Let’s dig into the relative performance of LPL Financial (NASDAQ: LPLA) and its peers as we unravel the now-completed Q2 investment banking & brokerage earnings season.

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 16 investment banking & brokerage stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 6.7%.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

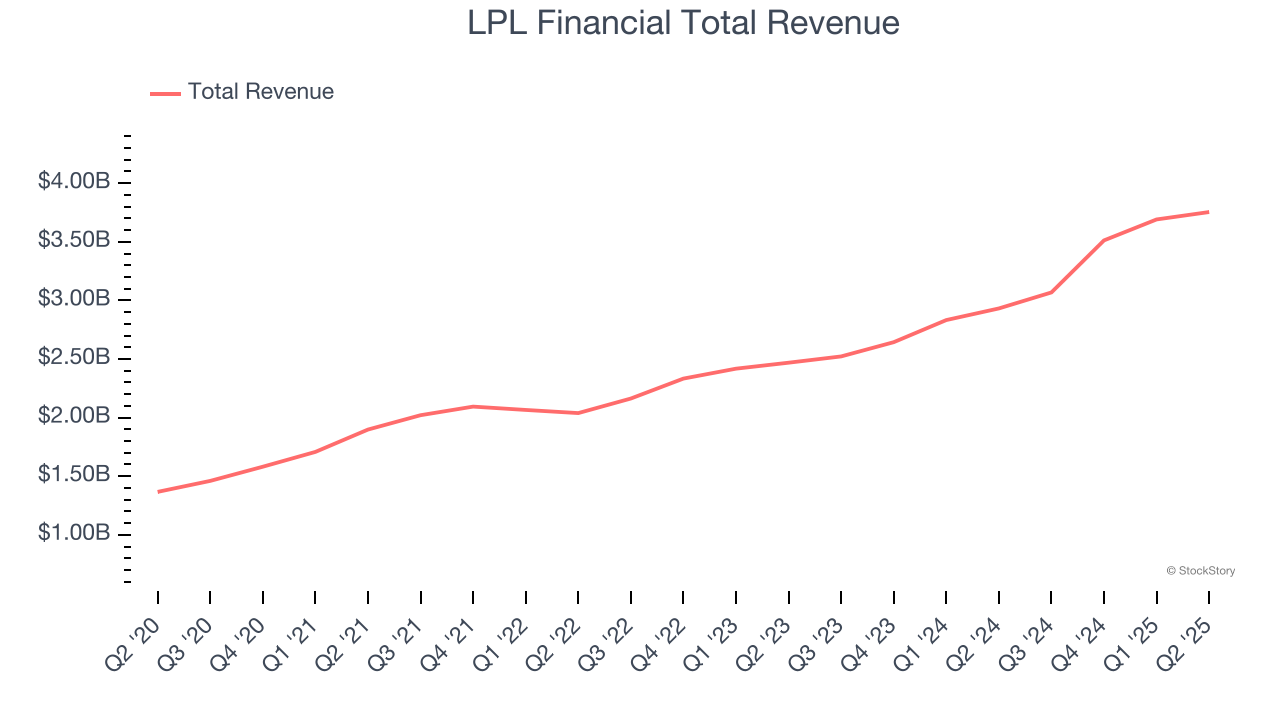

LPL Financial (NASDAQ: LPLA)

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ: LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

LPL Financial reported revenues of $3.75 billion, up 28.1% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates but a slight miss of analysts’ undefined segment estimates.

"We continue to execute on our vision to be the best firm in wealth management," said Rich Steinmeier, CEO.

Unsurprisingly, the stock is down 20.3% since reporting and currently trades at $316.

Is now the time to buy LPL Financial? Access our full analysis of the earnings results here, it’s free.

