Food flavoring company McCormick (NYSE: MKC) announced better-than-expected revenue in Q3 CY2025, with sales up 2.7% year on year to $1.72 billion. Its non-GAAP profit of $0.85 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy McCormick? Find out by accessing our full research report, it’s free for active Edge members.

McCormick (MKC) Q3 CY2025 Highlights:

- Revenue: $1.72 billion vs analyst estimates of $1.71 billion (2.7% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.85 vs analyst estimates of $0.82 (4.2% beat)

- Management lowered its full-year Adjusted EPS guidance to $3.03 at the midpoint, a 1% decrease

- Operating Margin: 16.7%, in line with the same quarter last year

- Sales Volumes rose 1.2% year on year, in line with the same quarter last year

- Market Capitalization: $18.33 billion

Brendan M. Foley, Chairman, President, and CEO, stated, "Our third quarter results marked our fifth consecutive quarter of volume-led growth, reflecting our differentiation and the benefit of continued investments in our brands, expanded distribution, and innovation. As a result of the dynamic global trade environment, our gross margin was further pressured by rising costs; however, we continued to drive operating profit growth through the effective execution of our cost savings initiatives. We remain disciplined on actions within our control and agile in adapting to external dynamics, positioning McCormick for sustained long-term growth."

Company Overview

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE: MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

Revenue Growth

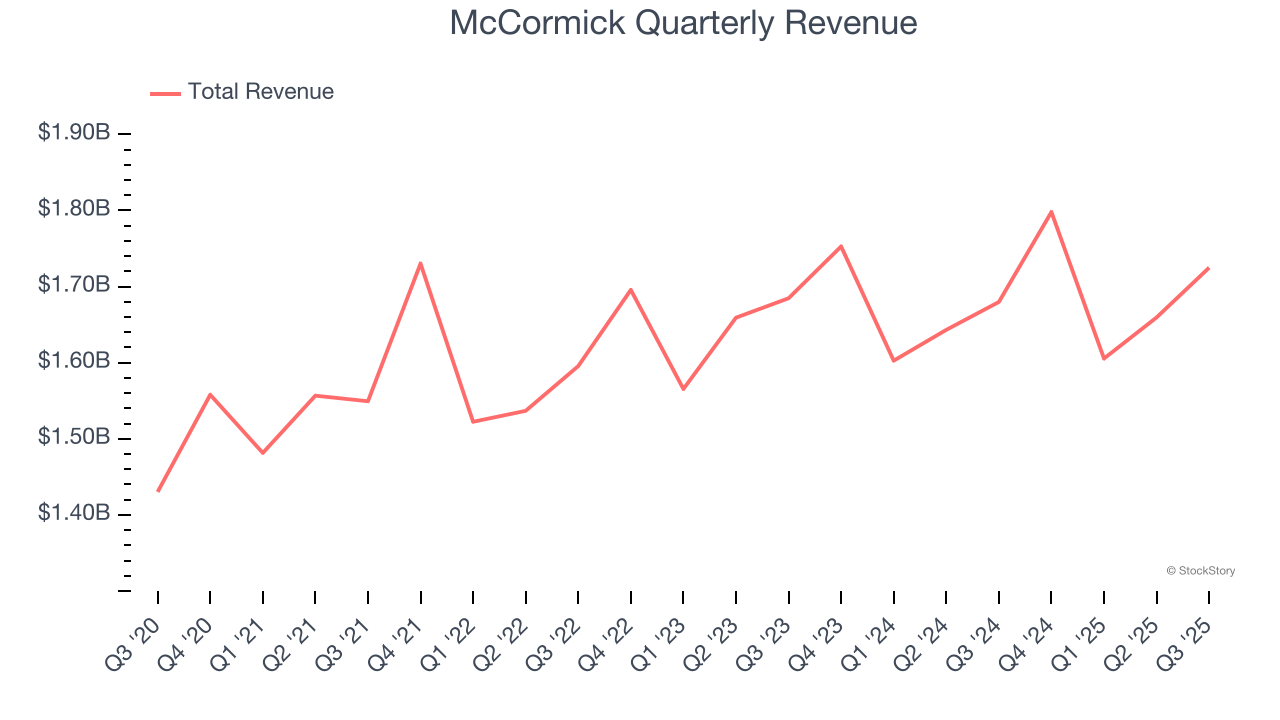

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $6.79 billion in revenue over the past 12 months, McCormick is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. For McCormick to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

