E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ: FLWS) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 11.1% year on year to $215.2 million. Its non-GAAP loss of $0.83 per share was 29.7% below analysts’ consensus estimates.

Is now the time to buy 1-800-FLOWERS? Find out by accessing our full research report, it’s free for active Edge members.

1-800-FLOWERS (FLWS) Q3 CY2025 Highlights:

- Revenue: $215.2 million vs analyst estimates of $217.8 million (11.1% year-on-year decline, 1.2% miss)

- Adjusted EPS: -$0.83 vs analyst expectations of -$0.64 (29.7% miss)

- Adjusted EBITDA: -$32.95 million vs analyst estimates of -$32.95 million (-15.3% margin, in line)

- Operating Margin: -23.5%, down from -18.7% in the same quarter last year

- Free Cash Flow was -$145.6 million compared to -$189.3 million in the same quarter last year

- Market Capitalization: $222 million

“Fiscal 2026 marks a pivotal year of stabilization for 1-800-Flowers.com, as we lay the foundation for sustainable, long-term growth. We are already seeing early benefits from our turnaround strategy, including improved marketing efficiency, enhanced customer focus, and expanded reach into new channels. Welcoming new talent and streamlining our operations have positioned us to execute with greater agility and accountability. While there is much more work ahead and some challenges to navigate, I am encouraged by the momentum building across the enterprise and am confident in our team’s ability to deliver improved results over time,” said Adolfo Villagomez, Chief Executive Officer.

