While the S&P 500 is up 23.8% since April 2025, American Woodmark (currently trading at $64.57 per share) has lagged behind, posting a return of 9.4%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in American Woodmark, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think American Woodmark Will Underperform?

We're cautious about American Woodmark. Here are three reasons you should be careful with AMWD and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, American Woodmark struggled to consistently increase demand as its $1.65 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect American Woodmark’s revenue to drop by 3.1%. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

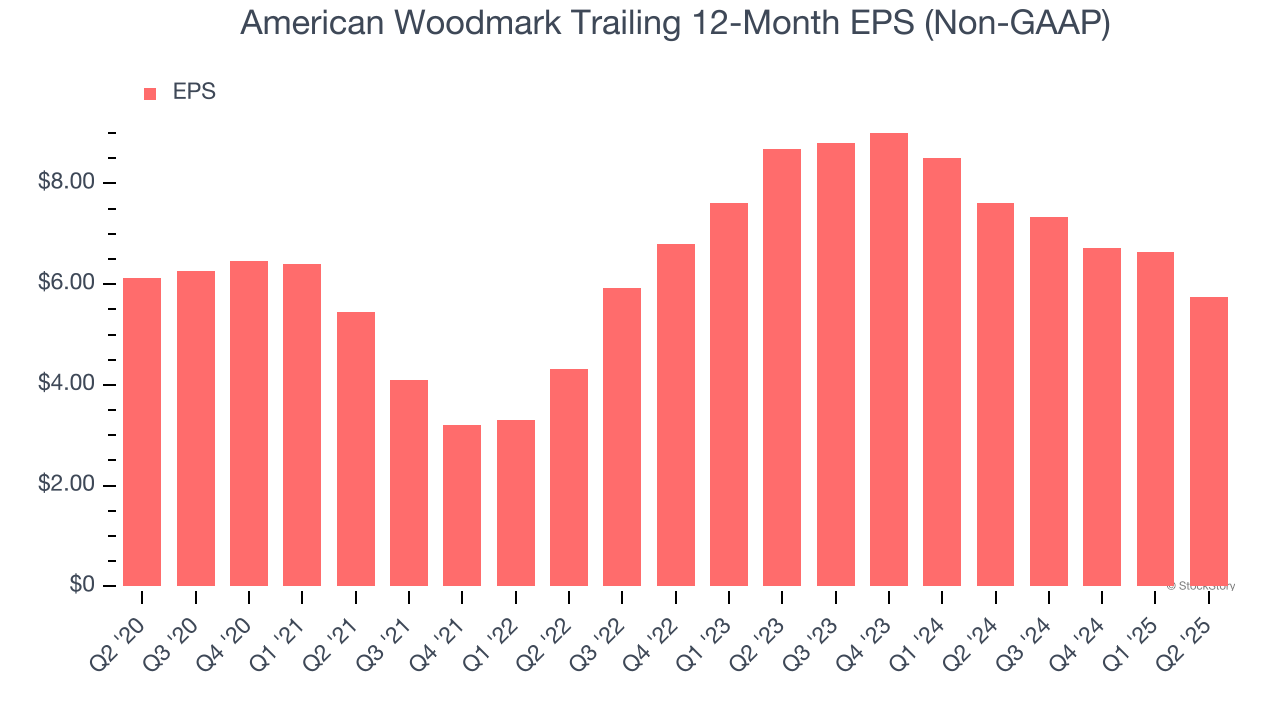

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for American Woodmark, its EPS declined by 1.3% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences.If the tide turns unexpectedly, American Woodmark’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of American Woodmark, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 14× forward P/E (or $64.57 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.