The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how safety & security services stocks fared in Q2, starting with MSA Safety (NYSE: MSA).

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

The 5 safety & security services stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.3% while next quarter’s revenue guidance was 0.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.3% since the latest earnings results.

MSA Safety (NYSE: MSA)

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE: MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

MSA Safety reported revenues of $474.1 million, up 2.5% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ revenue and EPS estimates.

"Our second quarter financial performance demonstrates our team's commitment to our Accelerate strategy and creating long-term value for our stakeholders," said Steve Blanco, MSA Safety President and CEO.

MSA Safety delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 7% since reporting and currently trades at $165.07.

Is now the time to buy MSA Safety? Access our full analysis of the earnings results here, it’s free for active Edge members.

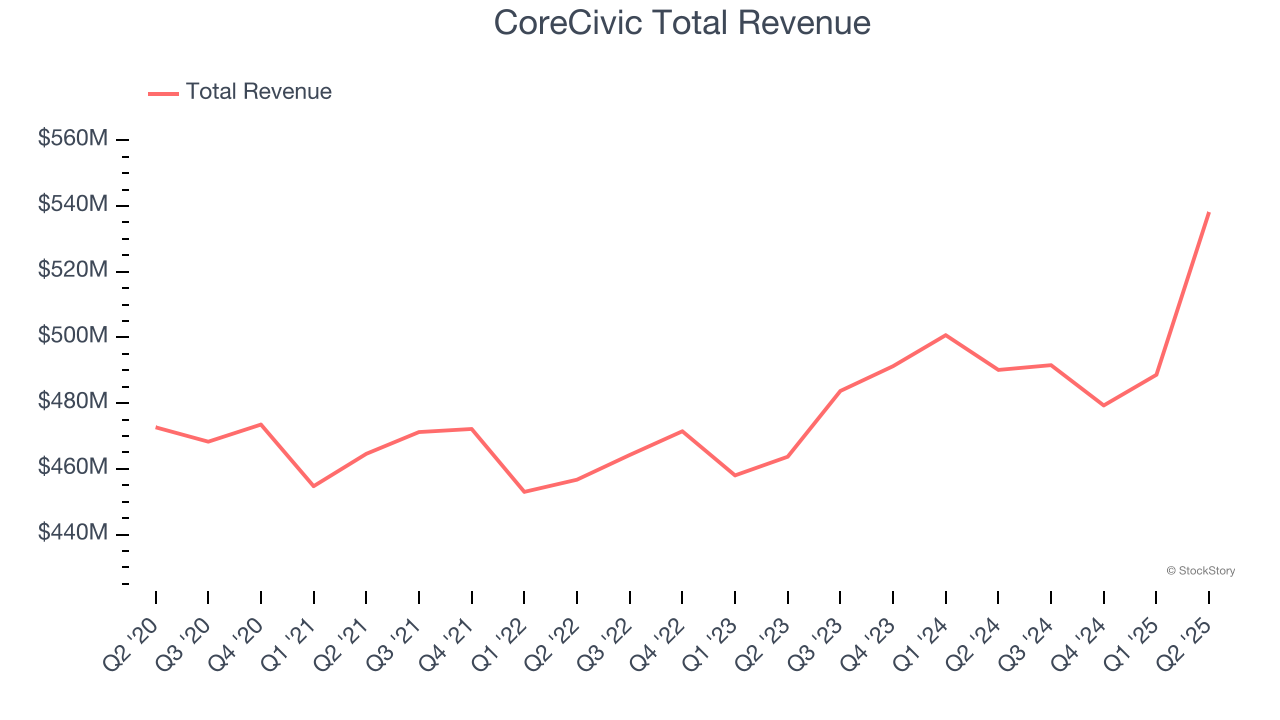

Best Q2: CoreCivic (NYSE: CXW)

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

CoreCivic reported revenues of $538.2 million, up 9.8% year on year, outperforming analysts’ expectations by 8.6%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

CoreCivic pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.4% since reporting. It currently trades at $17.96.

Is now the time to buy CoreCivic? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group reported revenues of $636.2 million, up 4.8% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

GEO Group delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 33.8% since the results and currently trades at $17.09.

Read our full analysis of GEO Group’s results here.

Brink's (NYSE: BCO)

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's (NYSE: BCO) provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

Brink's reported revenues of $1.30 billion, up 3.8% year on year. This print surpassed analysts’ expectations by 2.1%. It was an exceptional quarter as it also logged a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 25.8% since reporting and currently trades at $111.59.

Read our full, actionable report on Brink's here, it’s free for active Edge members.

Brady (NYSE: BRC)

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE: BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady reported revenues of $397.3 million, up 15.7% year on year. This number topped analysts’ expectations by 2.7%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ revenue estimates and a decent beat of analysts’ full-year EPS guidance estimates.

Brady delivered the fastest revenue growth among its peers. The stock is down 3.1% since reporting and currently trades at $75.43.

Read our full, actionable report on Brady here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.