Electronic brokerage firm Interactive Brokers (NASDAQ: IBKR) announced better-than-expected revenue in Q3 CY2025, with sales up 21.2% year on year to $1.66 billion. Its non-GAAP profit of $0.57 per share was 6.1% above analysts’ consensus estimates.

Is now the time to buy Interactive Brokers? Find out by accessing our full research report, it’s free for active Edge members.

Interactive Brokers (IBKR) Q3 CY2025 Highlights:

- Volume: $3.62 million vs analyst estimates of $3.59 million (33.8% year-on-year growth, 0.8% beat)

- Revenue: $1.66 billion vs analyst estimates of $1.53 billion (21.2% year-on-year growth, 8.1% beat)

- Pre-tax Profit: $1.31 billion (79.3% margin, 44.3% year-on-year growth)

- Adjusted EPS: $0.57 vs analyst estimates of $0.54 (6.1% beat)

- Market Capitalization: $31.06 billion

Company Overview

Founded in 1977 and known for its sophisticated trading technology and global reach across 150+ exchanges in 34 countries, Interactive Brokers (NASDAQ: IBKR) is a global electronic broker that provides low-cost trading and investment services across stocks, options, futures, forex, bonds, and other financial instruments.

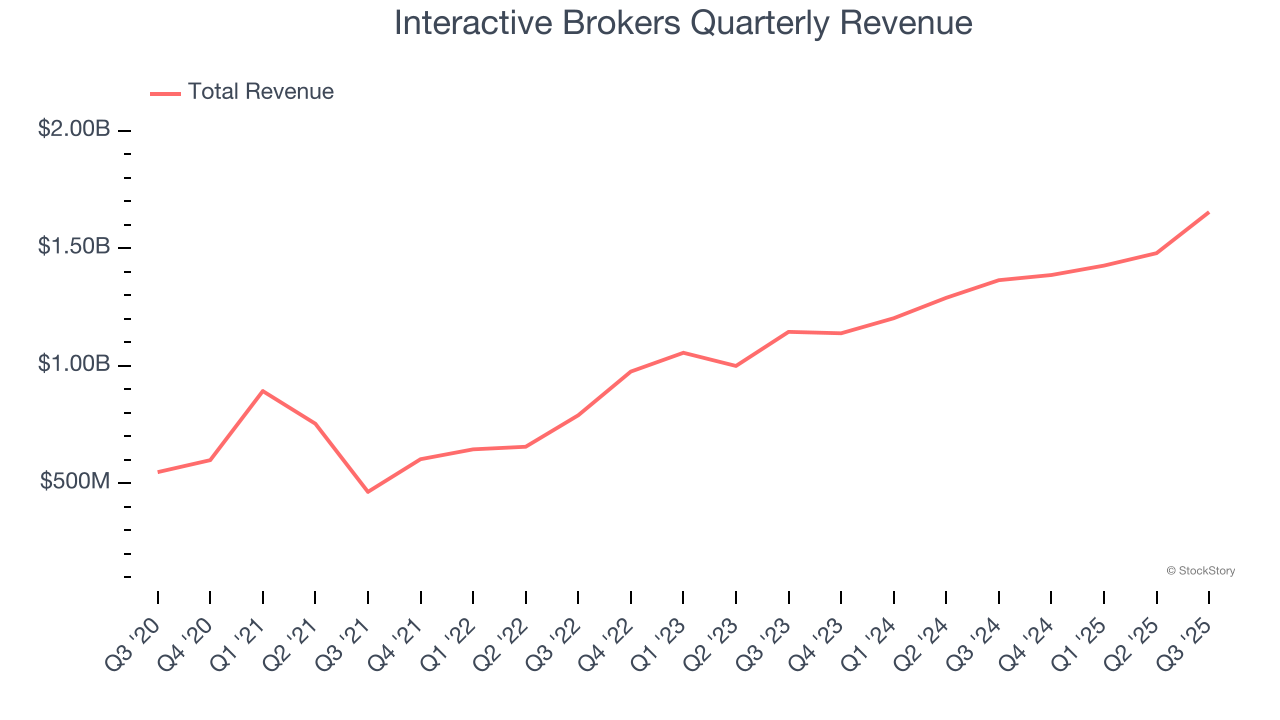

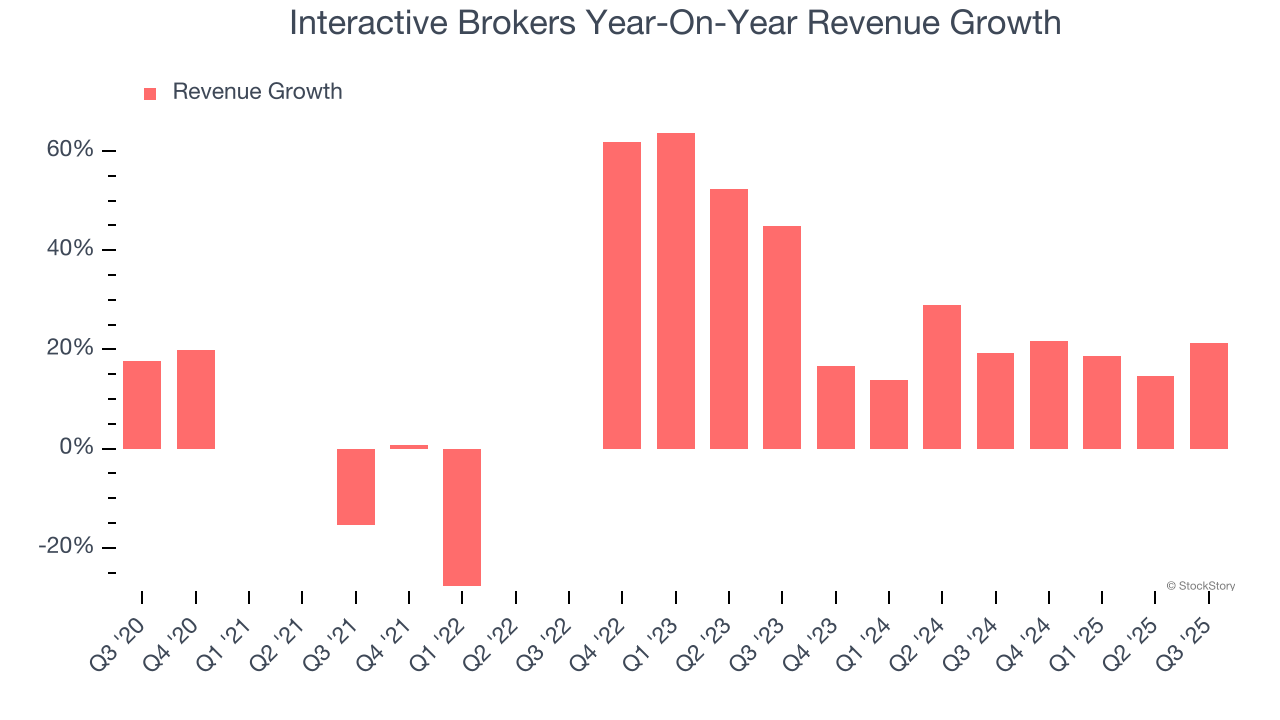

