Swimming pool distributor Pool (NASDAQ: POOL) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.3% year on year to $1.45 billion. Its GAAP profit of $3.40 per share was in line with analysts’ consensus estimates.

Is now the time to buy Pool? Find out by accessing our full research report, it’s free for active Edge members.

Pool (POOL) Q3 CY2025 Highlights:

- Revenue: $1.45 billion vs analyst estimates of $1.45 billion (1.3% year-on-year growth, in line)

- EPS (GAAP): $3.40 vs analyst expectations of $3.41 (in line)

- Adjusted EBITDA: $194.7 million vs analyst estimates of $196.6 million (13.4% margin, 1% miss)

- EPS (GAAP) guidance for the full year is $11.06 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 12.3%, in line with the same quarter last year

- Free Cash Flow Margin: 18.4%, down from 21.3% in the same quarter last year

- Market Capitalization: $11.11 billion

“Building on momentum from the second quarter, we achieved sales growth in the third quarter of 2025. Our dedicated teams delivered not only top-line growth but also expanded gross margin. We continued to strengthen our industry leading position by adding four new locations this quarter and elevated our customer experience through expanded private-label offerings and strategic product partnerships. This month, we proudly mark our 30th anniversary as a public company listed on the Nasdaq Stock Market, a milestone made possible by our team’s long-term strategic focus and ongoing commitment to offer our customers the best value proposition in the industry,” commented Peter D. Arvan, president and CEO.

