Let’s dig into the relative performance of Vital Farms (NASDAQ: VITL) and its peers as we unravel the now-completed Q3 perishable food earnings season.

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 8.1%.

While some perishable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.1% since the latest earnings results.

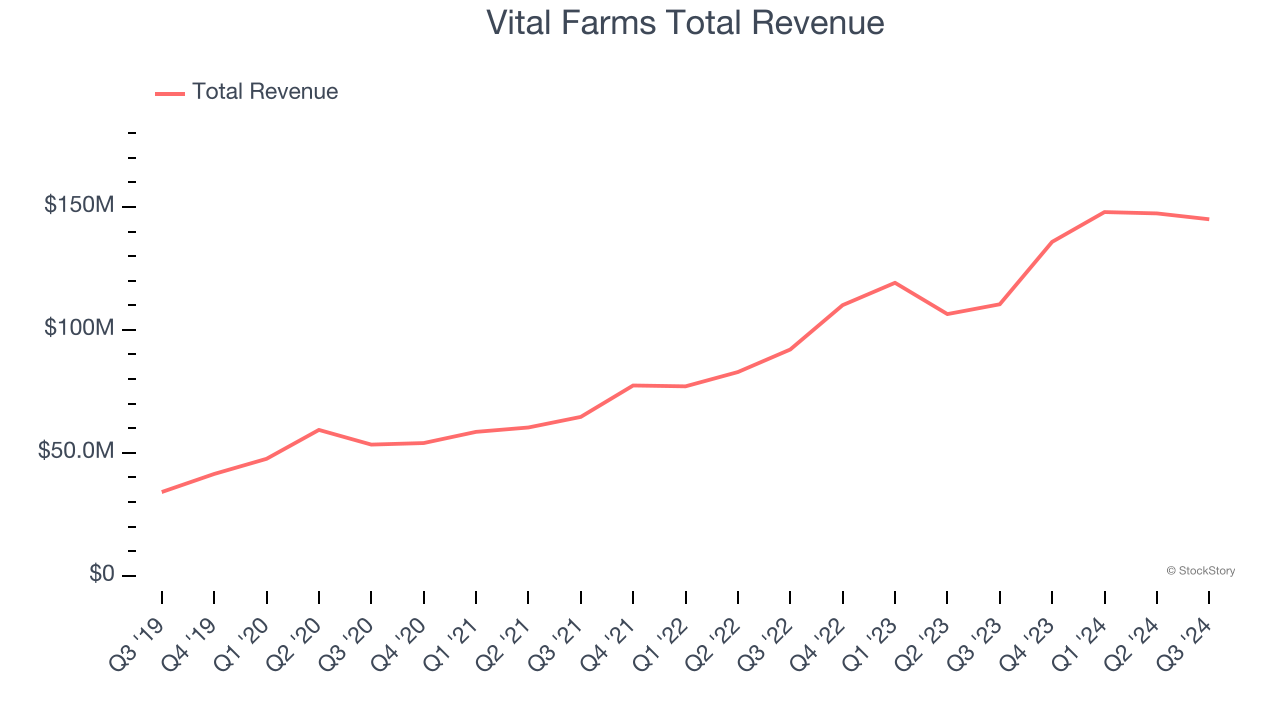

Vital Farms (NASDAQ: VITL)

With an emphasis on ethically produced products, Vital Farms (NASDAQ: VITL) specializes in pasture-raised eggs and butter.

Vital Farms reported revenues of $145 million, up 31.3% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

“Our sales momentum from the first half of the year carried into the third quarter of 2024 and we posted another strong topline result with net revenue of $145.0 million, 31.3% growth versus the same period last year.” said Russell Diez-Canseco, Vital Farms’ President and CEO.

Interestingly, the stock is up 22.2% since reporting and currently trades at $45.10.