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Interactive Brokers’s revenue grew at an exceptional 22.9% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Interactive Brokers’s annualized revenue growth of 19.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Interactive Brokers reported robust year-on-year revenue growth of 21.2%, and its $1.66 billion of revenue topped Wall Street estimates by 8.1%.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume

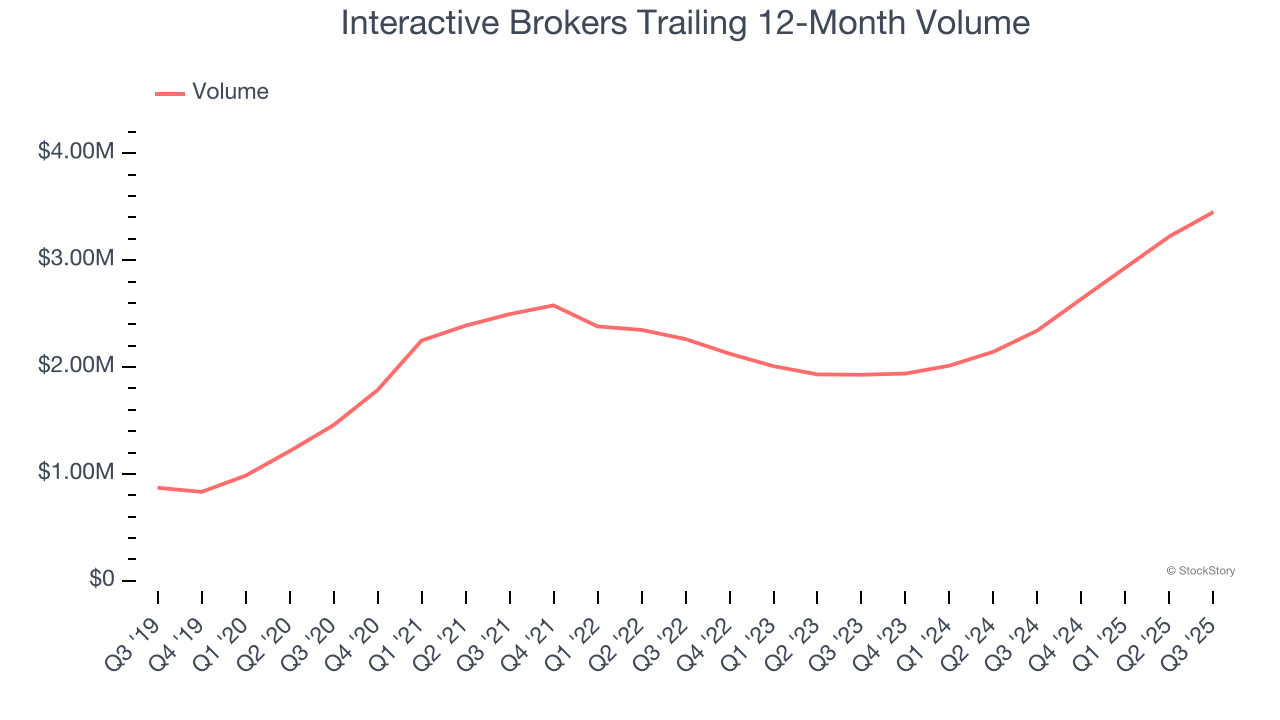

Financial services companies rely heavily on the total number of transactions and loan originations to drive top-line growth. Understanding these volumes is essential for finding winners in the sector.

Interactive Brokers’s volumes have grown at an annual rate of 18.8% over the last five years, better than the broader financials industry but slower than its total revenue. When analyzing Interactive Brokers’s volumes over the last two years, we can see that growth accelerated to 33.8% annually. Its recent performance could be a sign of better days to come.

Interactive Brokers’s volumes punched in at $3.62 million this quarter, beating analysts’ expectations by 0.8%. This print was 33.8% higher than the same quarter last year.

Key Takeaways from Interactive Brokers’s Q3 Results

We were impressed by how significantly Interactive Brokers blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $68.73 immediately after reporting.

Interactive Brokers put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.