Wrapping up Q2 earnings, we look at the numbers and key takeaways for the personal loan stocks, including Nubank (NYSE: NU) and its peers.

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

The 9 personal loan stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 4.9% while next quarter’s revenue guidance was 1.4% below.

In light of this news, share prices of the companies have held steady as they are up 1.9% on average since the latest earnings results.

Nubank (NYSE: NU)

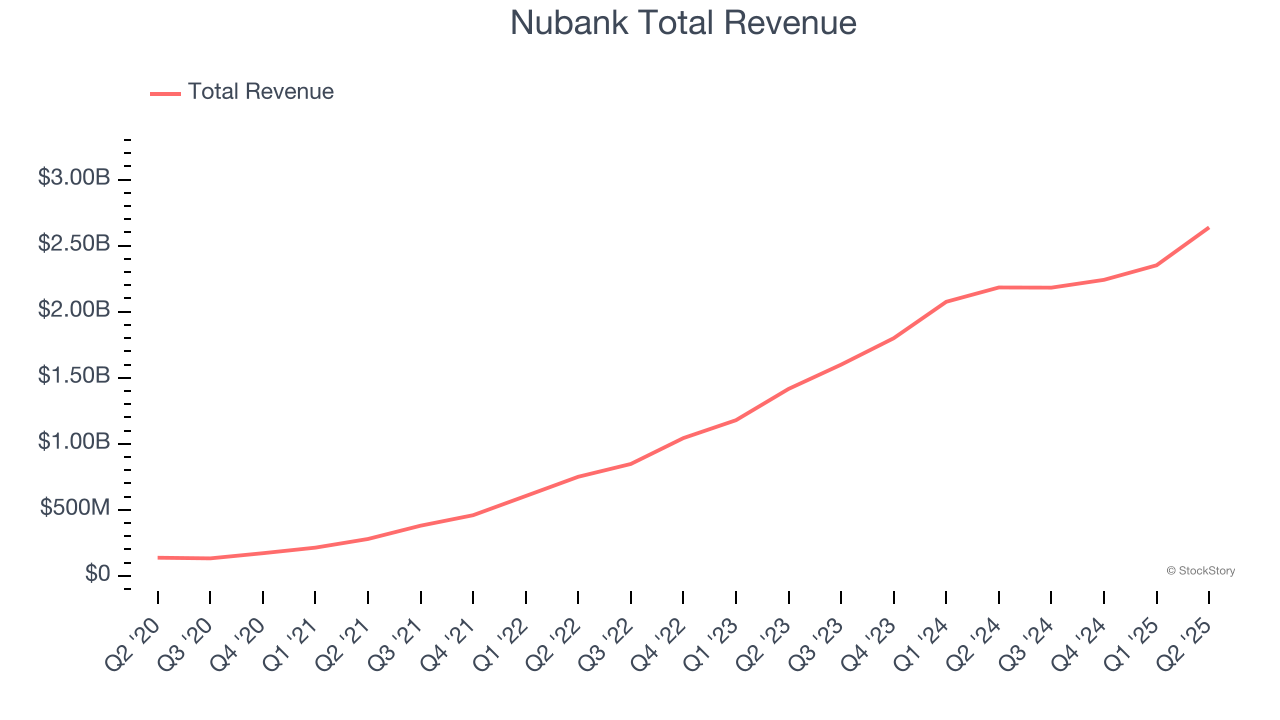

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE: NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

Nubank reported revenues of $2.64 billion, up 20.8% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a satisfactory quarter for the company with EPS in line with analysts’ estimates.

Interestingly, the stock is up 26.8% since reporting and currently trades at $15.22.

Is now the time to buy Nubank? Access our full analysis of the earnings results here, it’s free.

