Biotech company BioMarin Pharmaceutical (NASDAQ: BMRN) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.1% year on year to $776.1 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.18 billion at the midpoint. Its non-GAAP profit of $0.12 per share was 62.5% below analysts’ consensus estimates.

Is now the time to buy BioMarin Pharmaceutical? Find out by accessing our full research report, it’s free for active Edge members.

BioMarin Pharmaceutical (BMRN) Q3 CY2025 Highlights:

- Revenue: $776.1 million vs analyst estimates of $778.3 million (4.1% year-on-year growth, in line)

- Adjusted EPS: $0.12 vs analyst expectations of $0.32 (62.5% miss)

- Adjusted EBITDA: -$41.84 million vs analyst estimates of -$16.44 million (-5.4% margin, significant miss)

- The company slightly lifted its revenue guidance for the full year to $3.18 billion at the midpoint from $3.16 billion

- Management lowered its full-year Adjusted EPS guidance to $3.55 at the midpoint, a 20.7% decrease

- Operating Margin: -6%, down from 15.3% in the same quarter last year

- Free Cash Flow Margin: 43.8%, up from 27.2% in the same quarter last year

- Market Capitalization: $10.46 billion

"We are pleased with the contributions from our Enzyme Therapies and Skeletal Conditions business units to date this year driven by more than 20% revenue growth from PALYNZIQ and VOXZOGO," said Alexander Hardy, President and Chief Executive Officer of BioMarin.

Company Overview

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ: BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