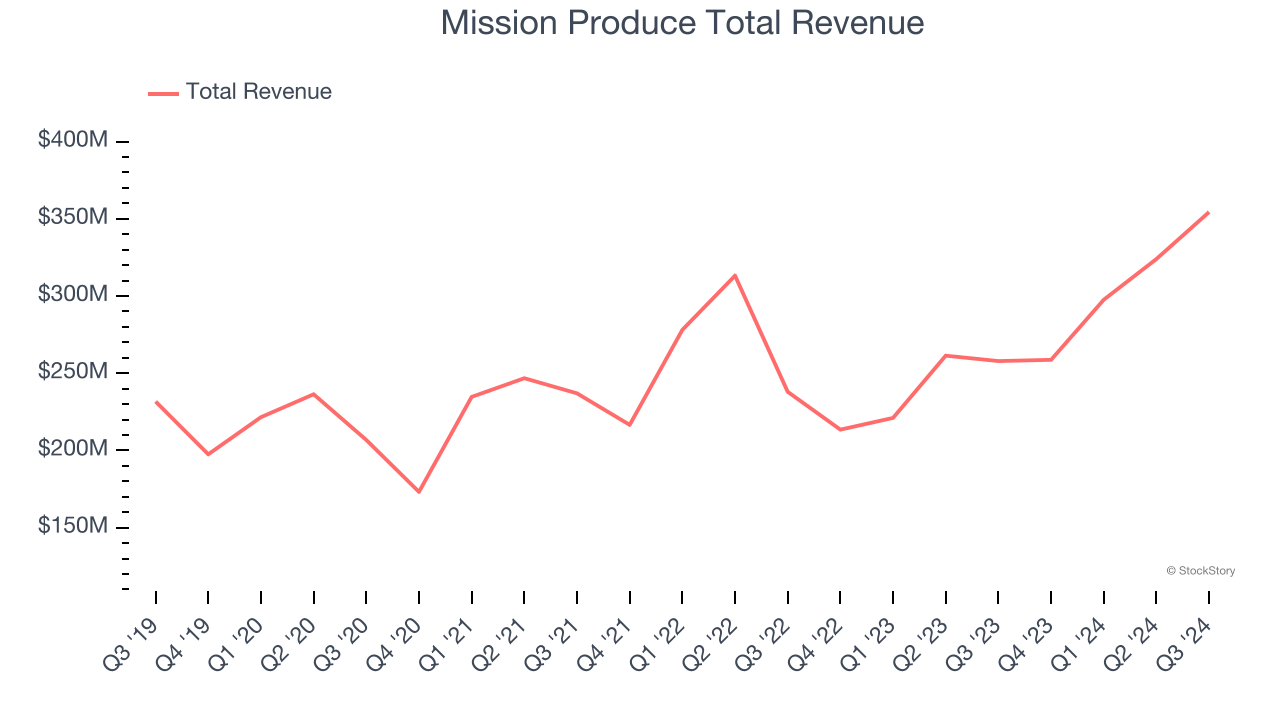

Best Q3: Mission Produce (NASDAQ: AVO)

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $354.4 million, up 37.4% year on year, outperforming analysts’ expectations by 50.2%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

Mission Produce delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.6% since reporting. It currently trades at $12.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Calavo (NASDAQ: CVGW)

A trailblazer in the avocado industry, Calavo Growers (NASDAQ: CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Calavo reported revenues of $170 million, up 19.5% year on year, exceeding analysts’ expectations by 5%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

As expected, the stock is down 3.6% since the results and currently trades at $23.30.

Read our full analysis of Calavo’s results here.

Fresh Del Monte Produce (NYSE: FDP)

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Fresh Del Monte Produce reported revenues of $1.02 billion, up 1.6% year on year. This result beat analysts’ expectations by 3%. Overall, it was a stunning quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ gross margin estimates.

The stock is up 7% since reporting and currently trades at $31.08.

Read our full, actionable report on Fresh Del Monte Produce here, it’s free.

Freshpet (NASDAQ: FRPT)

Standing out from typical processed pet foods, Freshpet (NASDAQ: FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Freshpet reported revenues of $253.4 million, up 26.3% year on year. This number topped analysts’ expectations by 2.1%. It was an exceptional quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Freshpet achieved the highest full-year guidance raise among its peers. The stock is up 22.2% since reporting and currently trades at $163.49.

Read our full, actionable report on Freshpet here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.