Blockchain infrastructure company Coinbase (NASDAQ: COIN) announced better-than-expected revenue in Q3 CY2025, with sales up 55.1% year on year to $1.87 billion. Its non-GAAP profit of $1.44 per share was 23.2% above analysts’ consensus estimates.

Is now the time to buy Coinbase? Find out by accessing our full research report, it’s free for active Edge members.

Coinbase (COIN) Q3 CY2025 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.78 billion (55.1% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.44 vs analyst estimates of $1.17 (23.2% beat)

- Adjusted EBITDA: $801 million vs analyst estimates of $716.4 million (42.9% margin, 11.8% beat)

- Operating Margin: 25.7%, up from 14.1% in the same quarter last year

- Free Cash Flow was -$784.5 million, down from $328.5 million in the previous quarter

- Market Capitalization: $89.57 billion

Company Overview

Widely regarded as the face of crypto, Coinbase (NASDAQ: COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Revenue Growth

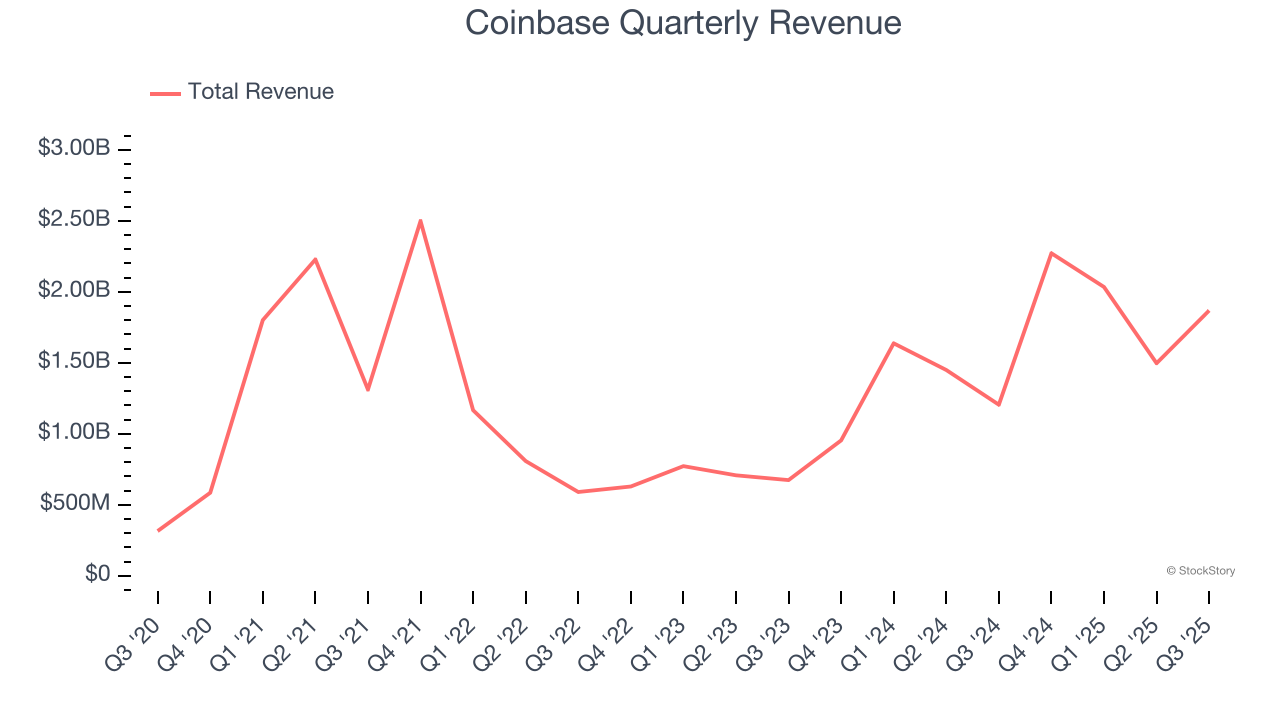

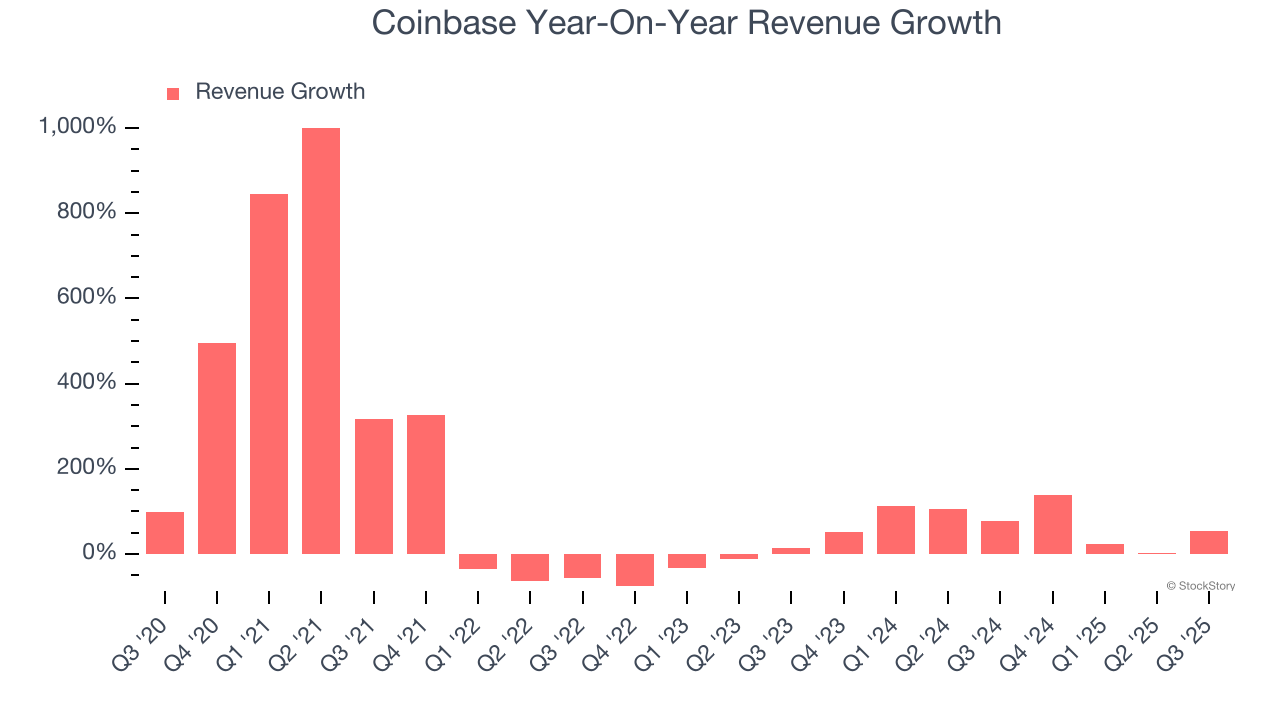