Revenue Growth

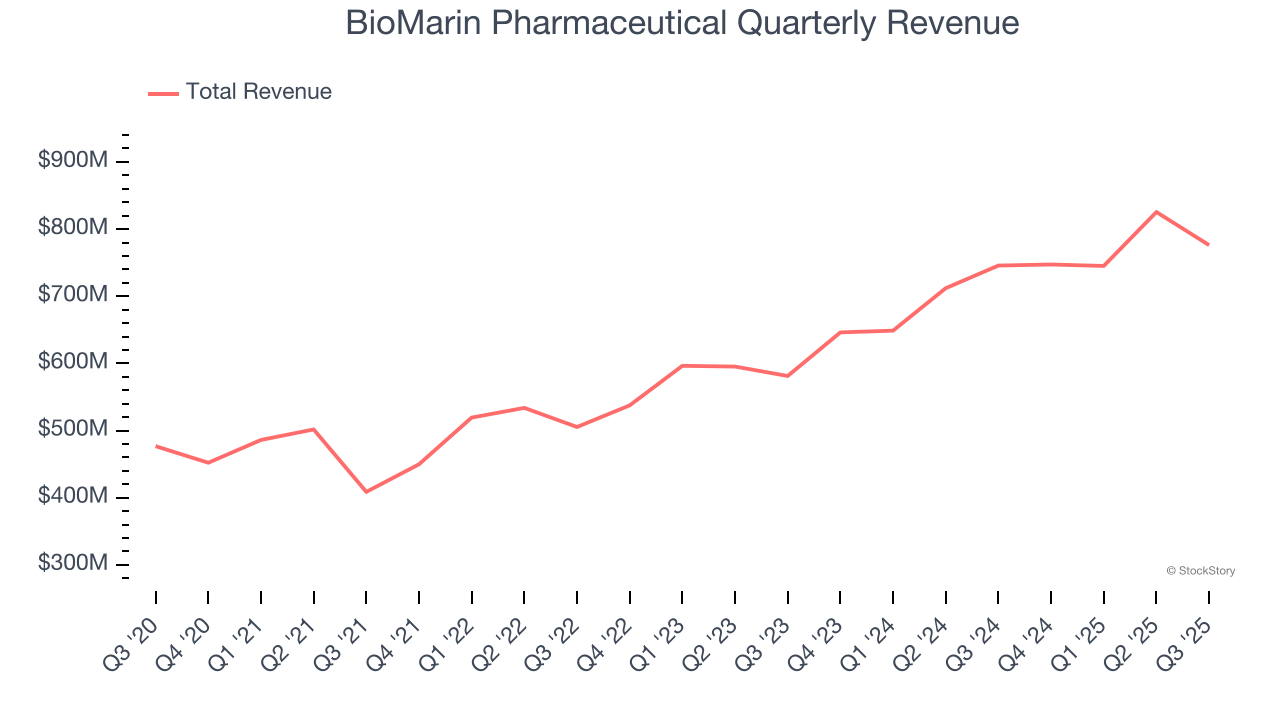

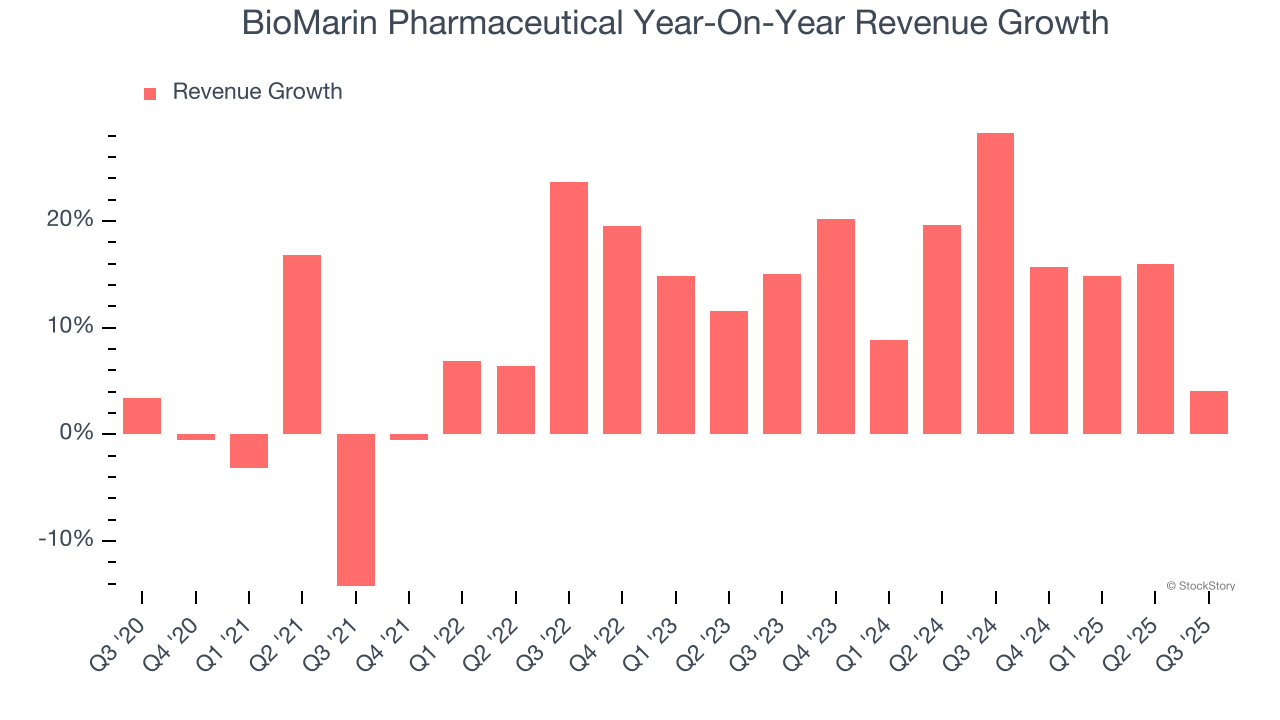

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, BioMarin Pharmaceutical’s 10.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. BioMarin Pharmaceutical’s annualized revenue growth of 15.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, BioMarin Pharmaceutical grew its revenue by 4.1% year on year, and its $776.1 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and implies the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

