Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Aris Water (NYSE: ARIS) and its peers.

Many environmental and facility services are non-discretionary (sports stadiums need to be cleaned after events), recurring, and performed through longer-term contracts. This makes for more predictable and stickier revenue streams. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. Despite these tailwinds, environmental and facility services companies are still at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these services.

The 14 environmental and facilities services stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.7% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.2% since the latest earnings results.

Best Q3: Aris Water (NYSE: ARIS)

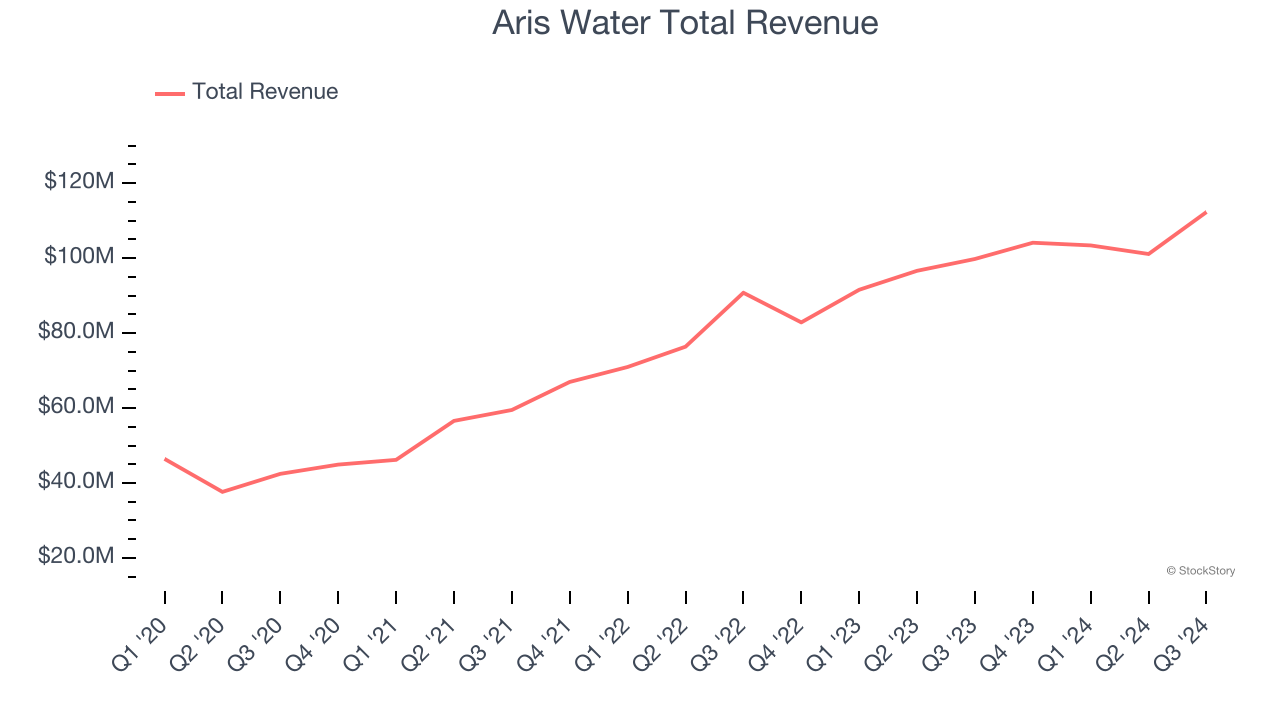

Primarily serving the oil and gas industry, Aris Water (NYSE: ARIS) is a provider of water handling and recycling solutions.

Aris Water reported revenues of $112.3 million, up 12.5% year on year. This print exceeded analysts’ expectations by 8.6%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ sales volume and EBITDA estimates.

“Aris had an exceptional third quarter as we continued to grow our produced water volumes, increased our recycled water sales, and maintained our strong margins. As we anticipated, our capital investment to support these increased activity levels was primarily deployed in the first half of the year and our capital spending in the third quarter declined significantly. We continue to experience steady volume growth and increasing cash generation. We anticipate a strong finish to the year and are extremely proud of our team’s efforts and results,” said Amanda Brock, President and CEO of Aris.

Aris Water scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 50.2% since reporting and currently trades at $24.94.

