As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the diversified financial services industry, including PayPal (NASDAQ: PYPL) and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 12 diversified financial services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2%.

While some diversified financial services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

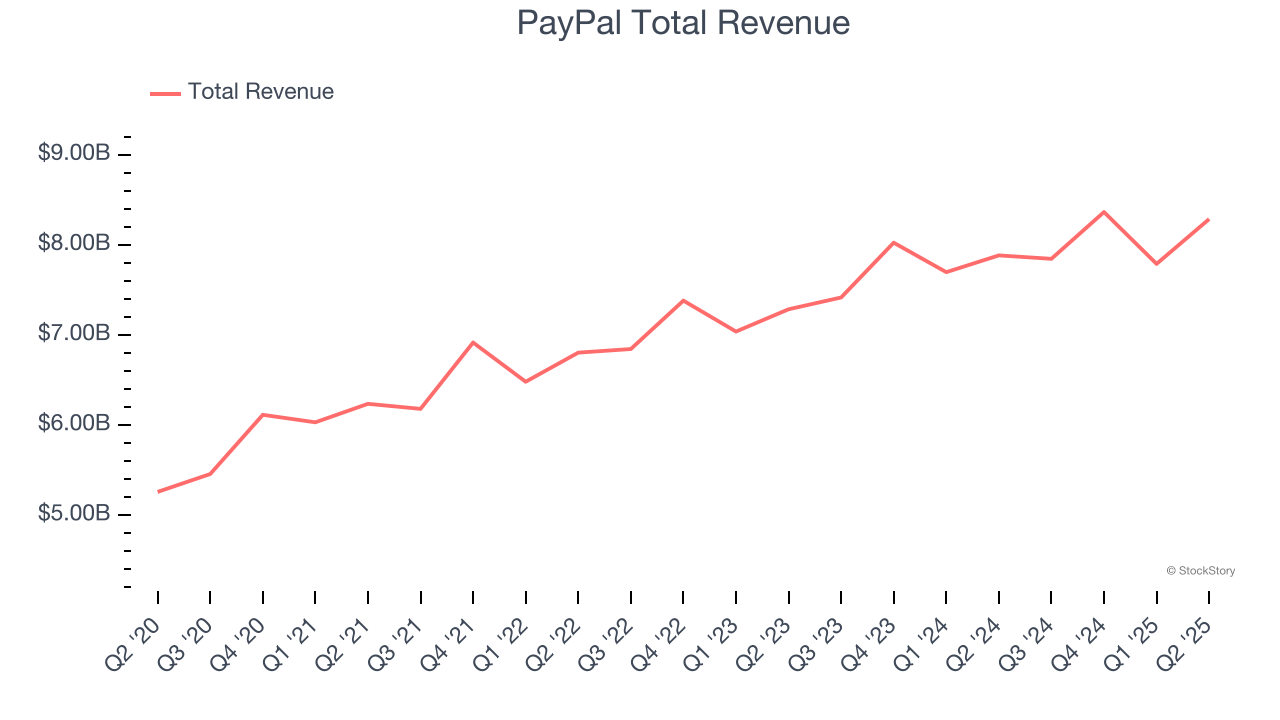

PayPal (NASDAQ: PYPL)

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ: PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

PayPal reported revenues of $8.29 billion, up 5.1% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA andtransaction volumes estimates.

Unsurprisingly, the stock is down 15% since reporting and currently trades at $66.49.

Is now the time to buy PayPal? Access our full analysis of the earnings results here, it’s free.

