Domain registrar and web services company GoDaddy (NYSE: GDDY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.3% year on year to $1.27 billion. On the other hand, next quarter’s revenue guidance of $1.27 billion was less impressive, coming in 0.5% below analysts’ estimates. Its GAAP profit of $1.51 per share was 3.1% above analysts’ consensus estimates.

Is now the time to buy GoDaddy? Find out by accessing our full research report, it’s free for active Edge members.

GoDaddy (GDDY) Q3 CY2025 Highlights:

- Revenue: $1.27 billion vs analyst estimates of $1.23 billion (10.3% year-on-year growth, 2.7% beat)

- EPS (GAAP): $1.51 vs analyst estimates of $1.46 (3.1% beat)

- Adjusted EBITDA: $408.6 million vs analyst estimates of $394.2 million (32.3% margin, 3.7% beat)

- Revenue Guidance for Q4 CY2025 is $1.27 billion at the midpoint, below analyst estimates of $1.27 billion

- Operating Margin: 23.4%, up from 22.1% in the same quarter last year

- Free Cash Flow Margin: 34.8%, up from 32.2% in the previous quarter

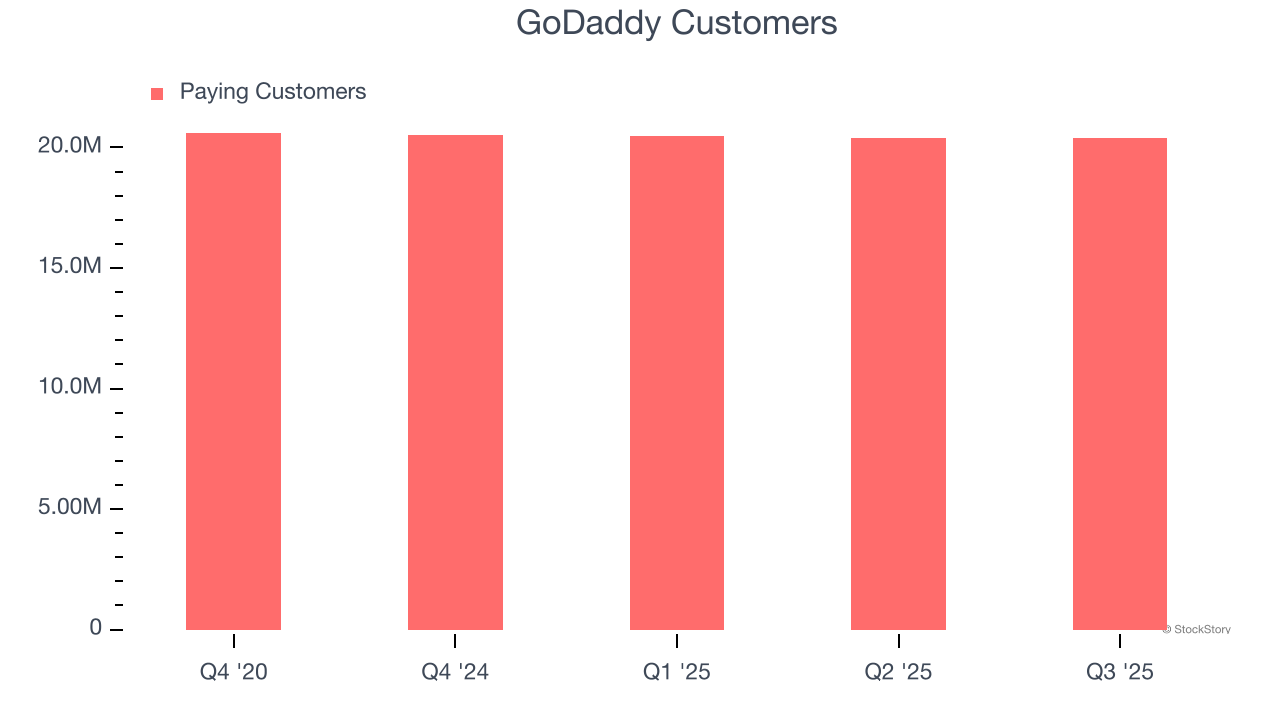

- Customers: 20.41 million, up from 20.41 million in the previous quarter

- Annual Recurring Revenue: $4.29 billion vs analyst estimates of $4.21 billion (8% year-on-year growth, 1.9% beat)

- Billings: $1.29 billion at quarter end, up 9.1% year on year

- Market Capitalization: $17.52 billion

Company Overview

Known for its memorable Super Bowl commercials that put it on the map, GoDaddy (NYSE: GDDY) is a domain registrar and web services provider that helps entrepreneurs establish an online presence through domain registration, website building, hosting, and e-commerce tools.