Company Overview

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Revenue Growth

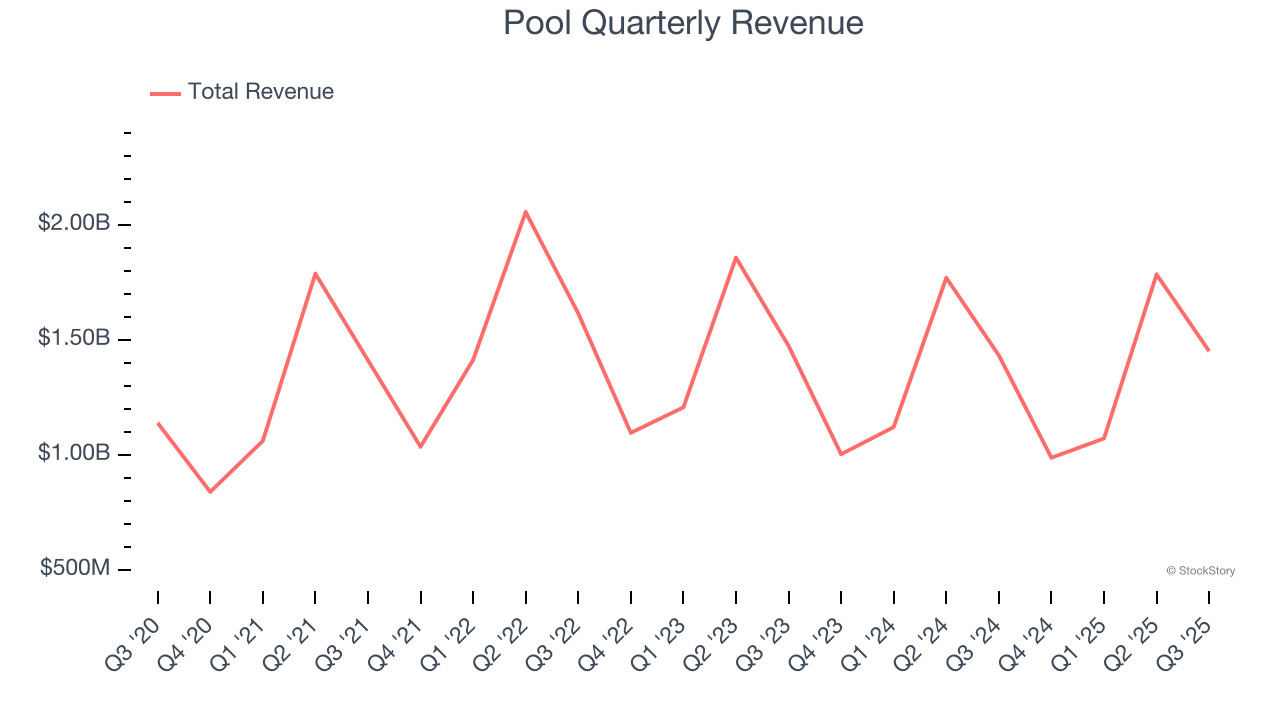

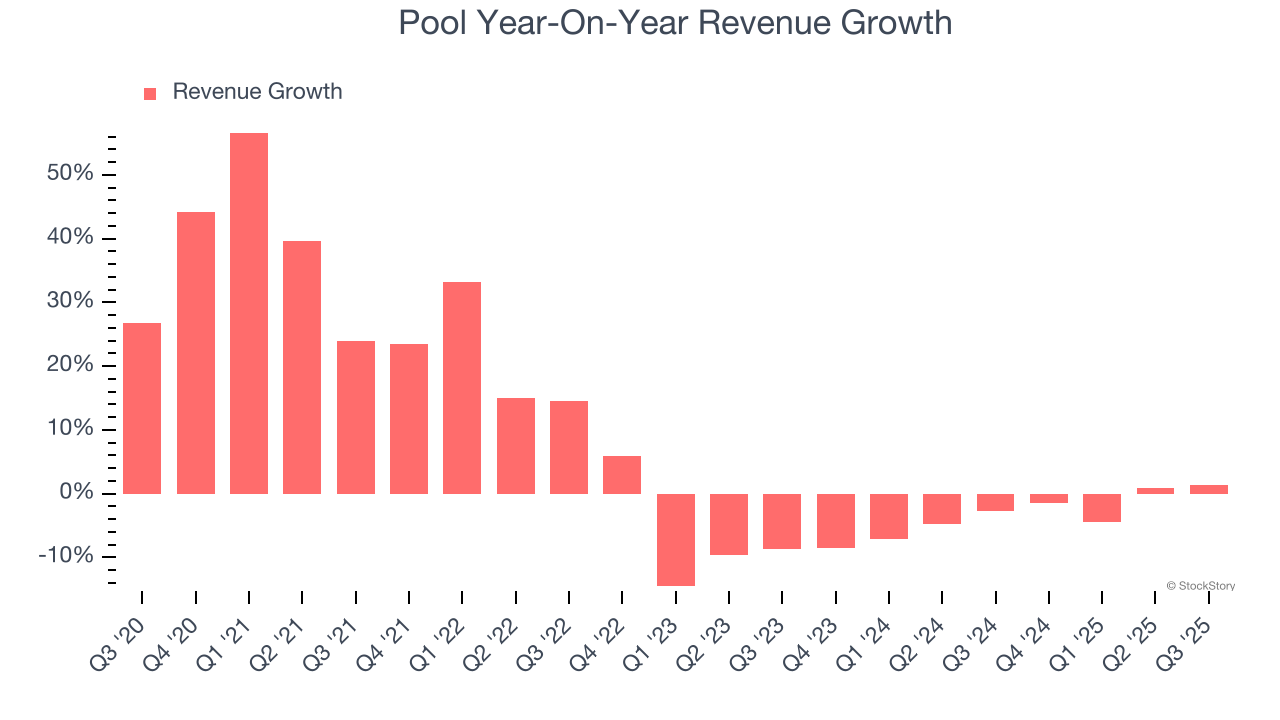

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Pool’s 7.5% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Pool’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.1% annually.

This quarter, Pool grew its revenue by 1.3% year on year, and its $1.45 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

