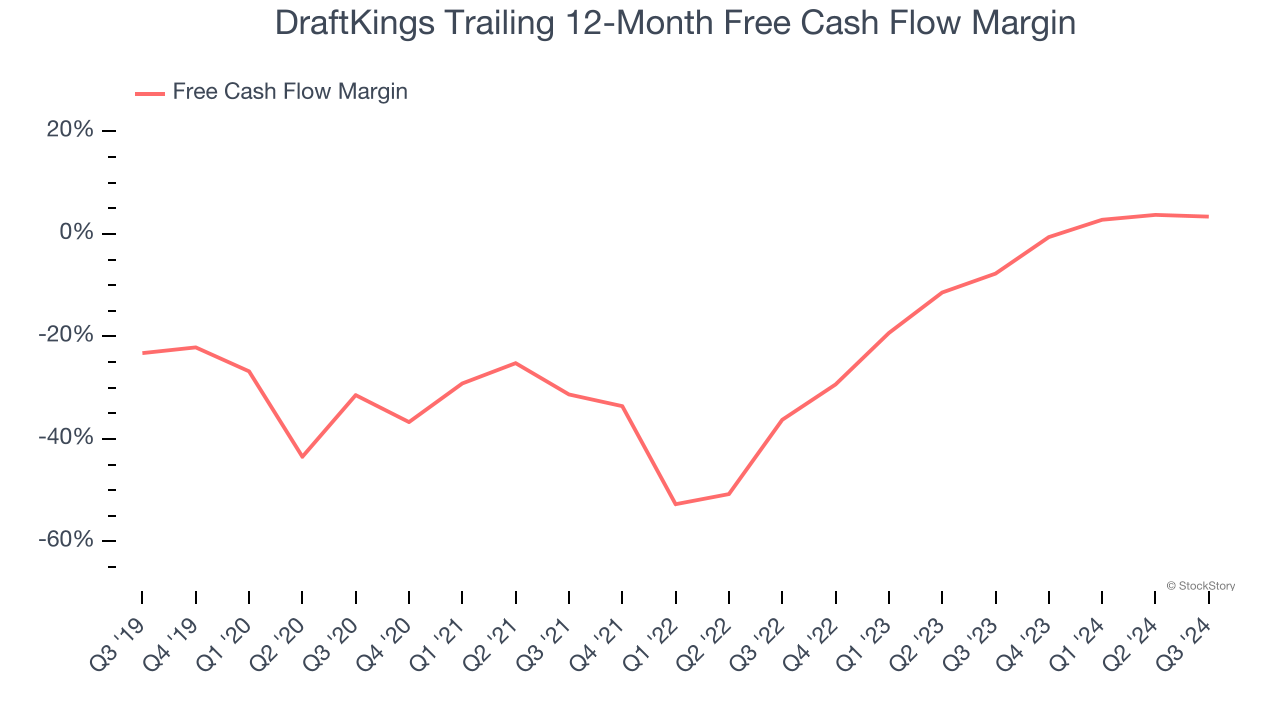

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While DraftKings posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, DraftKings’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.26 of cash on fire for every $100 in revenue.

Final Judgment

DraftKings isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 40.1× forward price-to-earnings (or $37.48 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of DraftKings

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.