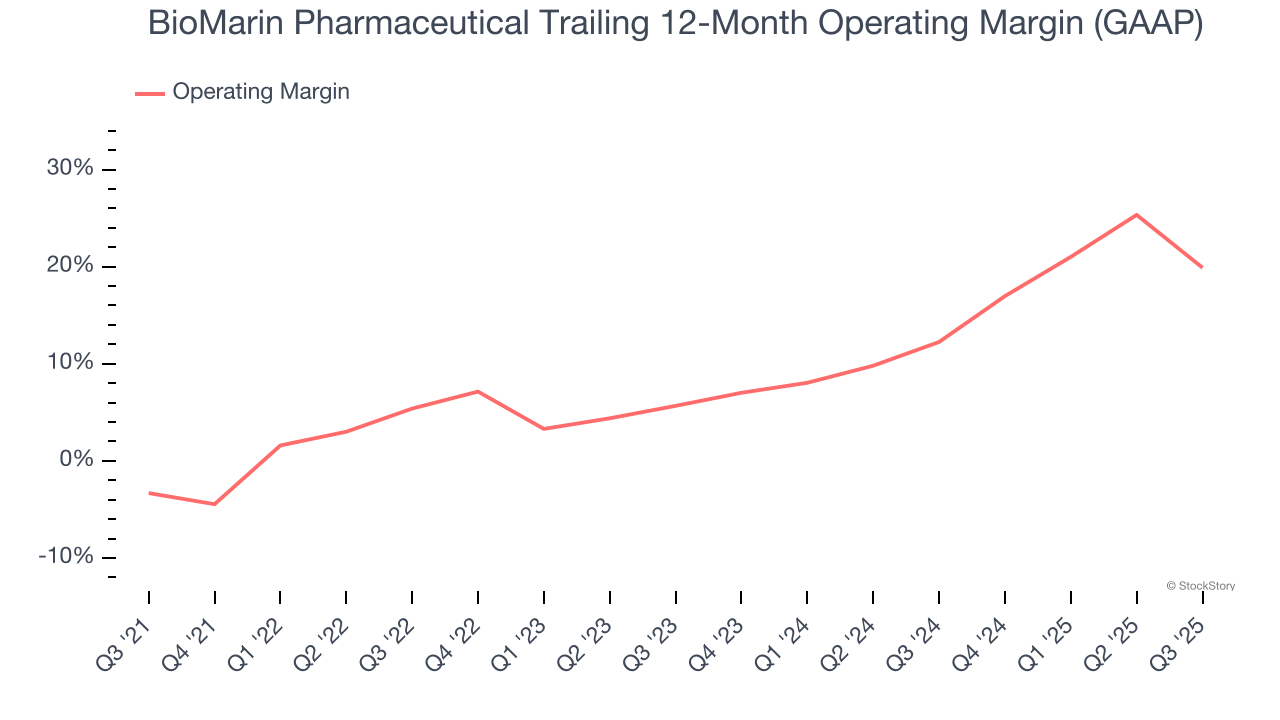

BioMarin Pharmaceutical was profitable over the last five years but held back by its large cost base. Its average operating margin of 9.4% was weak for a healthcare business.

On the plus side, BioMarin Pharmaceutical’s operating margin rose by 23.2 percentage points over the last five years, as its sales growth gave it immense operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 14.2 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, BioMarin Pharmaceutical generated an operating margin profit margin of negative 6%, down 21.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

