As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at cybersecurity stocks, starting with CrowdStrike (NASDAQ: CRWD).

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.5% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.7% since the latest earnings results.

CrowdStrike (NASDAQ: CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

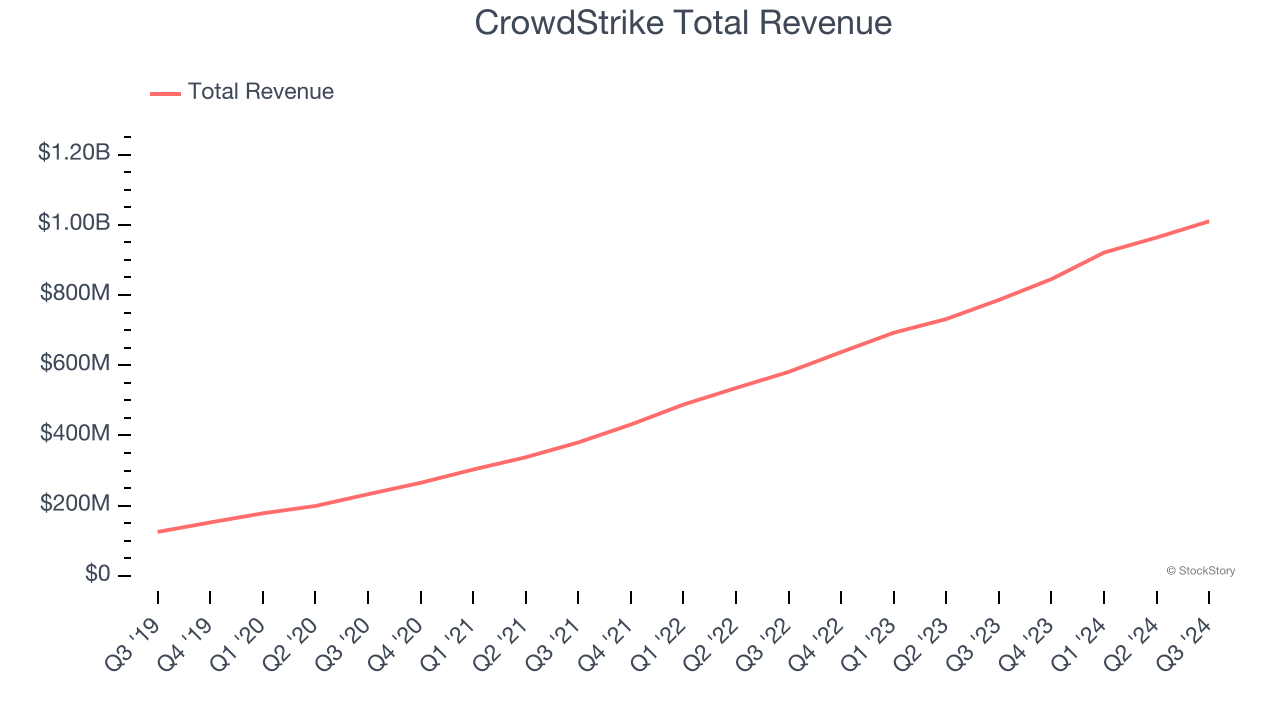

CrowdStrike reported revenues of $1.01 billion, up 28.5% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ billings and EBITDA estimates.

“CrowdStrike surpassed $4 billion in ending ARR in the quarter - the fastest and only pure play cybersecurity software company to reach this reported milestone - as our single platform approach and trailblazing innovation continue to resonate at-scale,” said George Kurtz, Founder and CEO.

CrowdStrike pulled off the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1.1% since reporting and currently trades at $360.35.

