Even though Hilltop Holdings (currently trading at $33.08 per share) has gained 15.9% over the last six months, it has lagged the S&P 500’s 33.2% return during that period. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Hilltop Holdings, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Hilltop Holdings Will Underperform?

We're sitting this one out for now. Here are three reasons why HTH doesn't excite us and a stock we'd rather own.

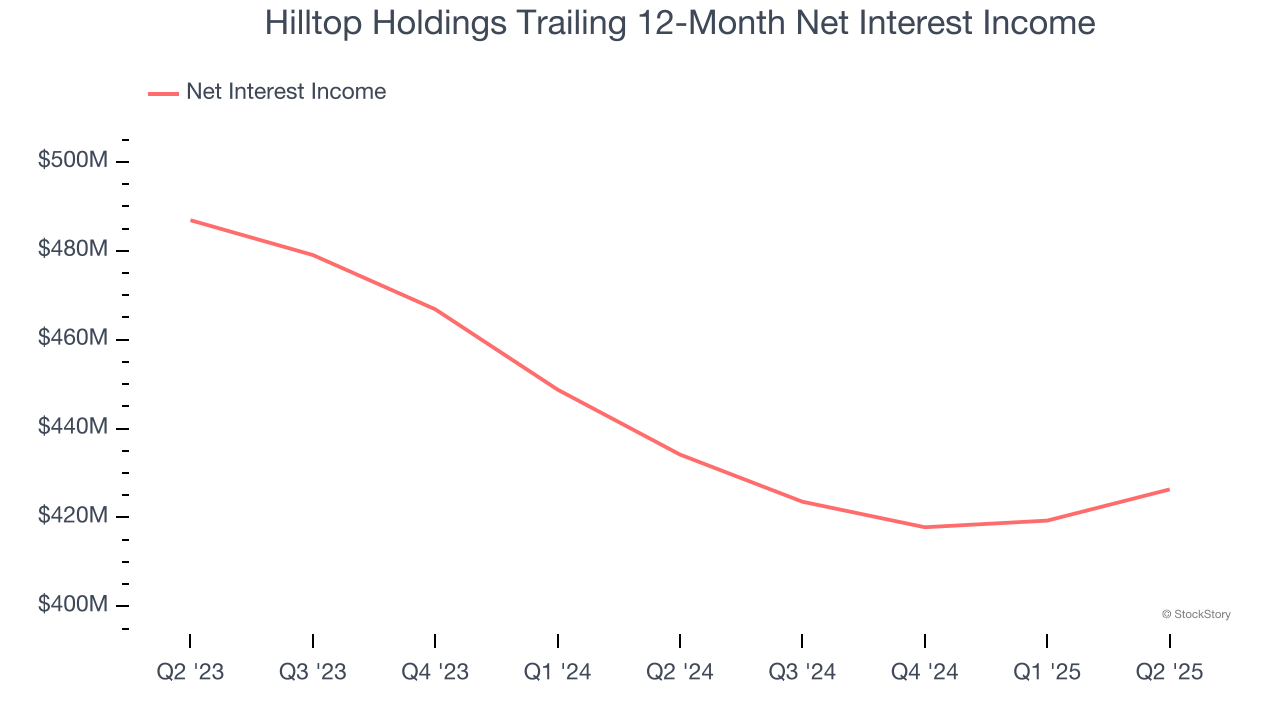

1. Net Interest Income Hits a Plateau

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Hilltop Holdings’s net interest income was flat over the last five years, much worse than the broader banking industry. A silver lining is that lending outperformed its other business lines.

