Looking back on heavy transportation equipment stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Cummins (NYSE: CMI) and its peers.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 13 heavy transportation equipment stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

Best Q2: Cummins (NYSE: CMI)

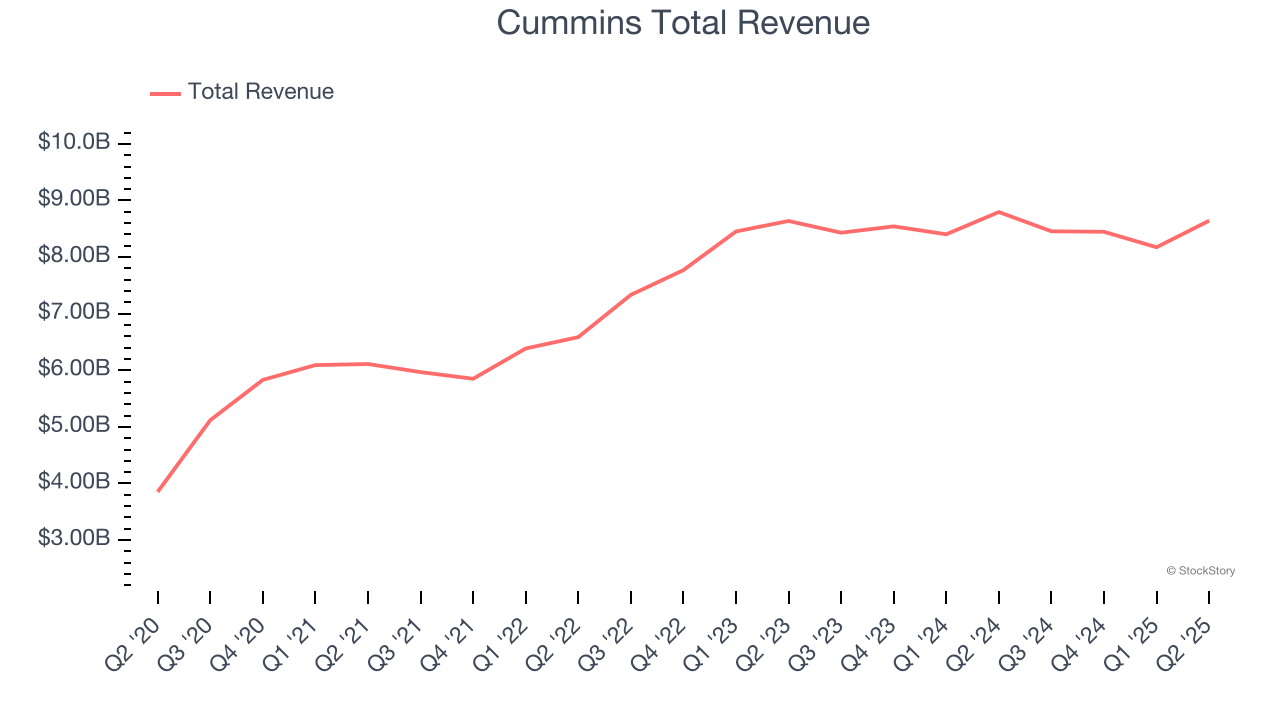

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE: CMI) offers engines and power systems.

Cummins reported revenues of $8.64 billion, down 1.7% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ EBITDA estimates.

“We delivered strong second quarter results, driven by record profitability in our Power Systems and Distribution segments,” said Jennifer Rumsey, Chair and CEO.

Interestingly, the stock is up 17% since reporting and currently trades at $423.39.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free for active Edge members.

