Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Electronic Arts (NASDAQ: EA) and its peers.

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

The 4 video gaming stocks we track reported a softer Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.9% below.

Luckily, video gaming stocks have performed well with share prices up 15.6% on average since the latest earnings results.

Electronic Arts (NASDAQ: EA)

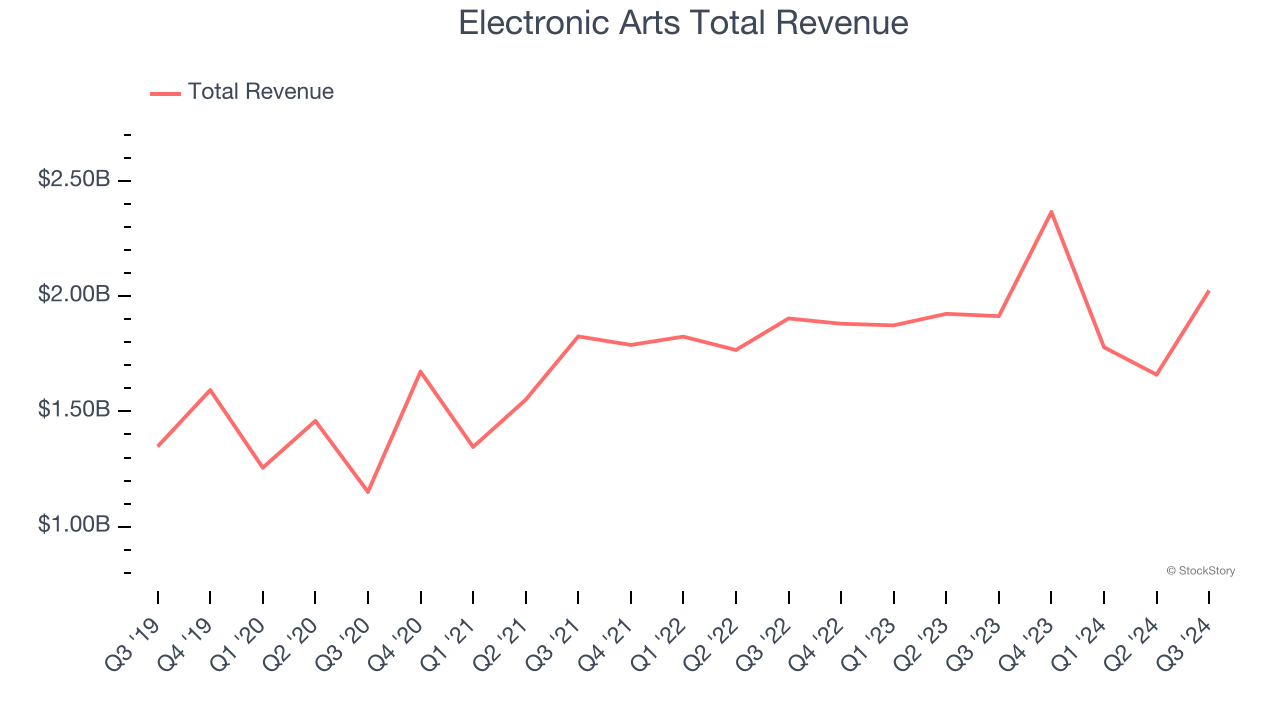

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ: EA) is one of the world’s largest video game publishers.

Electronic Arts reported revenues of $2.03 billion, up 5.8% year on year. This print exceeded analysts’ expectations by 2.3%. Despite the top-line beat, it was still a slower quarter for the company with EPS guidance for next quarter missing analysts’ expectations.

Unsurprisingly, the stock is down 18.3% since reporting and currently trades at $118.98.

Read our full report on Electronic Arts here, it’s free.