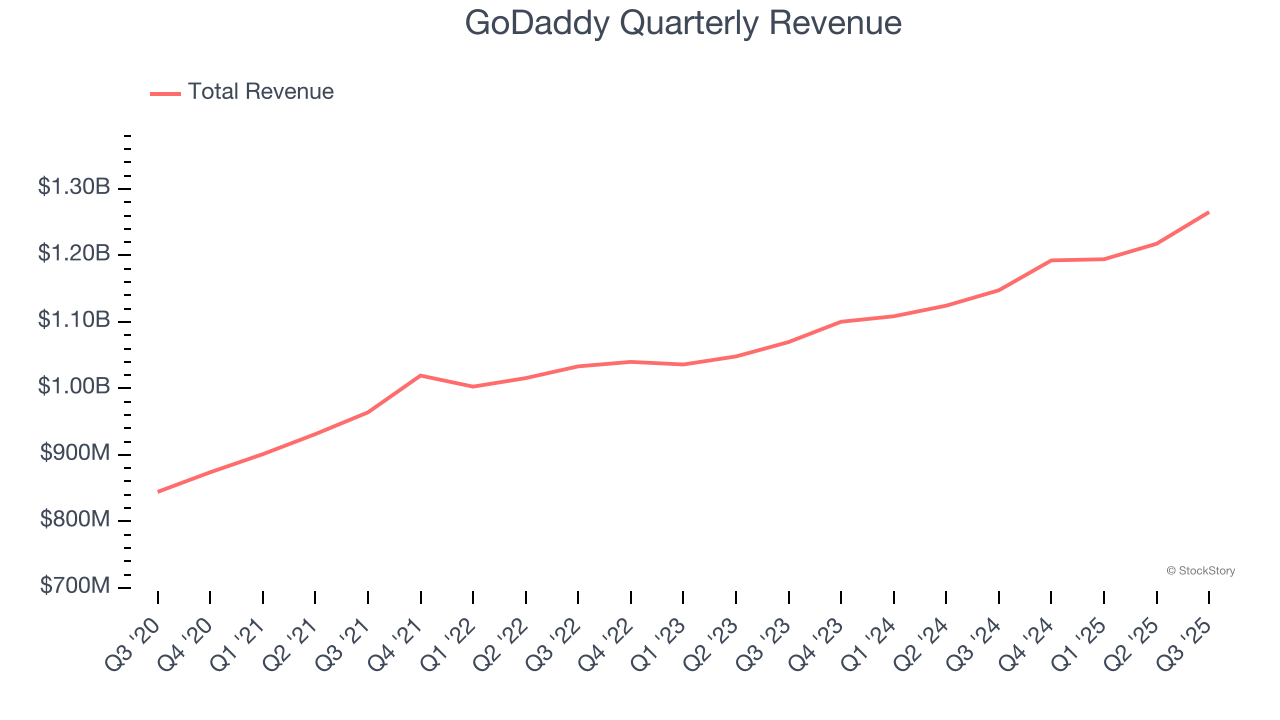

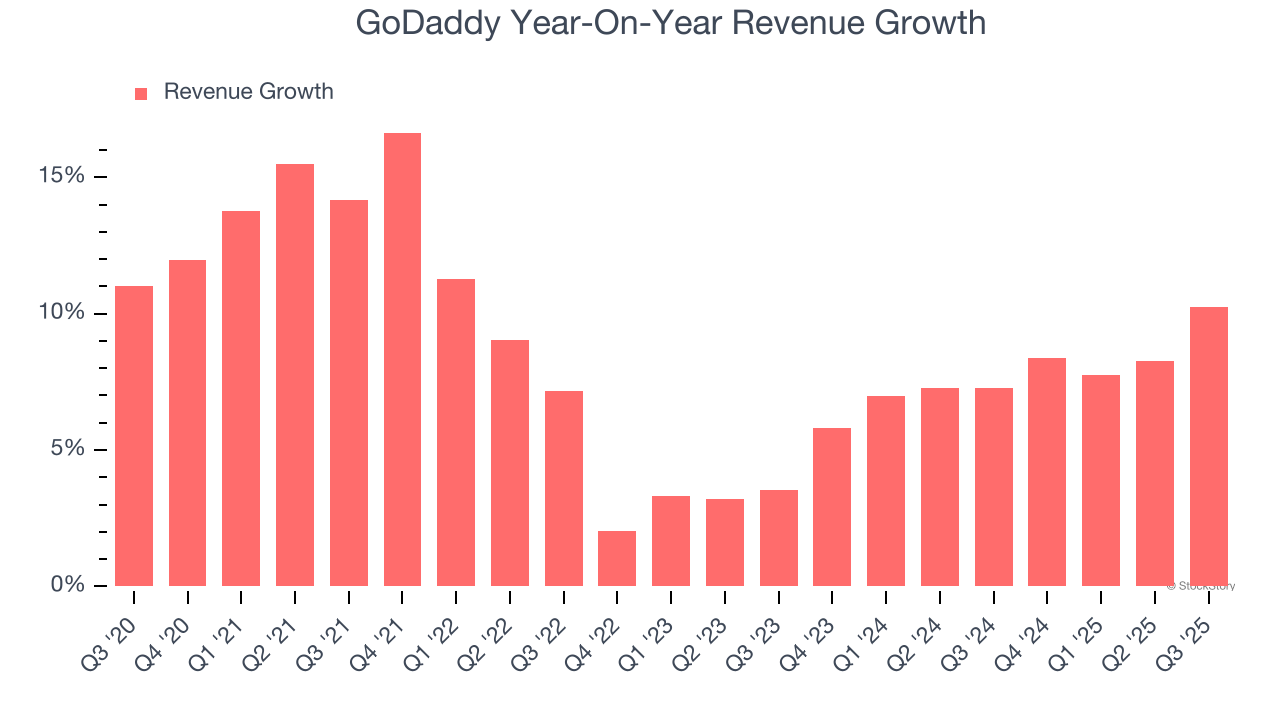

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, GoDaddy’s sales grew at a sluggish 8.6% compounded annual growth rate over the last five years. This was below our standard for the software sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. GoDaddy’s annualized revenue growth of 7.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, GoDaddy reported year-on-year revenue growth of 10.3%, and its $1.27 billion of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 6.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

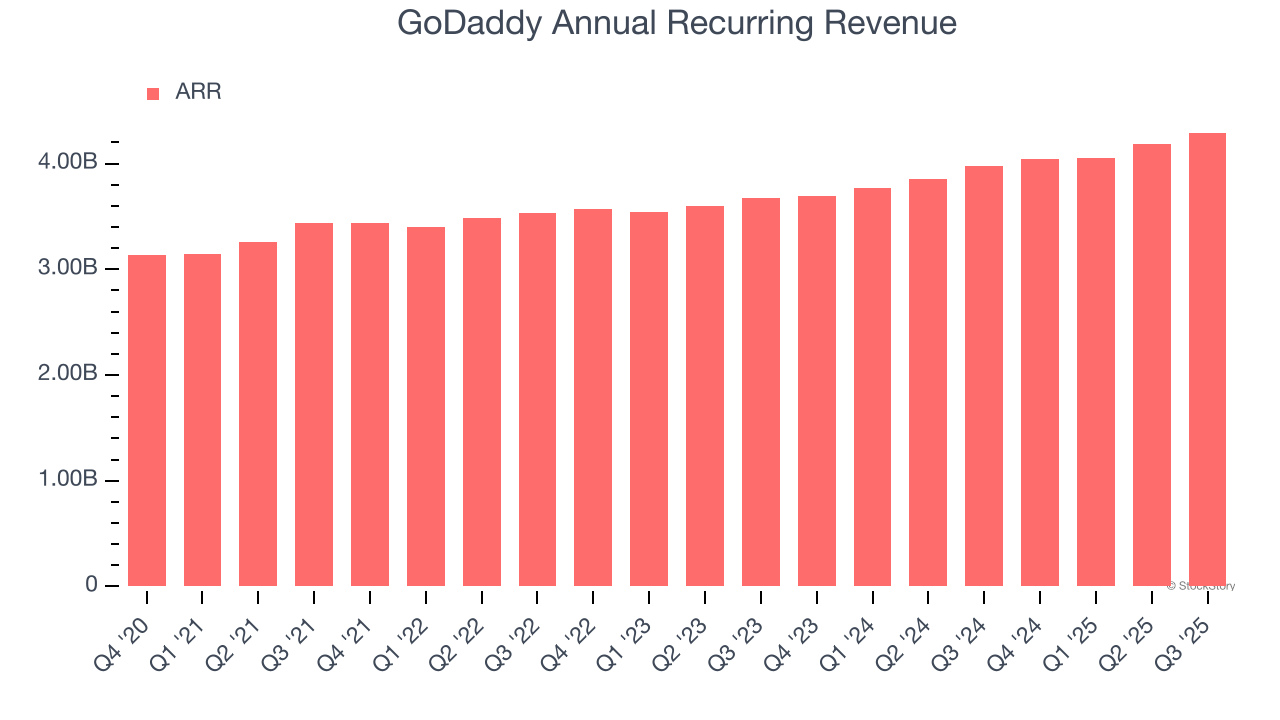

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GoDaddy’s ARR came in at $4.29 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 8.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Base

GoDaddy reported 20.41 million customers at the end of the quarter, a sequential increase of 4,000. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that GoDaddy has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

Key Takeaways from GoDaddy’s Q3 Results

We were impressed by how significantly GoDaddy blew past analysts’ bookings expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 1.3% to $125 immediately after reporting.

So do we think GoDaddy is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.