Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at MarineMax (NYSE: HZO) and its peers.

At their essence, cars and boats get you from point A to point B, but the former is usually a necessity in everyday life while the latter is a luxury or leisure product. The retailers that sell these vehicles therefore cater to different needs and populations. There are also retailers that may not sell cars and boats themselves but the parts and accessories needed to keep these complex machines in tip top shape.

The 11 automotive and marine retail stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 0.7%.

While some automotive and marine retail stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.8% since the latest earnings results.

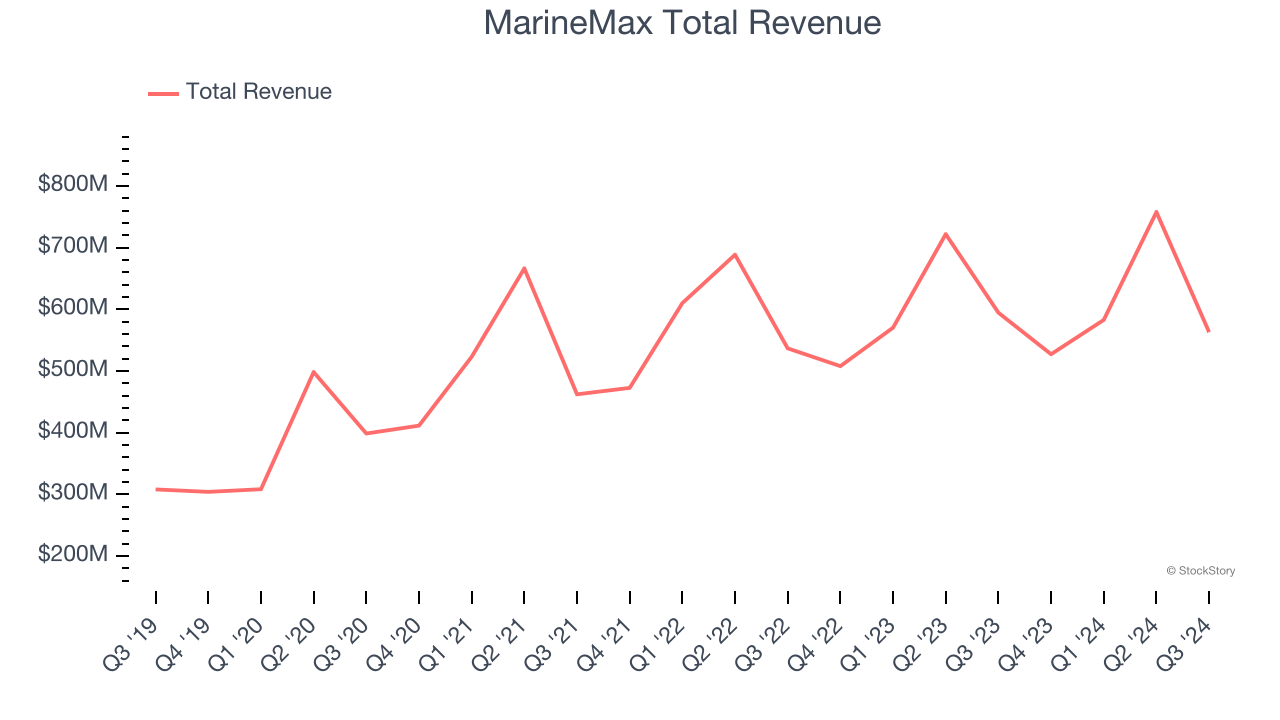

MarineMax (NYSE: HZO)

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE: HZO) sells boats, yachts, and other marine products.

MarineMax reported revenues of $563.1 million, down 5.3% year on year. This print fell short of analysts’ expectations by 2.4%. Overall, it was a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

“Resilient is the word that captures the spirit of our team members, who have shown extraordinary dedication and perseverance in the face of the devastating storms that hit Florida and the southeast over the past month,” said Brett McGill, Chief Executive Officer and President of MarineMax.

Unsurprisingly, the stock is down 6.7% since reporting and currently trades at $28.01.

Read our full report on MarineMax here, it’s free.