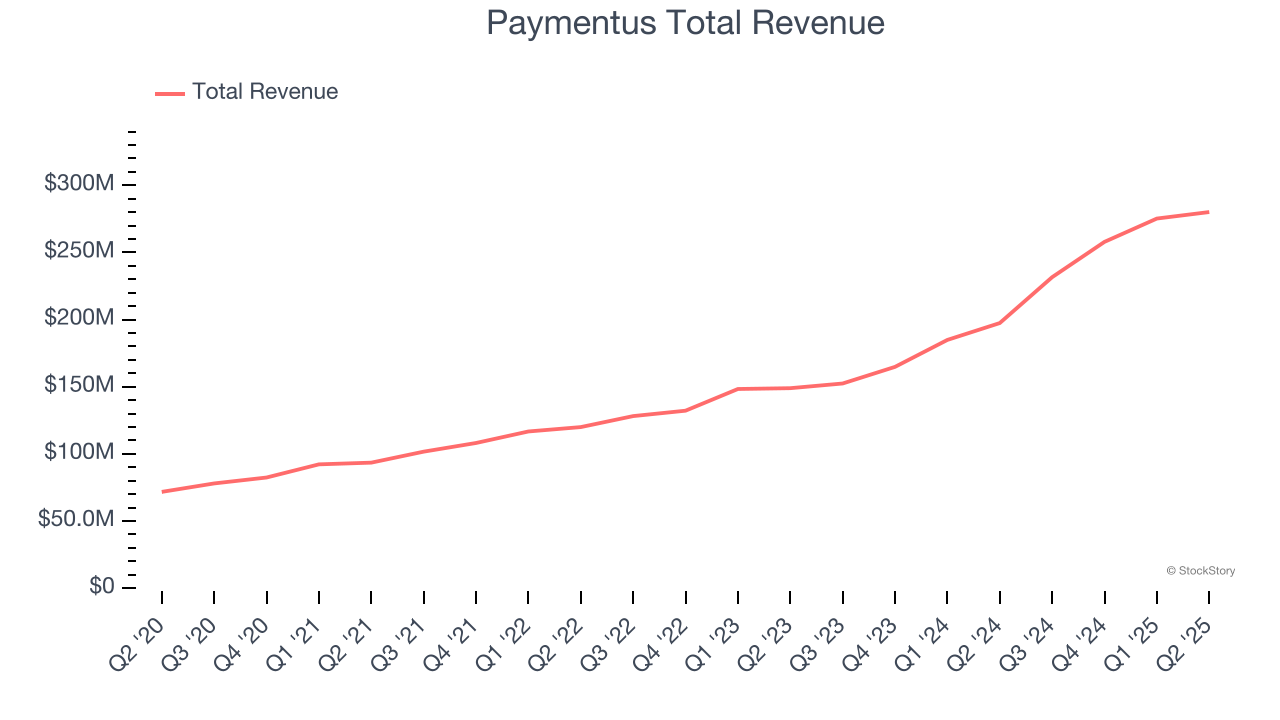

Best Q2: Paymentus (NYSE: PAY)

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE: PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $280.1 million, up 41.9% year on year, outperforming analysts’ expectations by 8.7%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Paymentus pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 4.5% since reporting. It currently trades at $30.60.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: NerdWallet (NASDAQ: NRDS)

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ: NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $186.9 million, up 24.1% year on year, falling short of analysts’ expectations by 4.4%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

NerdWallet delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $11.10.

Read our full analysis of NerdWallet’s results here.

NCR Atleos (NYSE: NATL)

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos (NYSE: NATL) provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.10 billion, up 2.1% year on year. This print surpassed analysts’ expectations by 2%. It was an exceptional quarter as it also logged a beat of analysts’ EPS and EBITDA estimates.

The stock is up 21% since reporting and currently trades at $39.31.

Read our full, actionable report on NCR Atleos here, it’s free.

AvidXchange (NASDAQ: AVDX)

Born from the frustration of paper-based accounting processes in the early 2000s, AvidXchange (NASDAQ: AVDX) provides accounts payable automation software and payment solutions that help middle-market businesses digitize and streamline their invoice processing and payments.

AvidXchange reported revenues of $110.6 million, up 5.2% year on year. This result beat analysts’ expectations by 0.6%. Aside from that, it was a softer quarter as it logged a significant miss of analysts’ EBITDA estimates and EPS in line with analysts’ estimates.

The stock is flat since reporting and currently trades at $9.94.

Read our full, actionable report on AvidXchange here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.