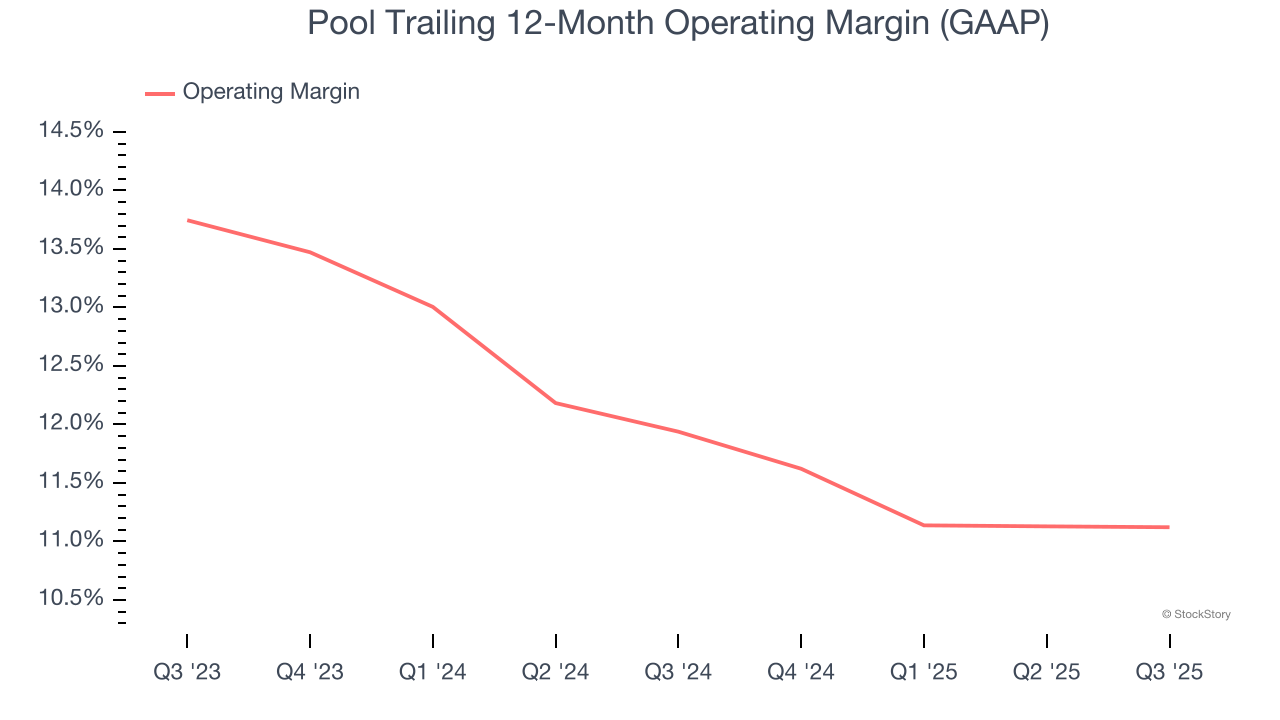

Pool’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 11.5% over the last two years. This profitability was higher than the broader consumer discretionary sector, showing it did a decent job managing its expenses.

In Q3, Pool generated an operating margin profit margin of 12.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

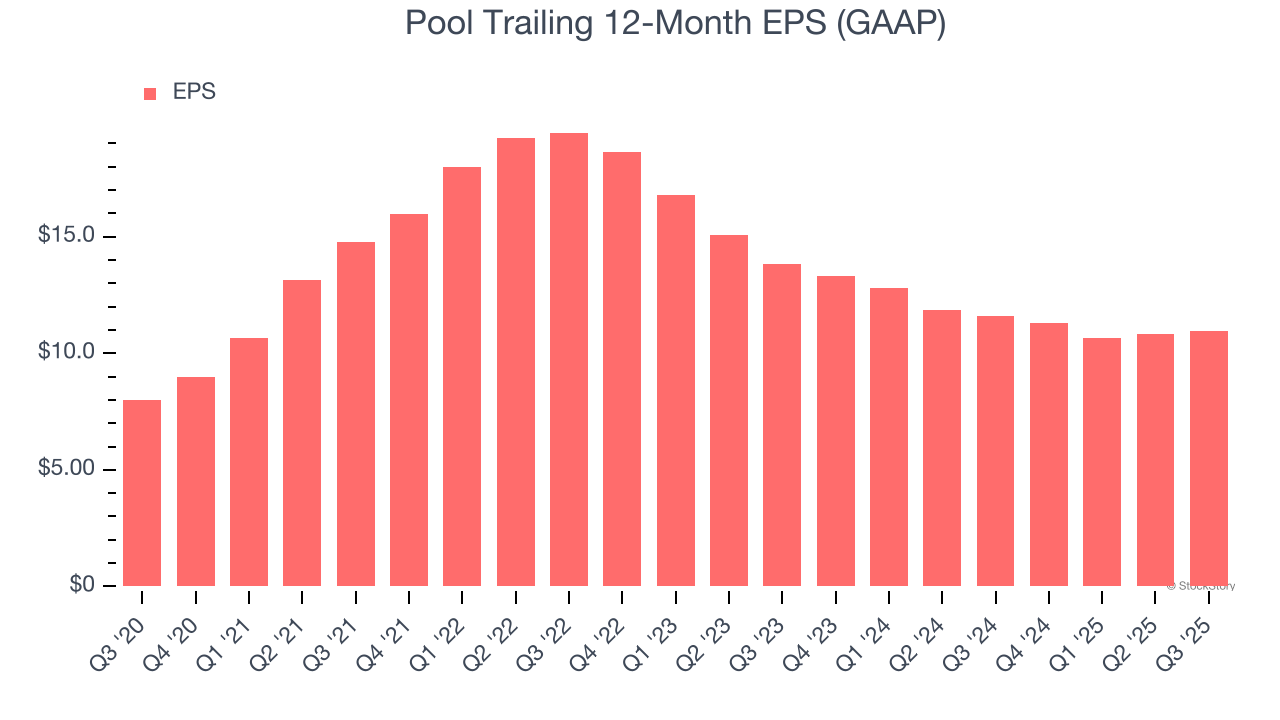

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Pool’s unimpressive 6.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, Pool reported EPS of $3.40, up from $3.27 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Pool’s full-year EPS of $10.97 to grow 4.9%.

Key Takeaways from Pool’s Q3 Results

Revenue, EPS, and EPS guidance were all in line. Zooming out, we think this was a quarter without many surprises, good or bad. The stock remained flat at $297.77 immediately after reporting.

So do we think Pool is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.