Best Q3: Okta (NASDAQ: OKTA)

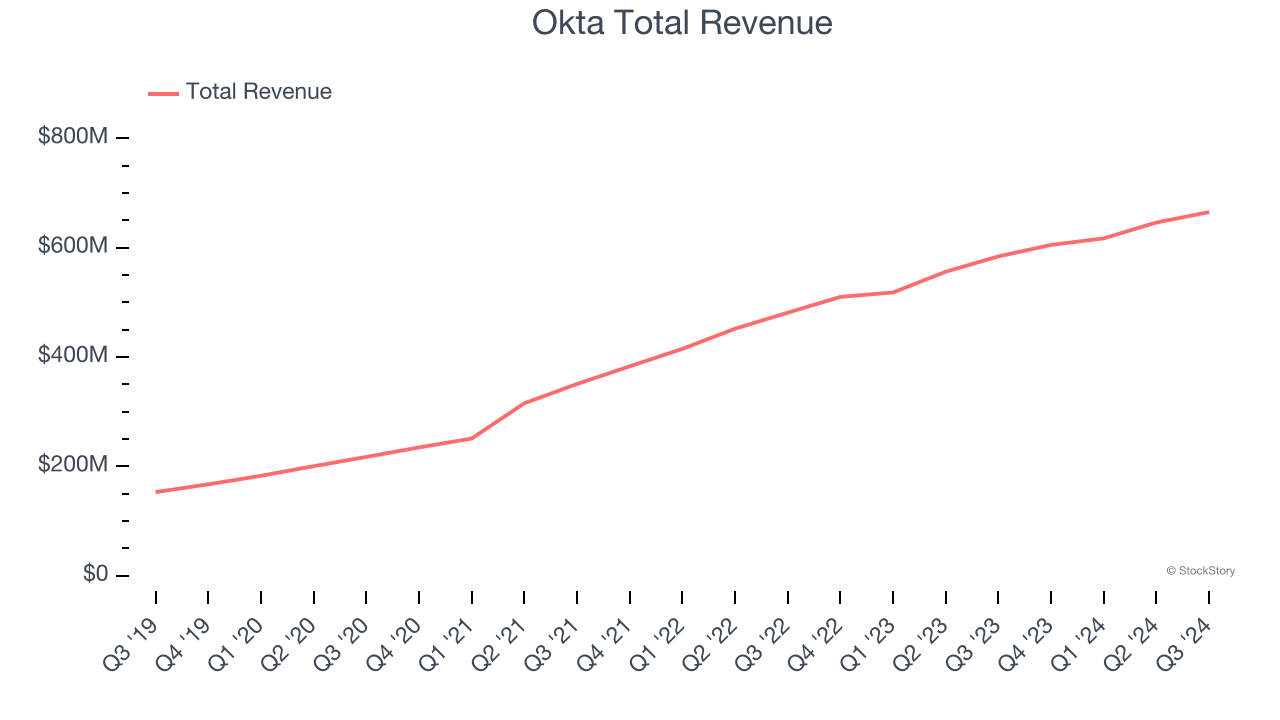

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $665 million, up 13.9% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $82.

Is now the time to buy Okta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SentinelOne (NYSE: S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $210.6 million, up 28.3% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

SentinelOne delivered the weakest performance against analyst estimates in the group. The company added 77 enterprise customers paying more than $100,000 annually to reach a total of 1,310. As expected, the stock is down 20.2% since the results and currently trades at $22.91.

Read our full analysis of SentinelOne’s results here.

Varonis (NASDAQ: VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ: VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $148.1 million, up 21.1% year on year. This result surpassed analysts’ expectations by 4.7%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Varonis scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 24.1% since reporting and currently trades at $44.58.

Read our full, actionable report on Varonis here, it’s free.

Rapid7 (NASDAQ: RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ: RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $214.7 million, up 8% year on year. This number topped analysts’ expectations by 2.2%. Aside from that, it was a satisfactory quarter as it also logged accelerating customer growth but EPS guidance for next quarter missing analysts’ expectations significantly.

Rapid7 had the slowest revenue growth among its peers. The company added 135 customers to reach a total of 11,619. The stock is down 5% since reporting and currently trades at $39.53.

Read our full, actionable report on Rapid7 here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.