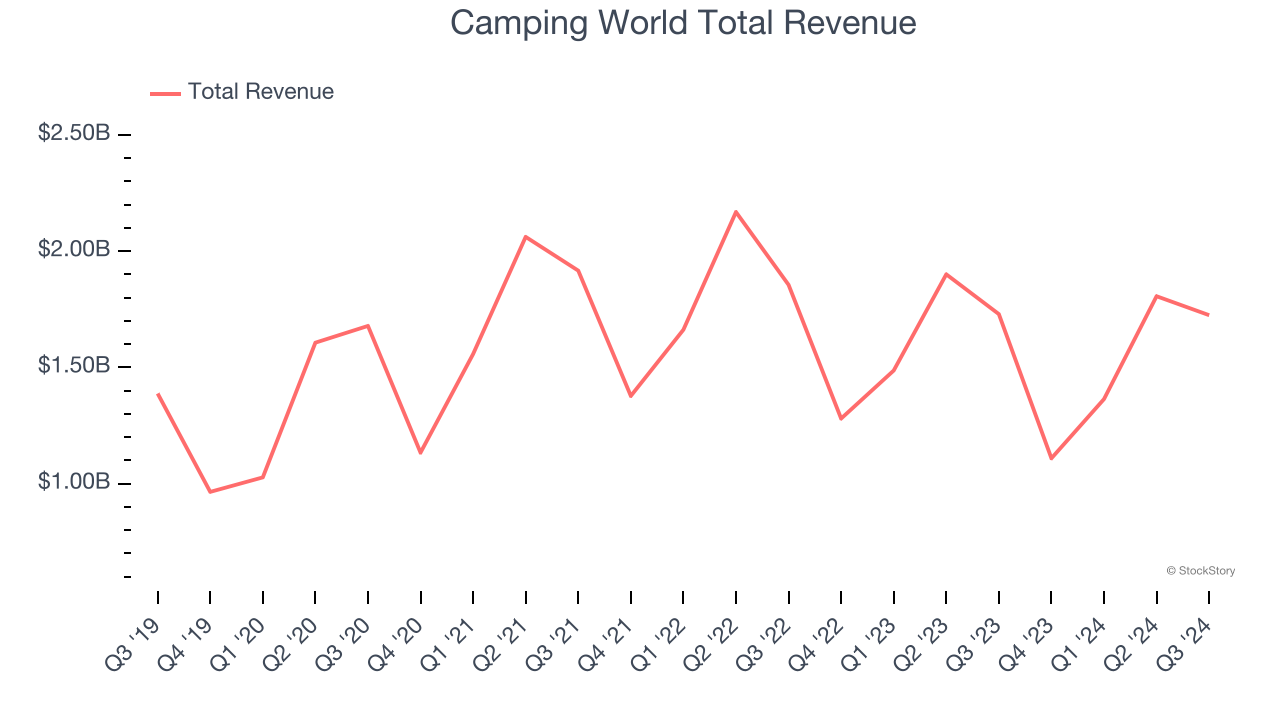

Best Q3: Camping World (NYSE: CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE: CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.72 billion, flat year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Camping World delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 10.8% since reporting. It currently trades at $23.71.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: OneWater (NASDAQ: ONEW)

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $377.9 million, down 16.2% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

OneWater delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 34.1% since the results and currently trades at $15.68.

Read our full analysis of OneWater’s results here.

Genuine Parts (NYSE: GPC)

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $5.97 billion, up 2.5% year on year. This result met analysts’ expectations. Zooming out, it was a softer quarter as it produced full-year EPS guidance missing analysts’ expectations.

The stock is down 17.5% since reporting and currently trades at $118.03.

Read our full, actionable report on Genuine Parts here, it’s free.

Lithia (NYSE: LAD)

With a strong presence in the Western US, Lithia Motors (NYSE: LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Lithia reported revenues of $9.22 billion, up 11.4% year on year. This number missed analysts’ expectations by 2.5%. Zooming out, it was actually a strong quarter as it logged a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Lithia scored the fastest revenue growth among its peers. The stock is up 15.6% since reporting and currently trades at $352.35.

Read our full, actionable report on Lithia here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.