REV Group (NYSE: REVG)

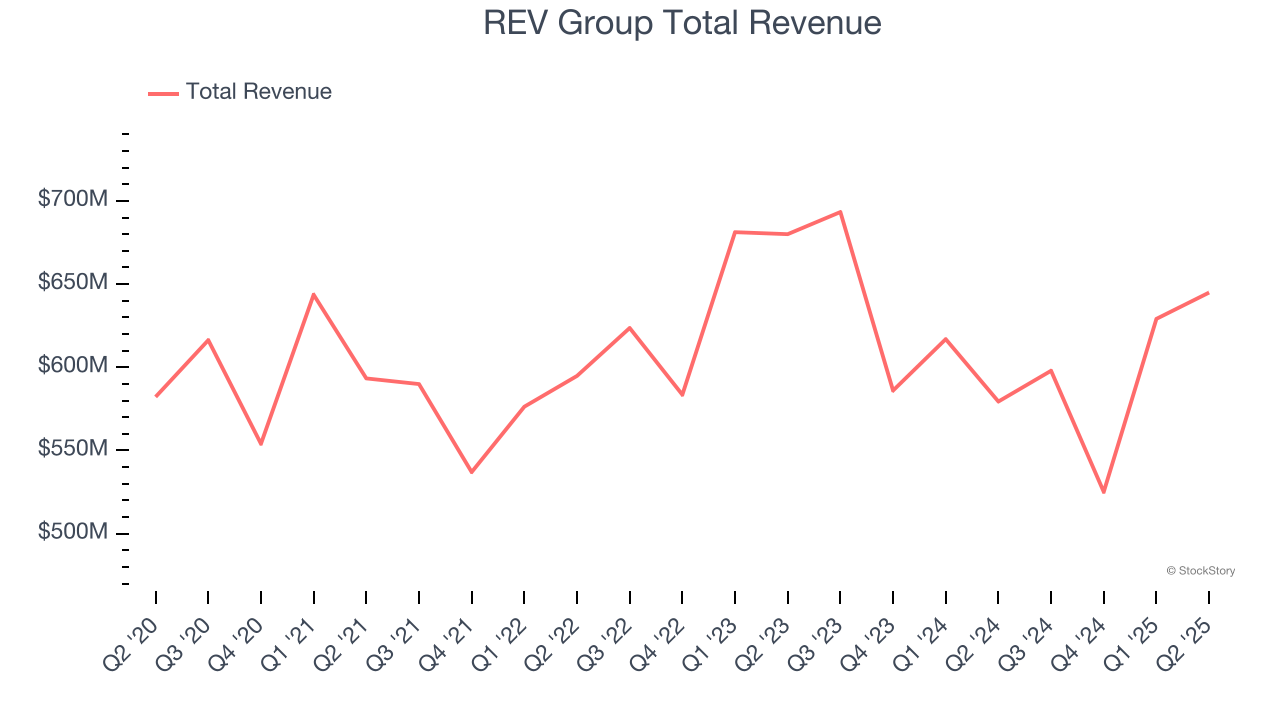

Offering the first full-electric North American fire truck, REV (NYSE: REVG) manufactures and sells specialty vehicles.

REV Group reported revenues of $644.9 million, up 11.3% year on year, outperforming analysts’ expectations by 5%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 11.9% since reporting. It currently trades at $58.

Is now the time to buy REV Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Trinity (NYSE: TRN)

Operating under the trade name TrinityRail, Trinity (NYSE: TRN) is a provider of railcar products and services in North America.

Trinity reported revenues of $506.2 million, down 39.8% year on year, falling short of analysts’ expectations by 13.3%. It was a slower quarter as it posted a significant miss of analysts’ revenue and EPS estimates.

Trinity delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 14.7% since the results and currently trades at $28.67.

Read our full analysis of Trinity’s results here.

Federal Signal (NYSE: FSS)

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE: FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

Federal Signal reported revenues of $564.6 million, up 15.1% year on year. This result beat analysts’ expectations by 5.2%. Overall, it was a stunning quarter as it also recorded a solid beat of analysts’ revenue estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is up 14.1% since reporting and currently trades at $119.60.

Read our full, actionable report on Federal Signal here, it’s free for active Edge members.

Greenbrier (NYSE: GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $842.7 million, up 2.7% year on year. This print surpassed analysts’ expectations by 7.3%. It was a stunning quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Greenbrier pulled off the biggest analyst estimates beat among its peers. The stock is down 2.4% since reporting and currently trades at $45.93.

Read our full, actionable report on Greenbrier here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.