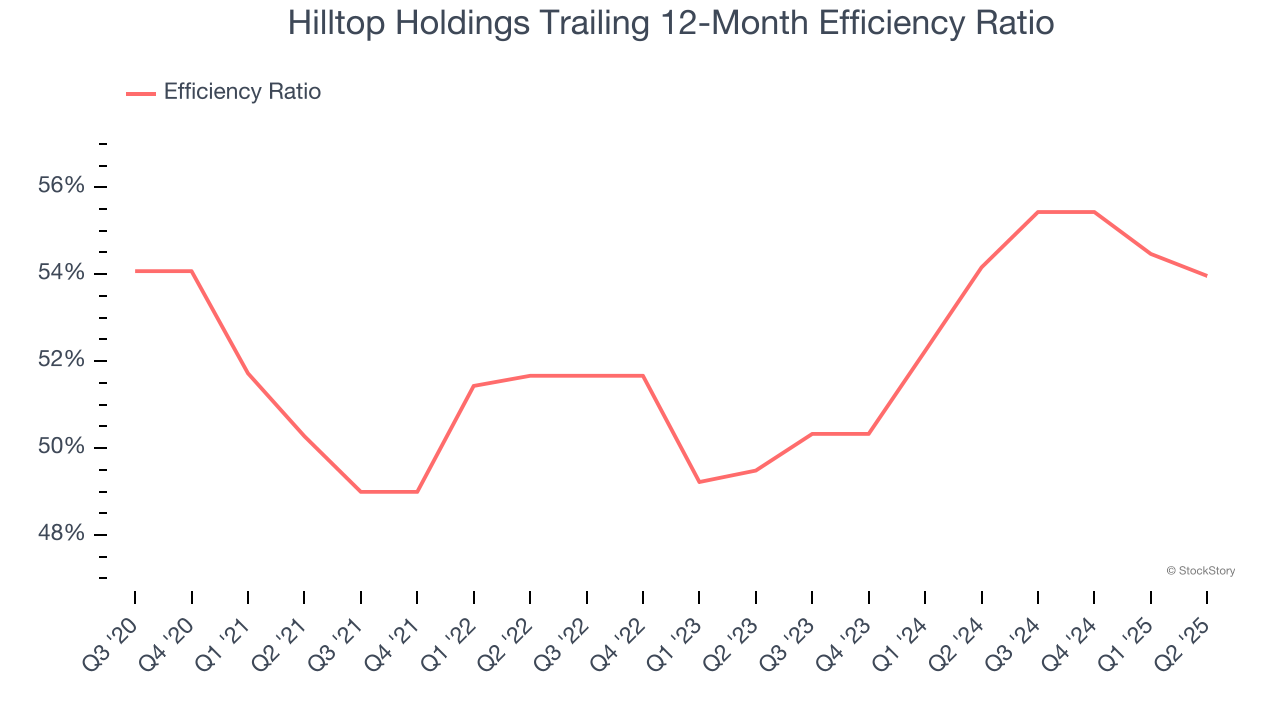

2. Efficiency Ratio Expected to Falter

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

For the next 12 months, Wall Street expects Hilltop Holdings to become less profitable as it anticipates an efficiency ratio of 86.3% compared to 54% over the past year.

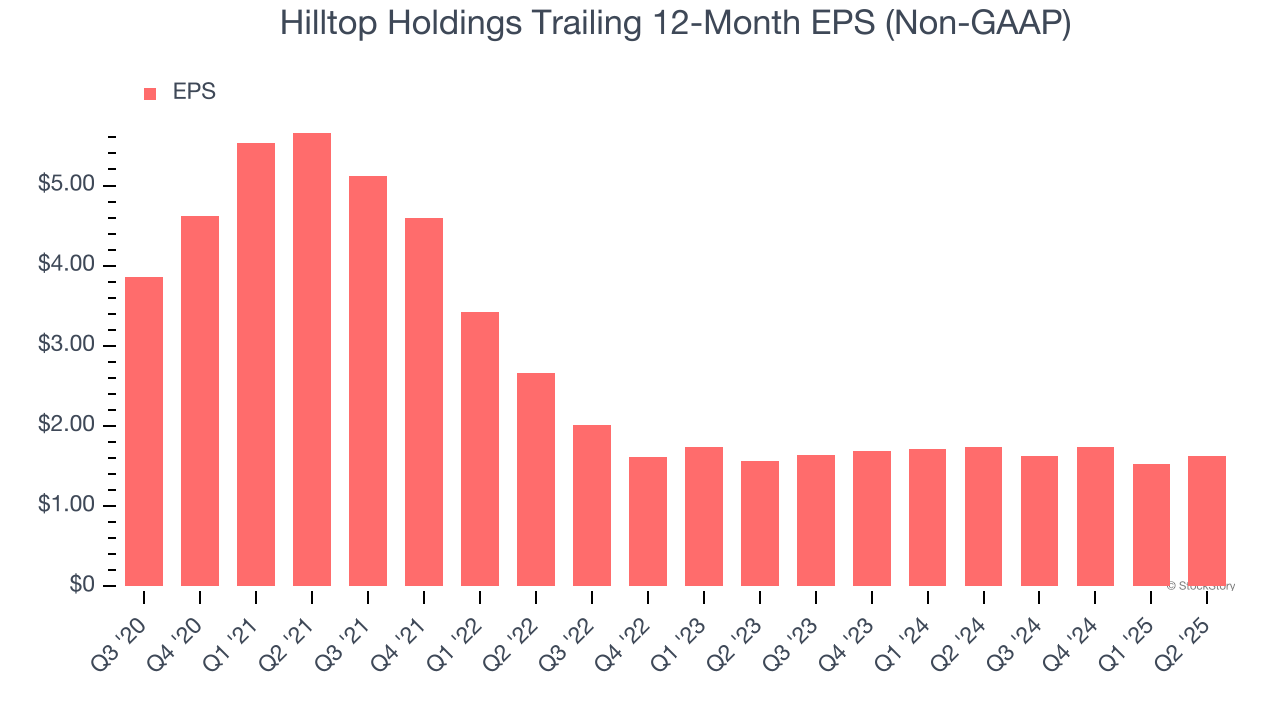

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hilltop Holdings, its EPS declined by 11.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Hilltop Holdings falls short of our quality standards. With its shares underperforming the market lately, the stock trades at 0.9× forward P/B (or $33.08 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Hilltop Holdings

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.