MercadoLibre has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13.9% to $1,848 per share while the index has gained 10.4%.

Is now a good time to buy MELI? Find out in our full research report, it’s free.

Why Are We Positive On MELI?

Originally started as an online auction platform, MercadoLibre (NASDAQ: MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

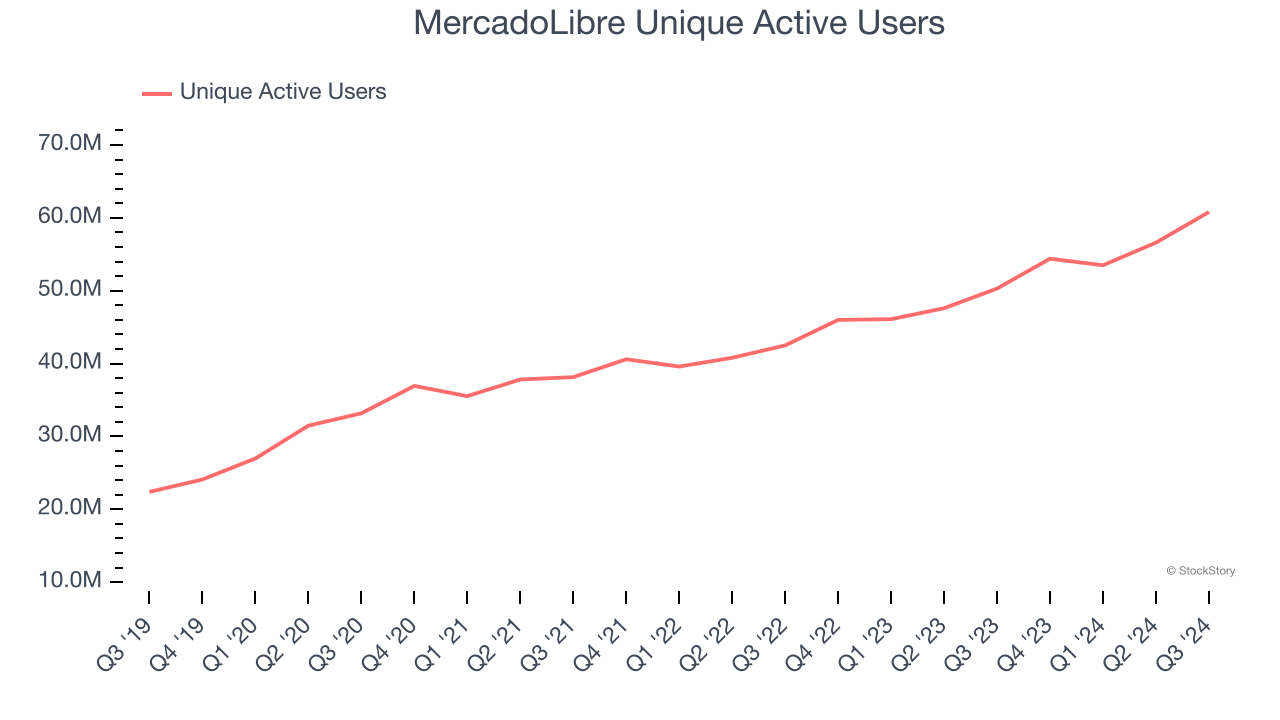

1. Unique Active Users Skyrocket, Fueling Growth Opportunities

As an online marketplace, MercadoLibre generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, MercadoLibre’s unique active users, a key performance metric for the company, increased by 17.4% annually to 60.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