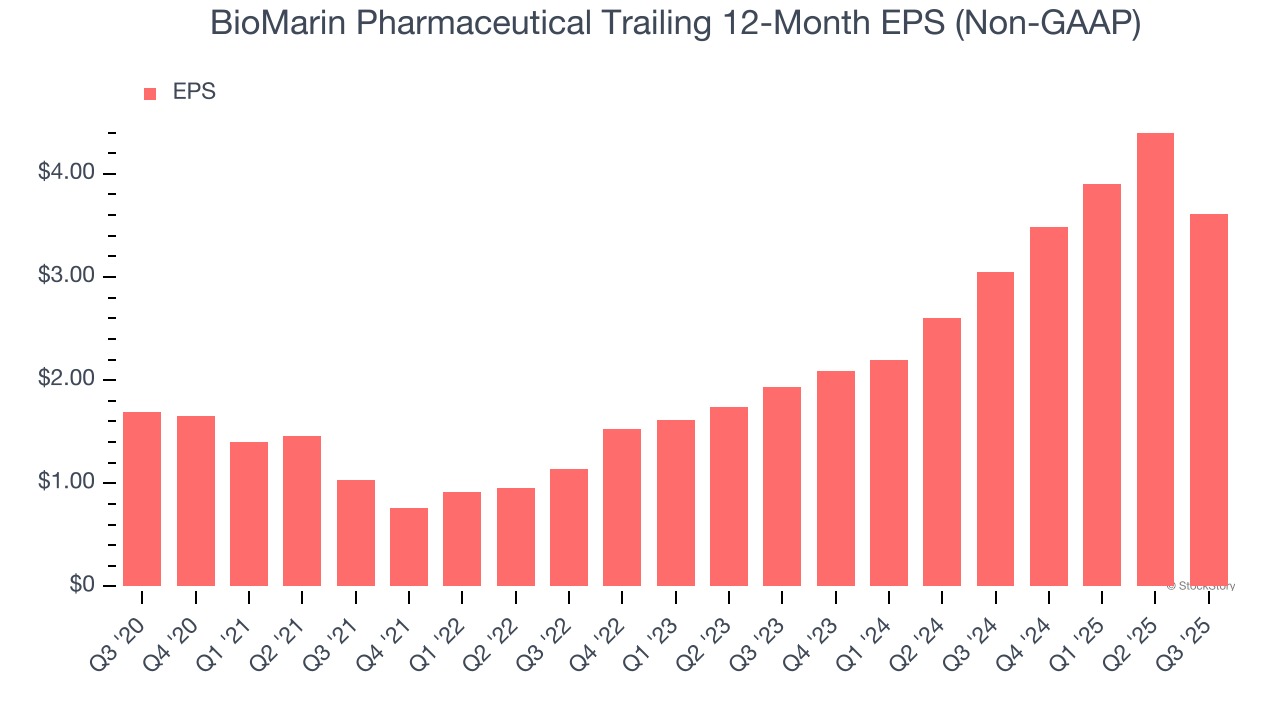

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

BioMarin Pharmaceutical’s EPS grew at an astounding 16.3% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

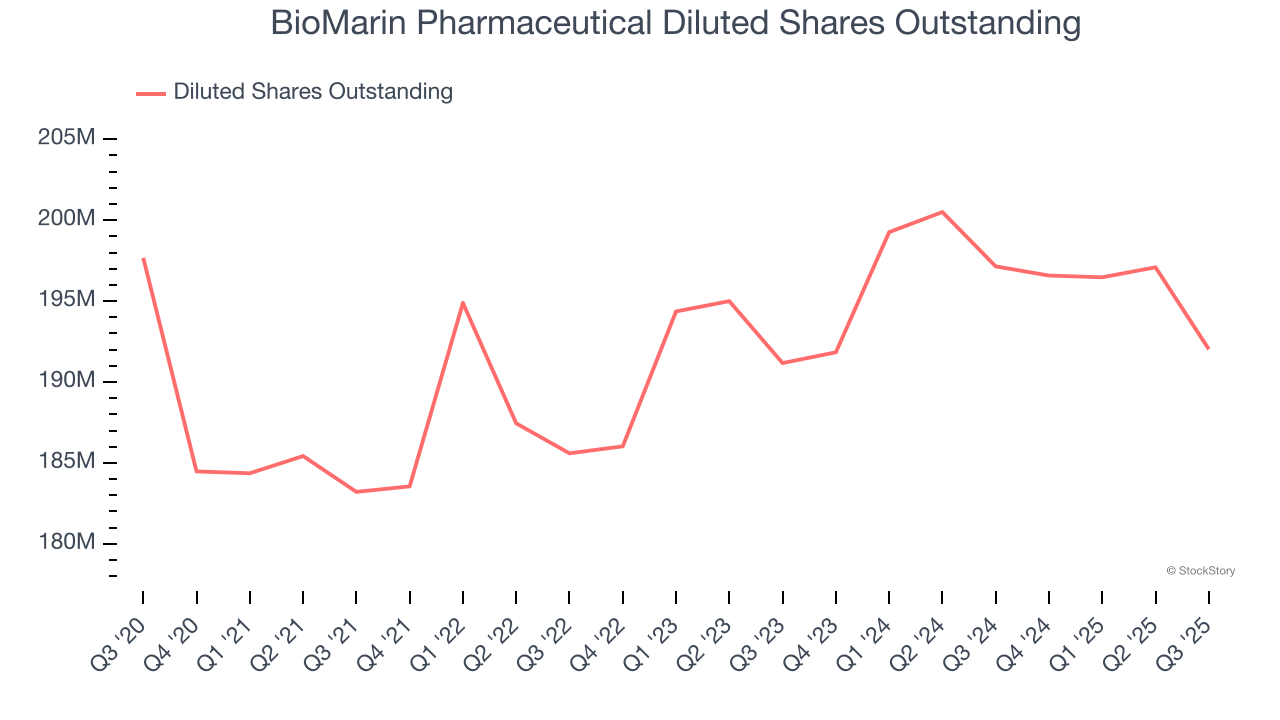

Diving into BioMarin Pharmaceutical’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, BioMarin Pharmaceutical’s operating margin declined this quarter but expanded by 23.2 percentage points over the last five years. Its share count also shrank by 2.9%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, BioMarin Pharmaceutical reported adjusted EPS of $0.12, down from $0.91 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects BioMarin Pharmaceutical’s full-year EPS of $3.61 to grow 31.5%.

Key Takeaways from BioMarin Pharmaceutical’s Q3 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $52.67 immediately following the results.

BioMarin Pharmaceutical didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.