Over the past six months, Clover Health’s shares (currently trading at $2.63) have posted a disappointing 18.1% loss, well below the S&P 500’s 32.7% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Clover Health, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Clover Health Not Exciting?

Despite the more favorable entry price, we're swiping left on Clover Health for now. Here are three reasons you should be careful with CLOV and a stock we'd rather own.

1. Revenue Tumbling Downwards

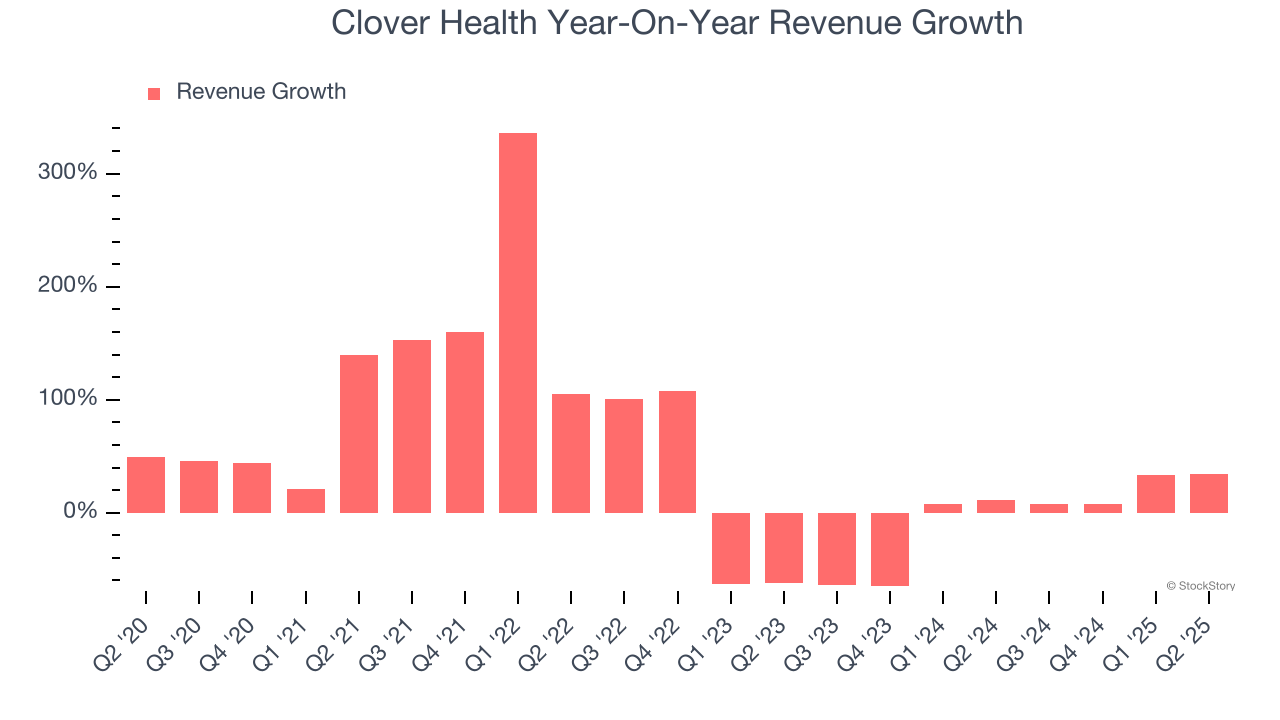

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. Clover Health’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 18.1% over the last two years.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.61 billion in revenue over the past 12 months, Clover Health is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

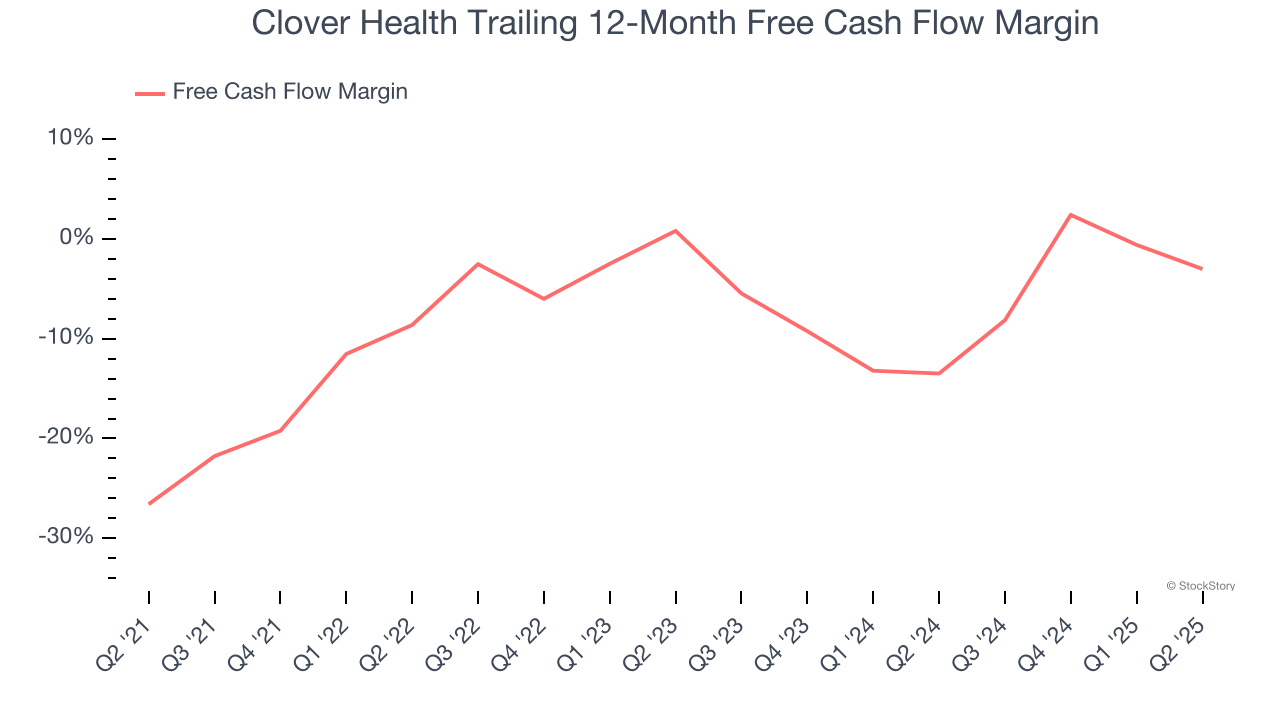

While Clover Health posted positive free cash flow this quarter, the broader story hasn’t been so clean. Clover Health’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 7.7%. This means it lit $7.69 of cash on fire for every $100 in revenue.

Final Judgment

Clover Health’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 18.5× forward P/E (or $2.63 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.