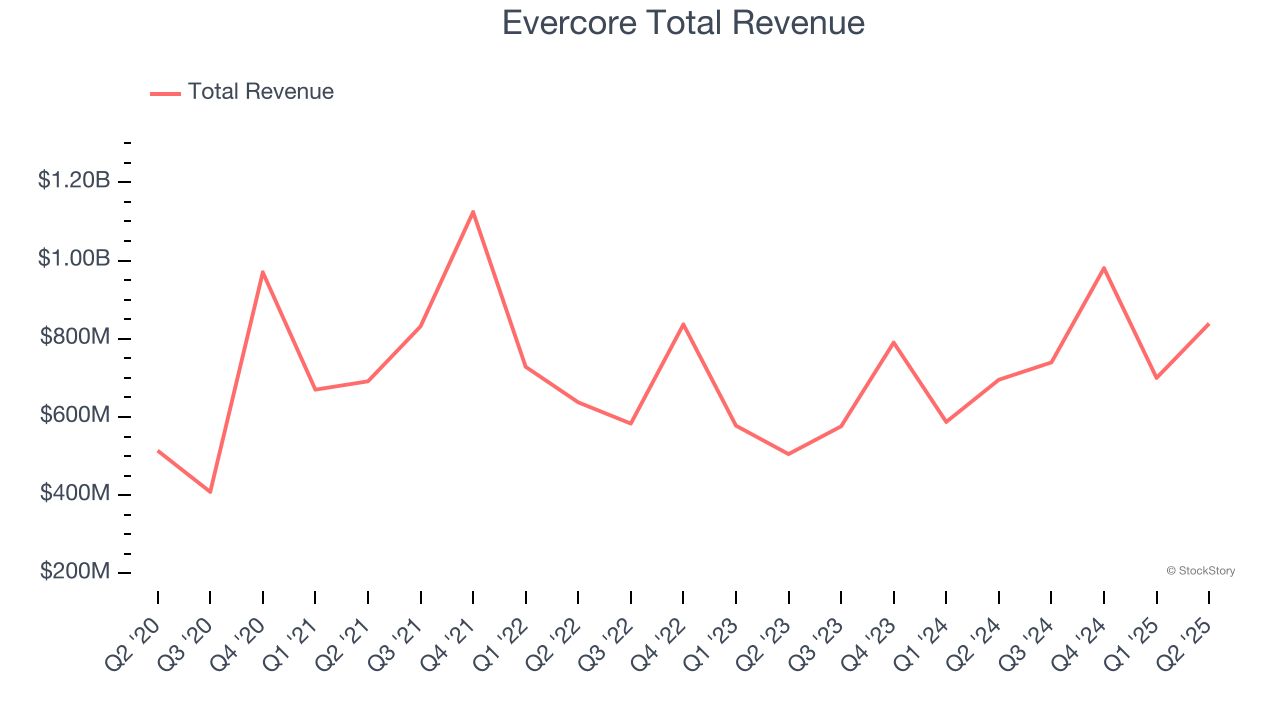

Best Q2: Evercore (NYSE: EVR)

Founded in 1995 as a boutique advisory firm focused on independence and client trust, Evercore (NYSE: EVR) is an independent investment banking firm that provides strategic advisory, capital markets, and wealth management services to corporations, financial sponsors, and high-net-worth individuals.

Evercore reported revenues of $838.9 million, up 20.7% year on year, outperforming analysts’ expectations by 16.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates. estimates.

The market seems happy with the results as the stock is up 10.5% since reporting. It currently trades at $334.01.

Is now the time to buy Evercore? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: BGC (NASDAQ: BGC)

Tracing its roots back to 1945 and named after founder Bernard Gerald Cantor, BGC Group (NASDAQ: BGC) operates a global brokerage and financial technology platform that facilitates trading across fixed income, foreign exchange, equities, energy, and commodities markets.

BGC reported revenues of $750.2 million, up 41.8% year on year, falling short of analysts’ expectations by 2.3%. It was a slower quarter as it posted a miss of analysts’ EBITDA estimates.

BGC delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 4.9% since the results and currently trades at $9.24.

Read our full analysis of BGC’s results here.

Interactive Brokers (NASDAQ: IBKR)

Founded in 1977 and known for its sophisticated trading technology and global reach across 150+ exchanges in 34 countries, Interactive Brokers (NASDAQ: IBKR) is a global electronic broker that provides low-cost trading and investment services across stocks, options, futures, forex, bonds, and other financial instruments.

Interactive Brokers reported revenues of $1.48 billion, up 14.7% year on year. This result beat analysts’ expectations by 6.3%. It was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

The stock is up 19.9% since reporting and currently trades at $71.30.

Read our full, actionable report on Interactive Brokers here, it’s free.

Stifel (NYSE: SF)

Tracing its roots back to 1890 when the firm was established in St. Louis, Stifel Financial (NYSE: SF) is a financial services firm that provides wealth management, investment banking, and institutional brokerage services to individuals, corporations, and institutions.

Stifel reported revenues of $1.28 billion, up 5.4% year on year. This print topped analysts’ expectations by 4.2%. Overall, it was a very strong quarter as it also produced a beat of analysts’ EPS estimates.

The stock is up 1.9% since reporting and currently trades at $112.09.

Read our full, actionable report on Stifel here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.