Best Q2: LendingClub (NYSE: LC)

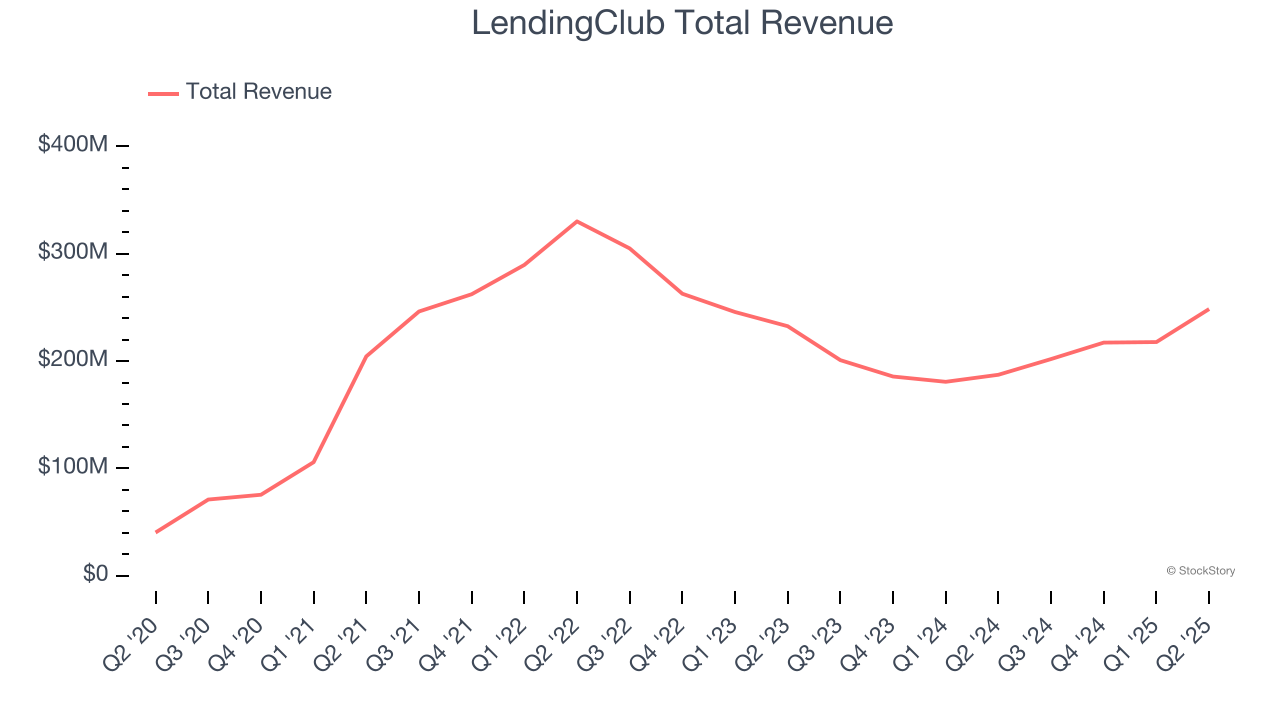

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE: LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

LendingClub reported revenues of $248.4 million, up 32.7% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 14.6% since reporting. It currently trades at $15.06.

Is now the time to buy LendingClub? Access our full analysis of the earnings results here, it’s free.

FirstCash (NASDAQ: FCFS)

Offering a financial lifeline to the unbanked and credit-constrained since 1988, FirstCash (NASDAQ: FCFS) operates pawn stores across the U.S. and Latin America while also providing retail point-of-sale payment solutions for credit-constrained consumers.

FirstCash reported revenues of $830.6 million, flat year on year, exceeding analysts’ expectations by 1%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

FirstCash delivered the slowest revenue growth in the group. Interestingly, the stock is up 11.6% since the results and currently trades at $149.09.

Read our full analysis of FirstCash’s results here.

Dave (NASDAQ: DAVE)

Named after the biblical David fighting financial Goliaths, Dave (NASDAQ: DAVE) is a digital financial services platform that helps Americans living paycheck to paycheck with cash advances, banking services, and tools to improve their financial health.

Dave reported revenues of $131.8 million, up 64.5% year on year. This result beat analysts’ expectations by 16%. Overall, it was an incredible quarter as it also put up a beat of analysts’ EPS estimates.

Dave achieved the biggest analyst estimates beat among its peers. The stock is down 14.6% since reporting and currently trades at $204.04.

Read our full, actionable report on Dave here, it’s free.

OneMain (NYSE: OMF)

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE: OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

OneMain reported revenues of $1.21 billion, up 10.2% year on year. This number surpassed analysts’ expectations by 1.7%. It was a very strong quarter as it also logged a solid beat of analysts’ yield estimates and a beat of analysts’ EPS estimates.

The stock is down 3.5% since reporting and currently trades at $56.58.

Read our full, actionable report on OneMain here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.