Pawn store operator FirstCash Holdings (NASDAQ: FCFS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 11.7% year on year to $935.6 million. Its non-GAAP profit of $2.26 per share was 17.1% above analysts’ consensus estimates.

Is now the time to buy FirstCash? Find out by accessing our full research report, it’s free for active Edge members.

FirstCash (FCFS) Q3 CY2025 Highlights:

- Revenue: $935.6 million vs analyst estimates of $856.4 million (11.7% year-on-year growth, 9.3% beat)

- Pre-tax Profit: $112.5 million (12% margin, 32% year-on-year growth)

- Adjusted EPS: $2.26 vs analyst estimates of $1.93 (17.1% beat)

- Market Capitalization: $6.57 billion

Mr. Rick Wessel, chief executive officer, stated, “FirstCash’s third quarter operating results were outstanding, evidenced by accelerating revenue growth, strong margins and continued earnings growth in both the U.S. and Latin American pawn segments coupled with a strong partial quarter contribution from the recently acquired H&T pawn stores in the U.K. We continue to experience extremely strong pawn demand across all markets, with third quarter local currency same-store pawn receivables up 13% in the U.S., 18% in Latin America and 25% in the U.K. over last year. Additionally, the retail point-of-sale payment solutions segment, American First Finance or “AFF,” recorded strong earnings growth driven by lower loss provisions and improved operating margins.

Company Overview

Offering a financial lifeline to the unbanked and credit-constrained since 1988, FirstCash (NASDAQ: FCFS) operates pawn stores across the U.S. and Latin America while also providing retail point-of-sale payment solutions for credit-constrained consumers.