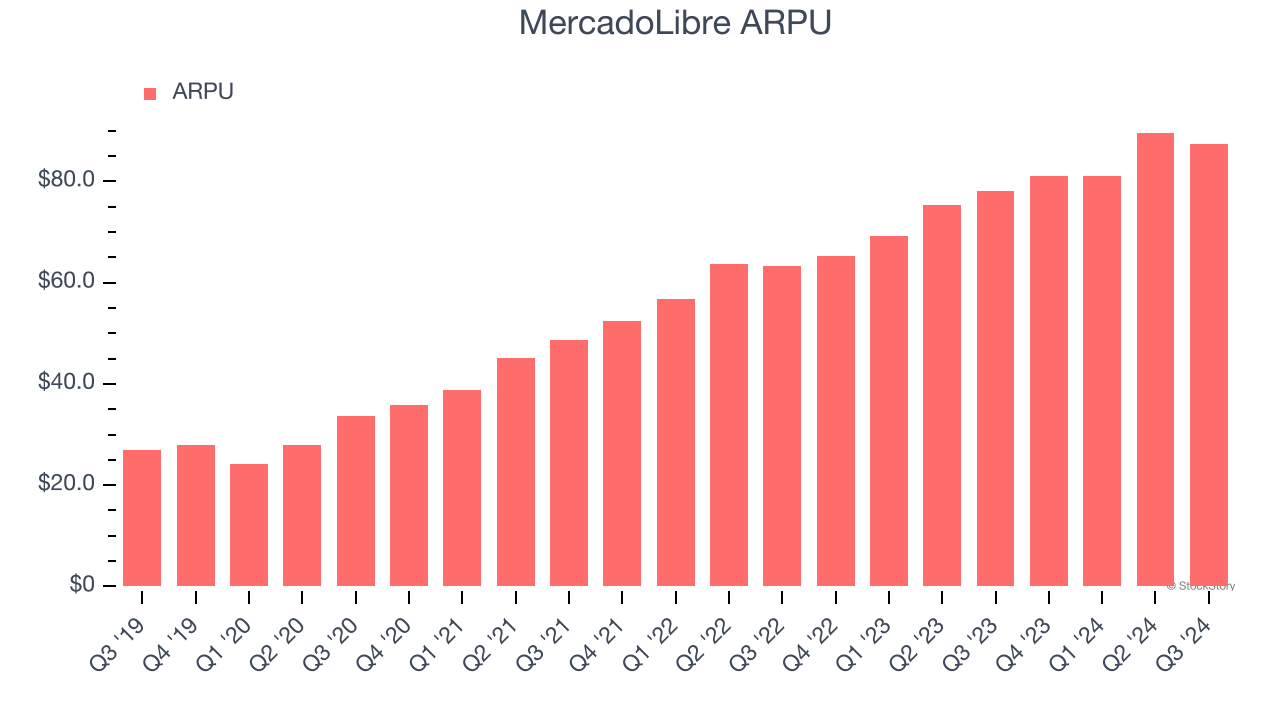

2. Eye-Popping Growth in Customer Spending

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like MercadoLibre because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and MercadoLibre’s take rate, or "cut", on each order.

MercadoLibre’s ARPU growth has been exceptional over the last two years, averaging 20%. Its ability to increase monetization while growing its unique active users at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

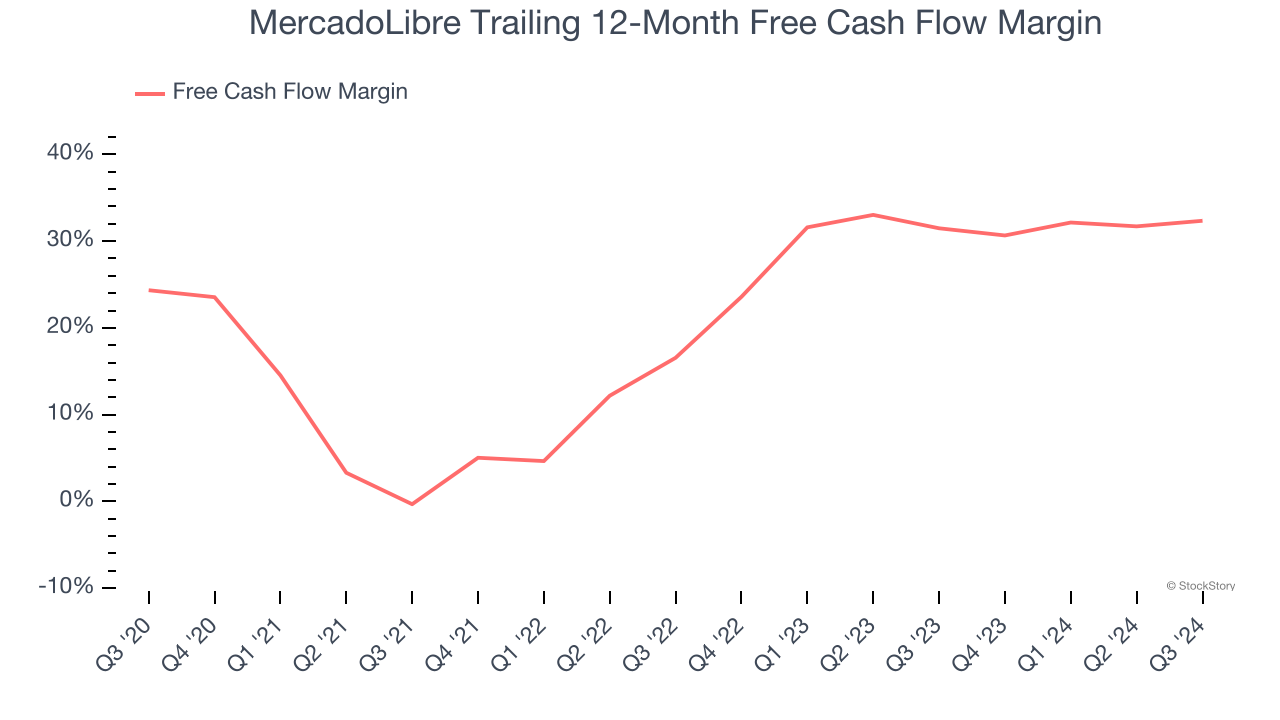

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

MercadoLibre has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 32% over the last two years.

Final Judgment

These are just a few reasons why we think MercadoLibre is one of the best consumer internet companies out there, but at $1,848 per share (or 21.9× forward EV-to-EBITDA), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than MercadoLibre

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.