Looking back on specialized consumer services stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Pool (NASDAQ: POOL) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.3% since the latest earnings results.

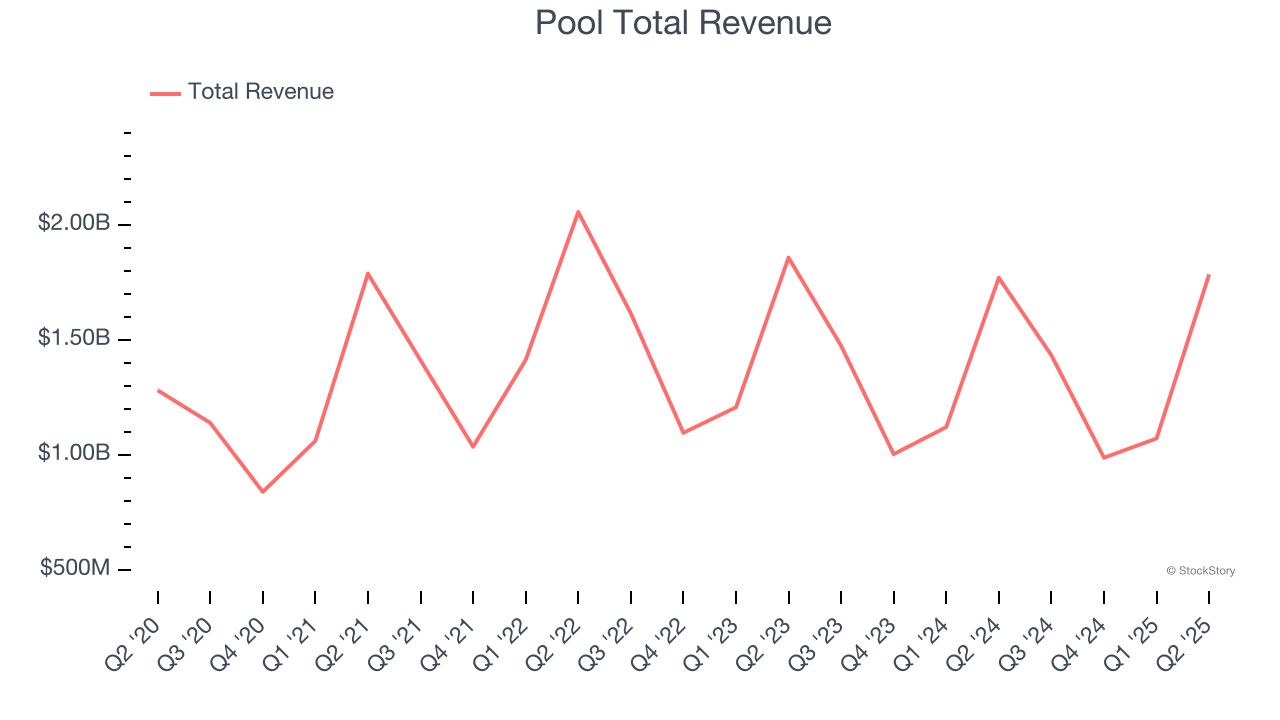

Pool (NASDAQ: POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.78 billion, flat year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a solid beat of analysts’ organic revenue estimates.

“During the second quarter of 2025, we saw sales expansion, reflecting continued growth in maintenance products and improving trends on discretionary spending, and celebrated the opening of our 450th sales center. We remain focused on prioritizing our strategic initiatives through providing an outstanding customer experience and advancing our technology investments, positioning the business for sustained success,” commented Peter D. Arvan, president and CEO.

Unsurprisingly, the stock is down 9% since reporting and currently trades at $288.41.

Is now the time to buy Pool? Access our full analysis of the earnings results here, it’s free for active Edge members.