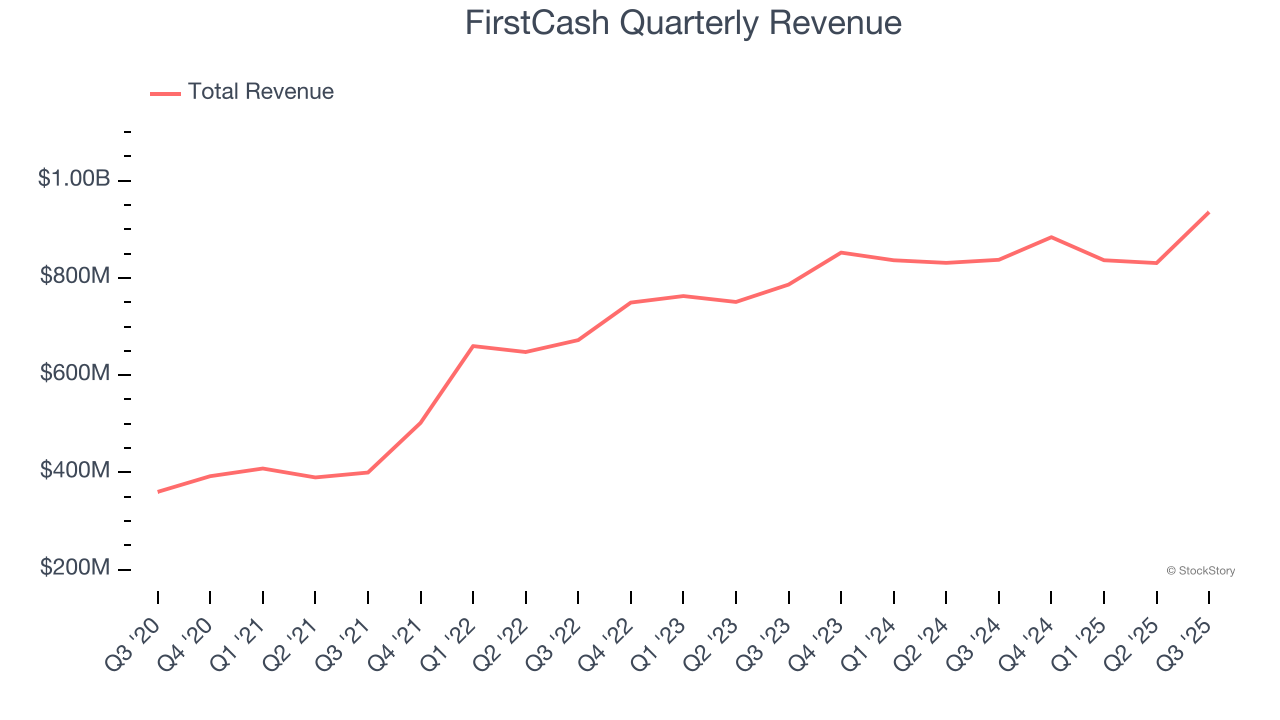

Revenue Growth

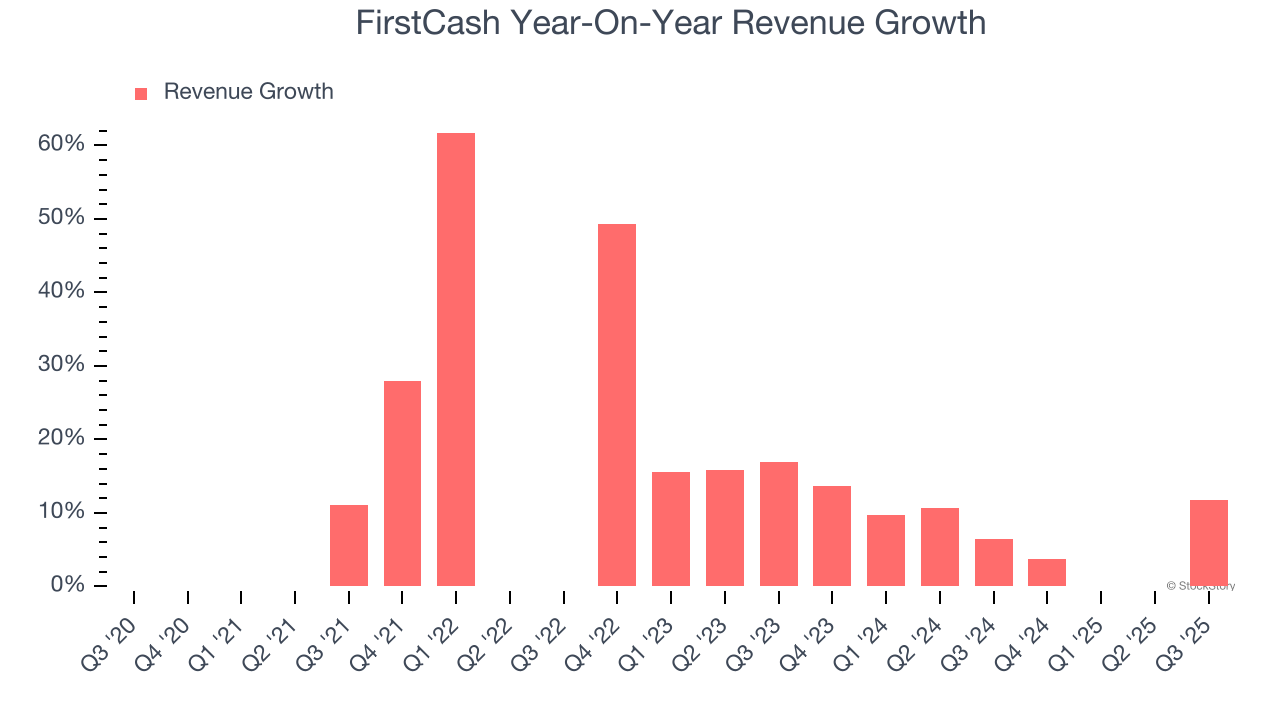

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, FirstCash grew its revenue at an impressive 14.9% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. FirstCash’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.9% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, FirstCash reported year-on-year revenue growth of 11.7%, and its $935.6 million of revenue exceeded Wall Street’s estimates by 9.3%.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from FirstCash’s Q3 Results

We were impressed by how significantly FirstCash blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 5.3% to $140 immediately following the results.

So should you invest in FirstCash right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.