ABM Industries (NYSE: ABM)

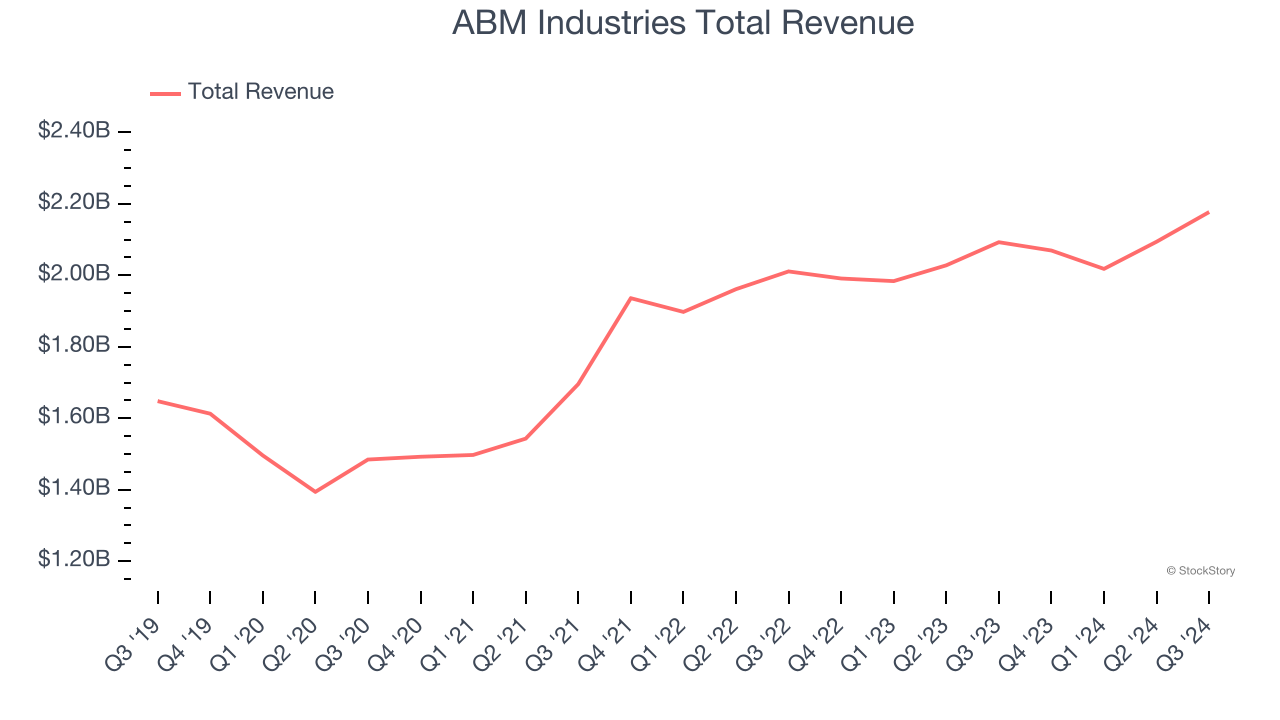

Started with a $4.50 investment to purchase a bucket, sponge, and mop, ABM (NYSE: ABM) offers janitorial, parking, and facility services.

ABM Industries reported revenues of $2.18 billion, up 4% year on year, outperforming analysts’ expectations by 4.7%. The business had a very strong quarter with a solid beat of analysts’ organic revenue estimates and full-year EPS guidance slightly topping analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.7% since reporting. It currently trades at $50.71.

Is now the time to buy ABM Industries? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Perma-Fix (NASDAQ: PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ: PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $16.81 million, down 23.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Perma-Fix delivered the slowest revenue growth in the group. As expected, the stock is down 27% since the results and currently trades at $10.71.

Read our full analysis of Perma-Fix’s results here.

Clean Harbors (NYSE: CLH)

Established in 1980, Clean Harbors (NYSE: CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.53 billion, up 12% year on year. This number topped analysts’ expectations by 1.2%. More broadly, it was a slower quarter as it produced full-year EBITDA guidance missing analysts’ expectations.

The stock is down 12.7% since reporting and currently trades at $230.

Read our full, actionable report on Clean Harbors here, it’s free.

Waste Management (NYSE: WM)

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.61 billion, up 7.9% year on year. This number surpassed analysts’ expectations by 1.7%. Overall, it was a strong quarter as it also produced a decent beat of analysts’ adjusted operating income estimates.

The stock is down 3.5% since reporting and currently trades at $201.

Read our full, actionable report on Waste Management here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.