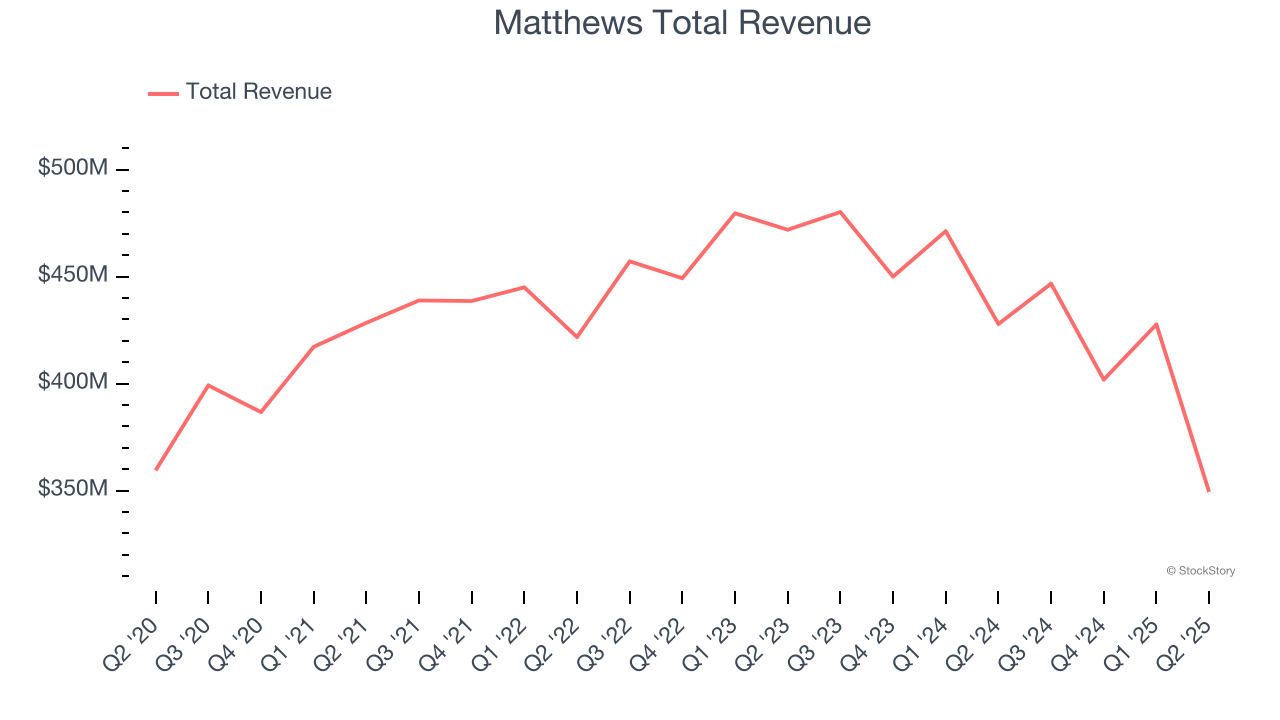

Best Q2: Matthews (NASDAQ: MATW)

Originally a death care company, Matthews International (NASDAQ: MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $349.4 million, down 18.3% year on year, outperforming analysts’ expectations by 8.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Matthews pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3% since reporting. It currently trades at $23.33.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: LKQ (NASDAQ: LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.64 billion, down 1.9% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 23.8% since the results and currently trades at $29.43.

Read our full analysis of LKQ’s results here.

WeightWatchers (NASDAQ: WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $189.2 million, down 6.4% year on year. This print topped analysts’ expectations by 6.2%. It was a very strong quarter as it also put up a beat of analysts’ EPS and EBITDA estimates.

The stock is down 22.3% since reporting and currently trades at $29.60.

Read our full, actionable report on WeightWatchers here, it’s free for active Edge members.

1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $336.6 million, down 6.7% year on year. This result surpassed analysts’ expectations by 2%. Taking a step back, it was a slower quarter as it recorded a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

The stock is down 16.2% since reporting and currently trades at $4.47.

Read our full, actionable report on 1-800-FLOWERS here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.