Company Overview

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

Revenue Growth

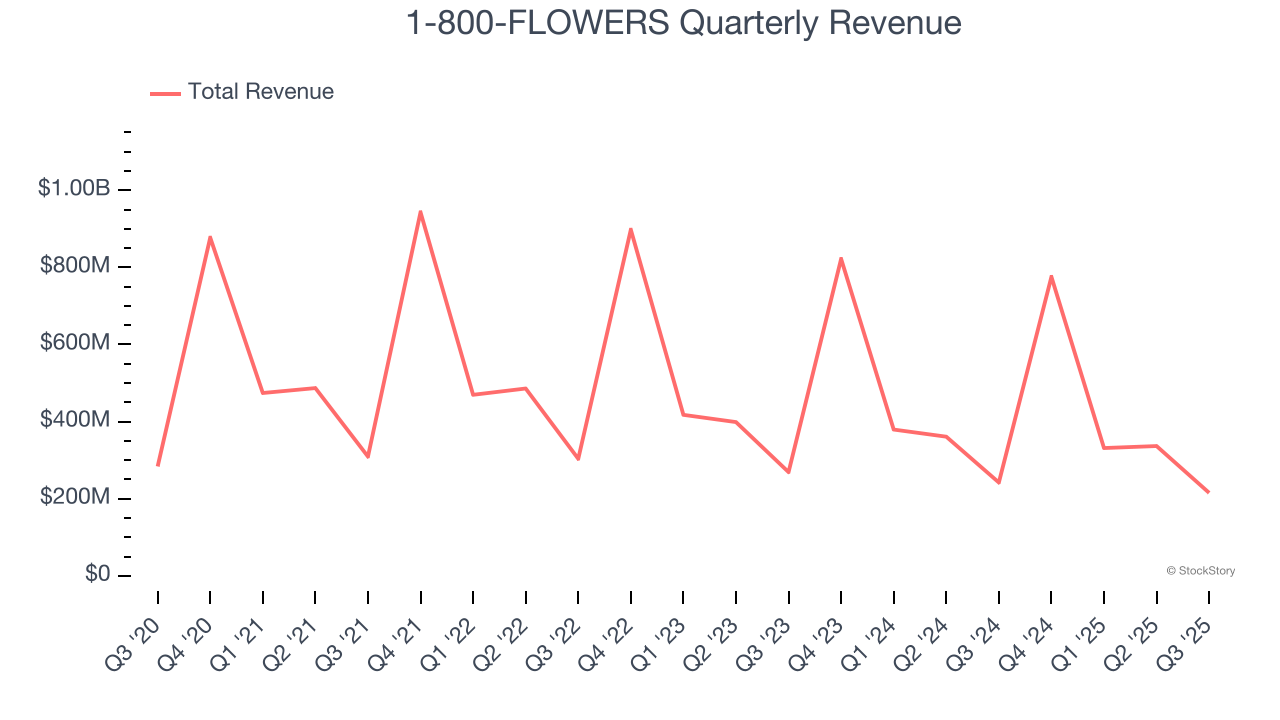

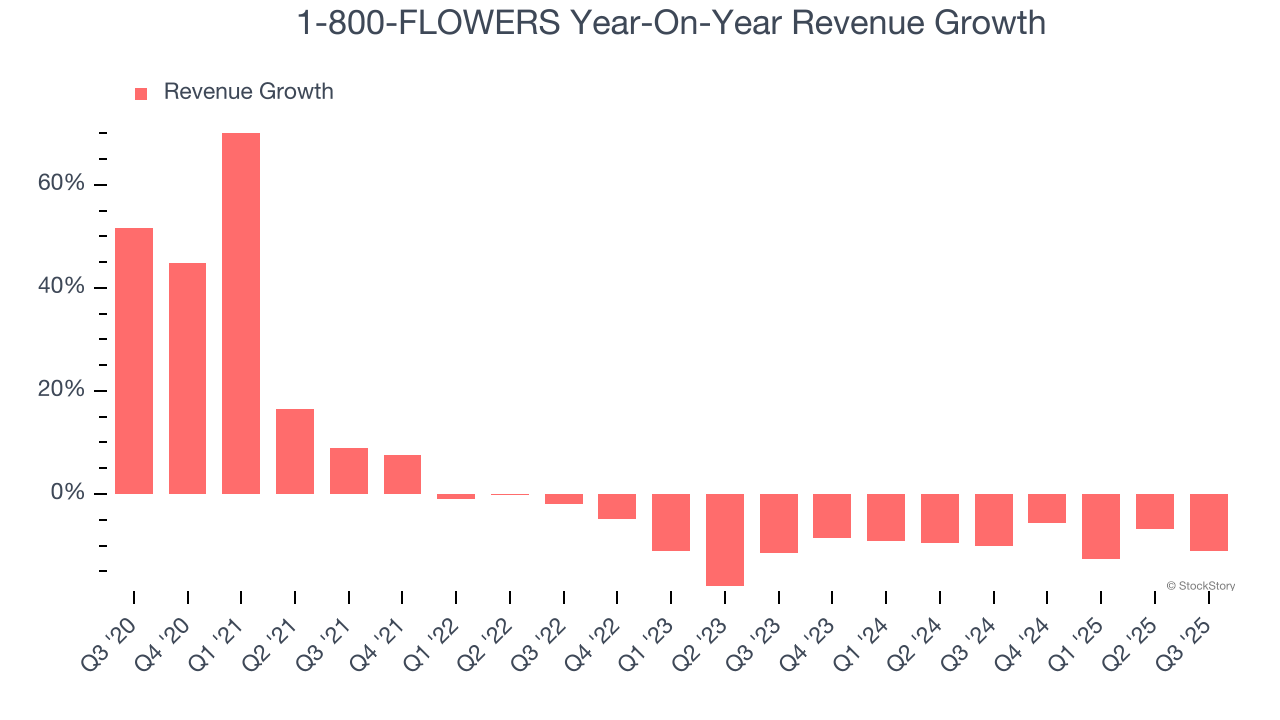

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, 1-800-FLOWERS struggled to consistently increase demand as its $1.66 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. 1-800-FLOWERS’s recent performance shows its demand remained suppressed as its revenue has declined by 8.5% annually over the last two years.

This quarter, 1-800-FLOWERS missed Wall Street’s estimates and reported a rather uninspiring 11.1% year-on-year revenue decline, generating $215.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 2.2% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