Best Q3: Take-Two (NASDAQ: TTWO)

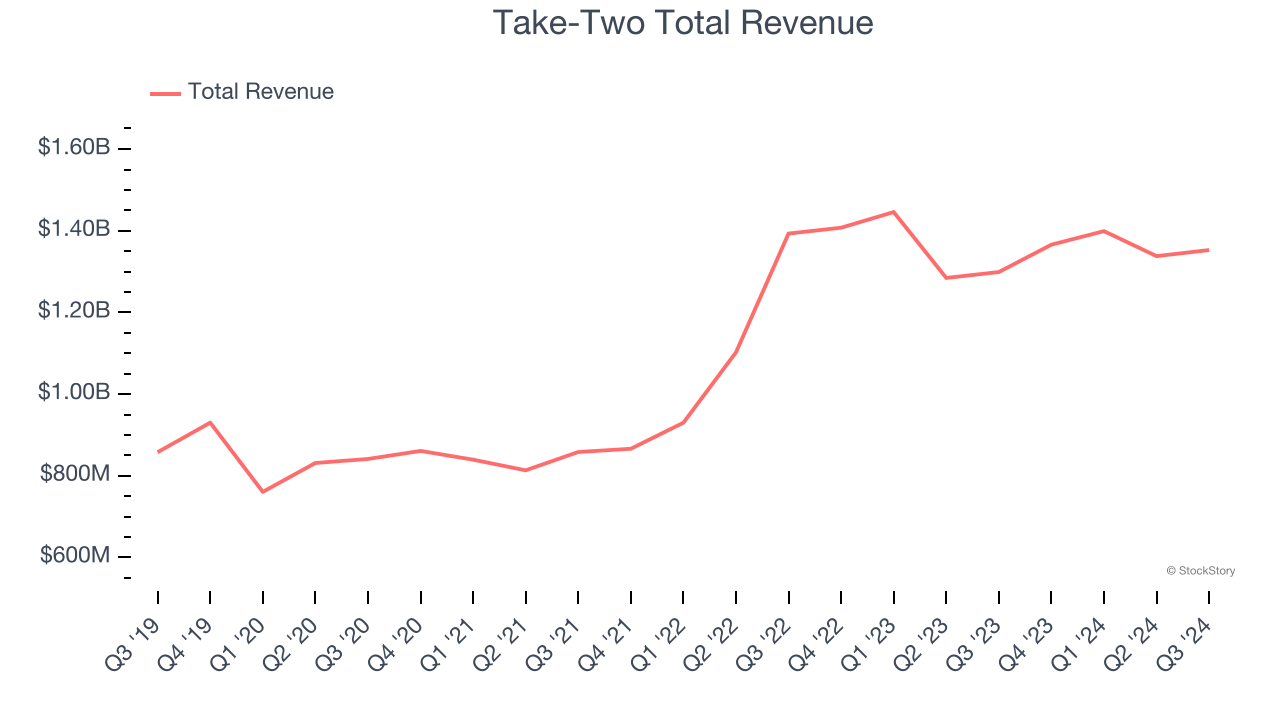

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ: TTWO) is one of the world’s largest video game publishers.

Take-Two reported revenues of $1.35 billion, up 4.1% year on year, outperforming analysts’ expectations by 1%. The business performed better than its peers, but it was unfortunately a slower quarter with full-year EBITDA guidance missing analysts’ expectations.

Take-Two pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 10.8% since reporting. It currently trades at $184.50.

Is now the time to buy Take-Two? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $24.56 million, down 32.6% year on year, falling short of analysts’ expectations by 7.9%. It was a disappointing quarter as it posted a decline in its users and a significant miss of analysts’ number of paying monthly active users estimates.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 28% year on year. Interestingly, the stock is up 14.5% since the results and currently trades at $6.46.

Read our full analysis of Skillz’s results here.

Roblox (NYSE: RBLX)

Best known for its wide assortment of user-generated content, Roblox (NYSE: RBLX) is an online gaming platform and game creation system.

Roblox reported revenues of $919 million, up 28.8% year on year. This print surpassed analysts’ expectations by 3.8%. More broadly, it was a slower quarter as it produced full-year EBITDA guidance missing analysts’ expectations.

Roblox scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update among its peers. The company reported 88.9 million daily active users, up 26.6% year on year. The stock is up 55.5% since reporting and currently trades at $67.11.

Read our full, actionable report on Roblox here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.