Macy's has been on fire lately. In the past six months alone, the company’s stock price has rocketed 69.2%, setting a new 52-week high of $18.65 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Macy's, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Macy's Will Underperform?

We’re happy investors have made money, but we're swiping left on Macy's for now. Here are three reasons you should be careful with M and a stock we'd rather own.

1. Stores Are Closing, a Headwind for Revenue

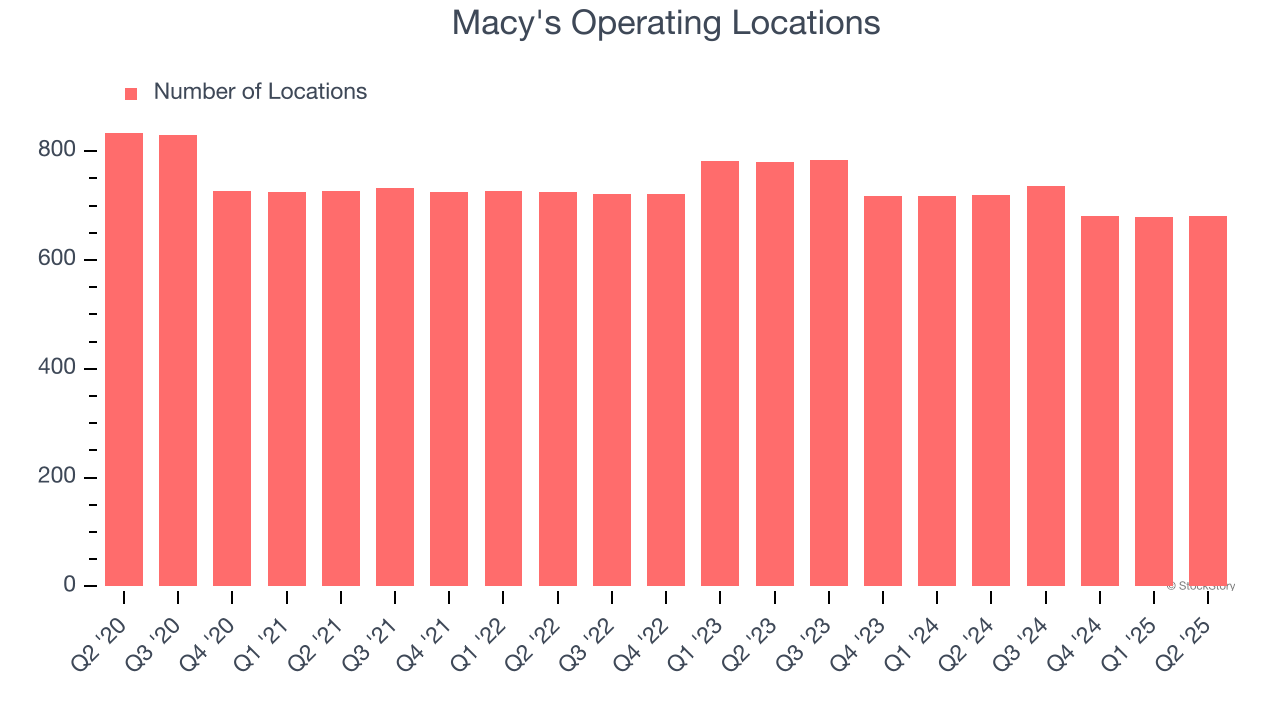

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Macy's operated 681 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 3.8% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

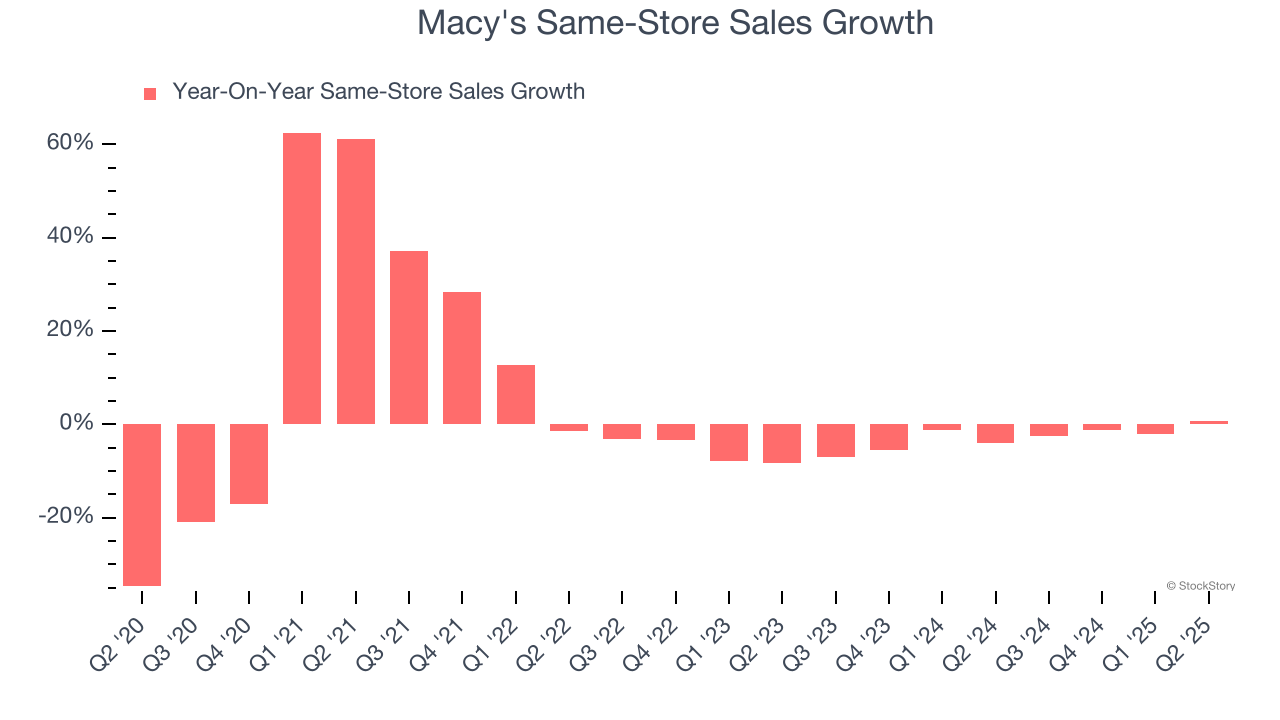

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Macy’s demand has been shrinking over the last two years as its same-store sales have averaged 2.8% annual declines.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Macy’s revenue to drop by 4%, a decrease from This projection doesn't excite us and indicates its products will face some demand challenges.

Final Judgment

Macy's doesn’t pass our quality test. Following the recent rally, the stock trades at 9.6× forward P/E (or $18.65 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Macy's

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.