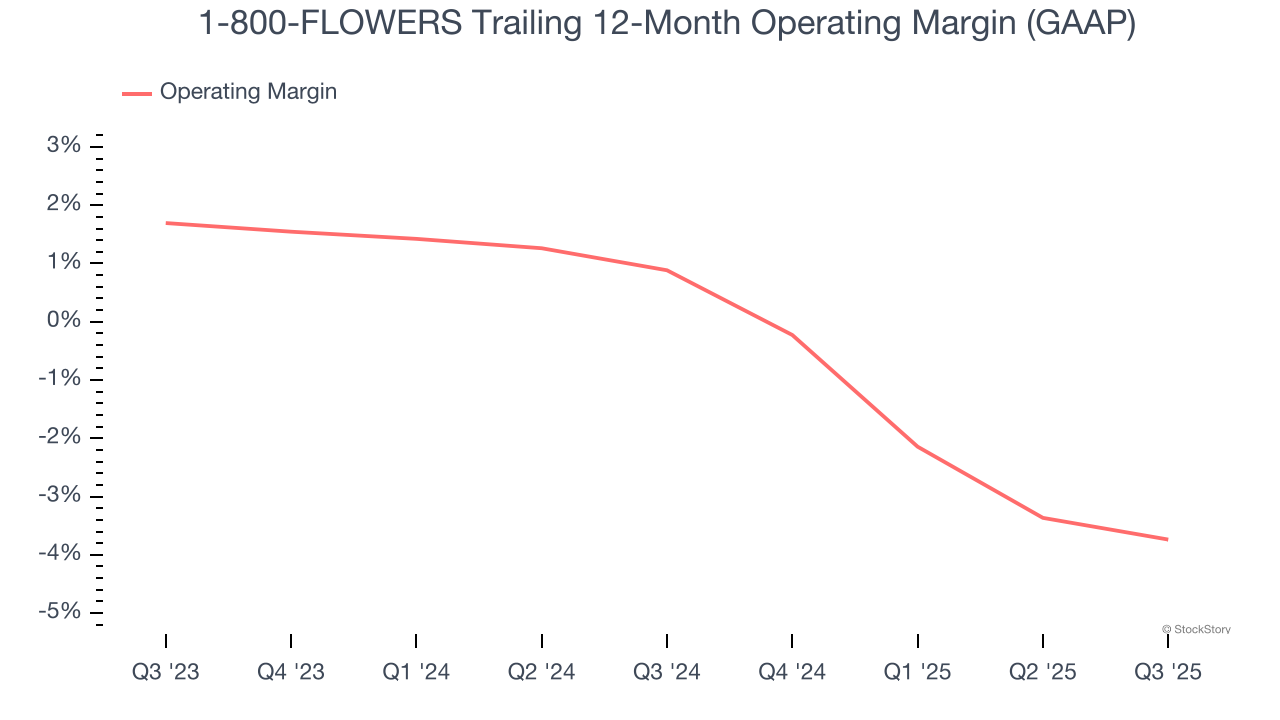

1-800-FLOWERS’s operating margin has shrunk over the last 12 months and averaged negative 1.3% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

1-800-FLOWERS’s operating margin was negative 23.5% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

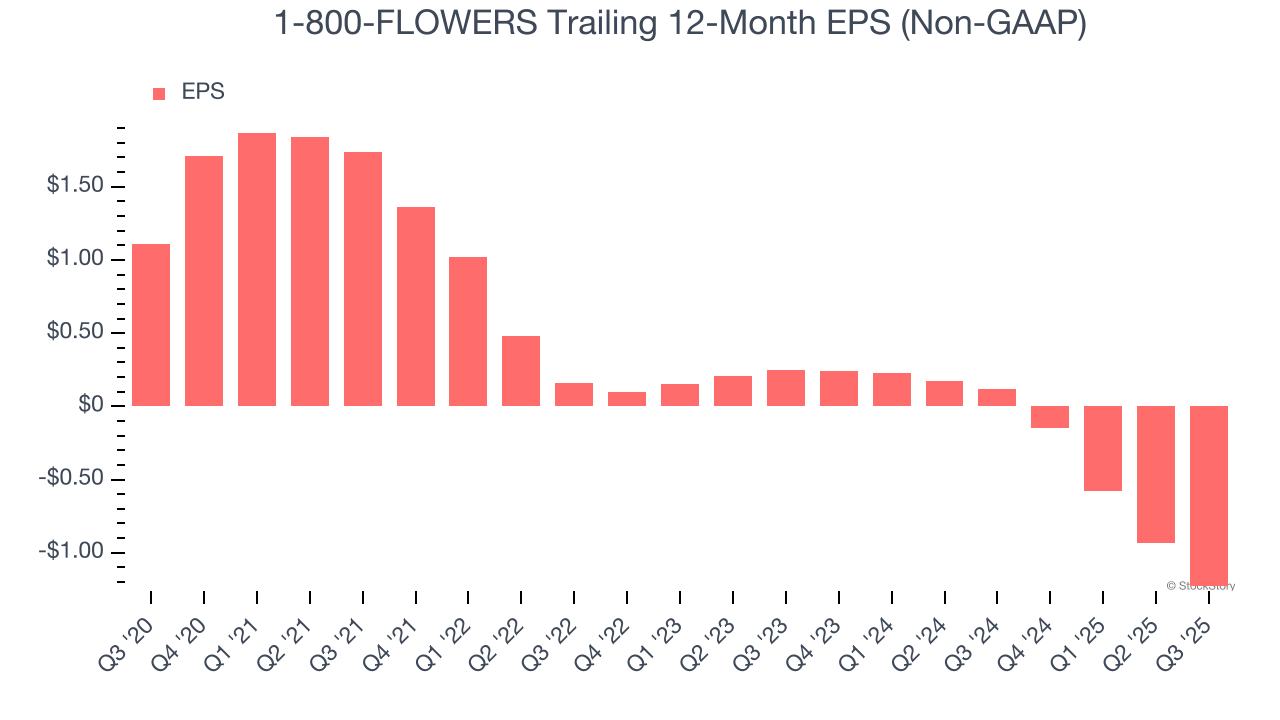

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for 1-800-FLOWERS, its EPS declined by 25.5% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, 1-800-FLOWERS reported adjusted EPS of negative $0.83, down from negative $0.53 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects 1-800-FLOWERS to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.23 will advance to negative $0.61.

Key Takeaways from 1-800-FLOWERS’s Q3 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 11.6% to $3.09 immediately after reporting.

The latest quarter from 1-800-FLOWERS’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.