As you can see below, McCormick grew its sales at a sluggish 2.1% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, McCormick reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and suggests its newer products will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

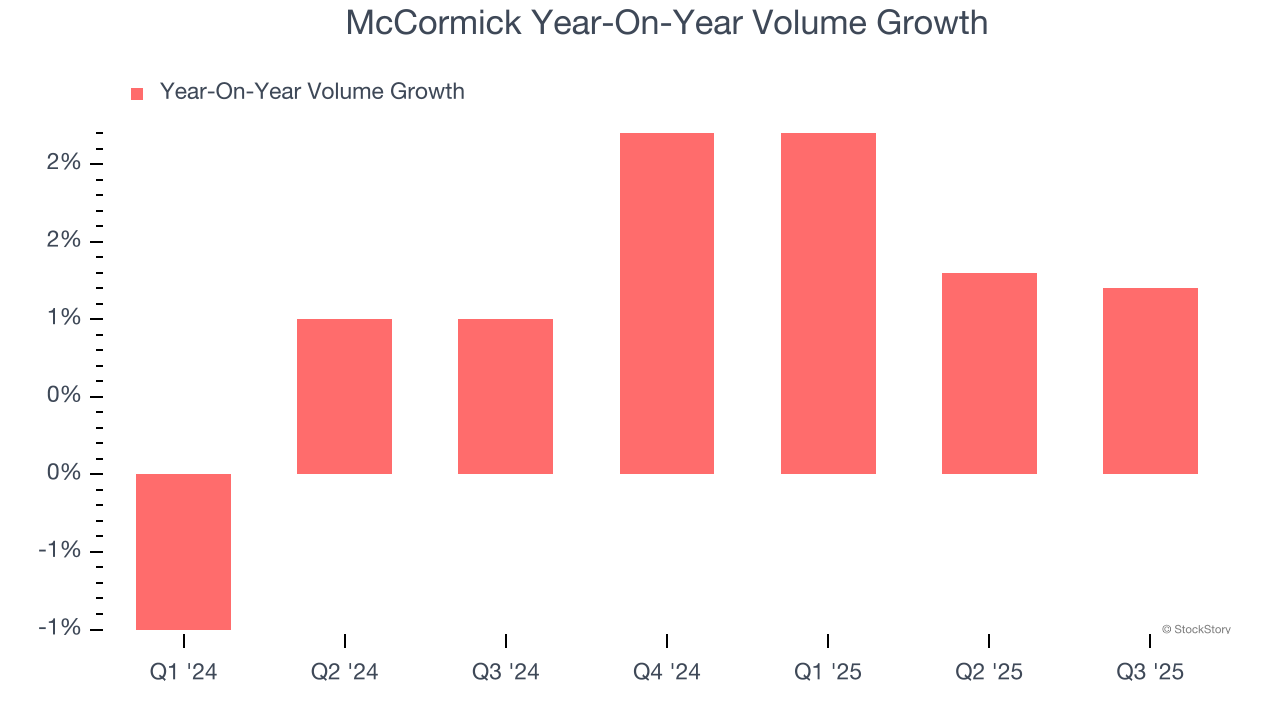

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

McCormick’s average quarterly volume growth was a healthy 1.1% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In McCormick’s Q3 2025, sales volumes jumped 1.2% year on year. This result was in line with its historical levels.

Key Takeaways from McCormick’s Q3 Results

It was good to see McCormick narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $68.50 immediately after reporting.

Is McCormick an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.