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Coinbase grew its sales at an incredible 57.5% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer internet, a half-decade historical view may miss recent innovations or disruptive industry trends. Coinbase’s annualized revenue growth of 66% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Coinbase reported magnificent year-on-year revenue growth of 55.1%, and its $1.87 billion of revenue beat Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

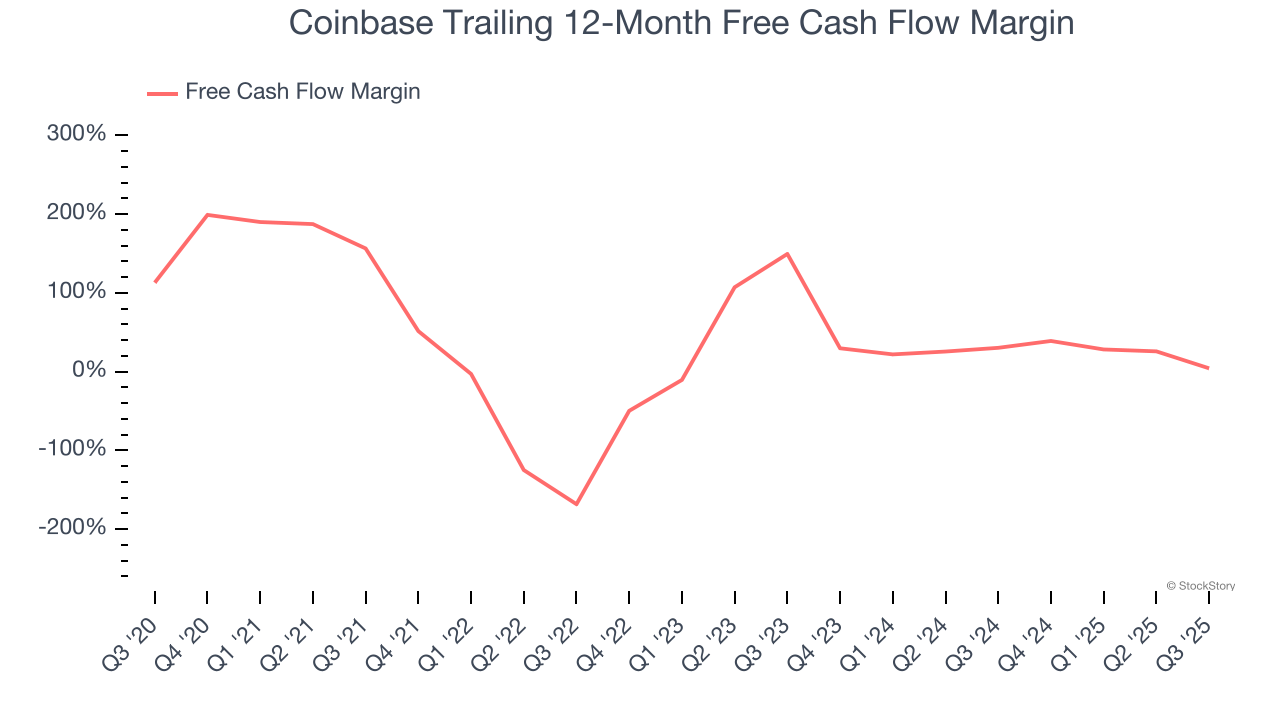

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Coinbase has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 14.8% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Coinbase’s margin dropped meaningfully over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity.

Coinbase burned through $784.5 million of cash in Q3, equivalent to a negative 42% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from Coinbase’s Q3 Results

We were impressed by how significantly Coinbase blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. These results were driven by better-than-anticipated trading revenue and continued momentum in USDC, a stablecoin emerging as a payment and treasury tool for financial institutions and corporations. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.4% to $333.75 immediately after reporting.

Coinbase had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.