Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Academy Sports (NASDAQ: ASO) and its peers.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.3% on average since the latest earnings results.

Academy Sports (NASDAQ: ASO)

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ: ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

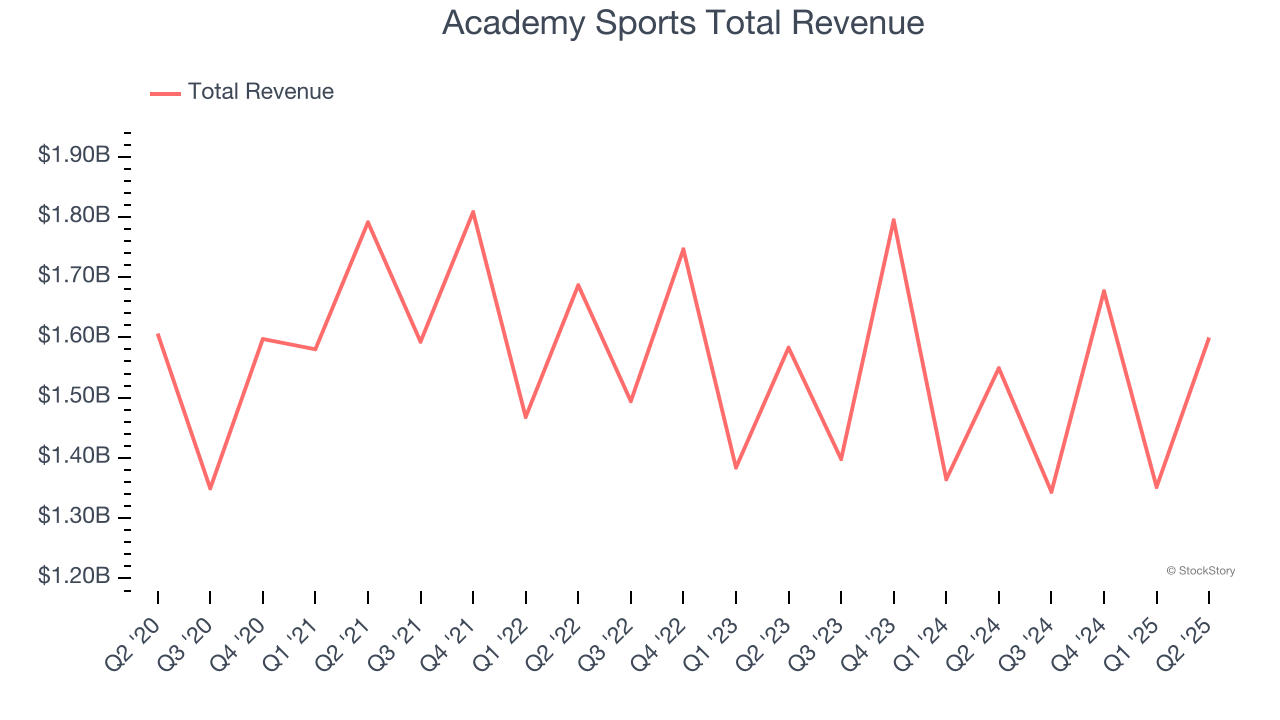

Academy Sports reported revenues of $1.6 billion, up 3.3% year on year. This print fell short of analysts’ expectations by 0.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

"We were pleased to see sales inflect to a positive comp in the second quarter, driven by steady improvements in the business that are a result of the progress we continue to make against our strategic initiatives. Customers are gravitating to our diversified assortment and our value proposition is resonating with them, which has allowed us to pick up market share in the first half of the year," said Steve Lawrence, Chief Executive Officer.

Academy Sports delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 2.1% since reporting and currently trades at $54.68.

Read our full report on Academy Sports here, it’s free for active Edge members.

Best Q2: GameStop (NYSE: GME)

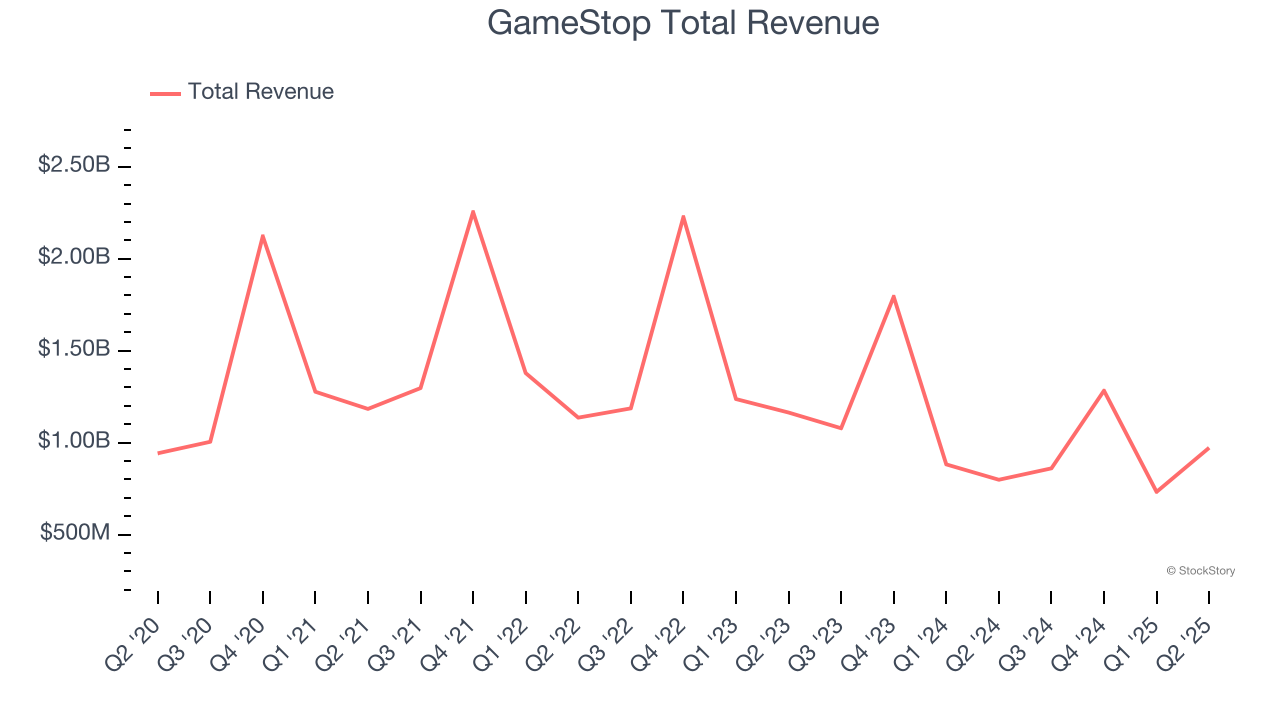

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $972.2 million, up 21.8% year on year, outperforming analysts’ expectations by 18.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates.

GameStop achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $25.

Is now the time to buy GameStop? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Bath and Body Works (NYSE: BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $1.55 billion, up 1.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted EPS guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ EBITDA estimates.

As expected, the stock is down 15.9% since the results and currently trades at $26.50.

Read our full analysis of Bath and Body Works’s results here.

Best Buy (NYSE: BBY)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE: BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy reported revenues of $9.44 billion, up 1.6% year on year. This number topped analysts’ expectations by 2.3%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EBITDA and EPS estimates.

The stock is flat since reporting and currently trades at $75.60.

Read our full, actionable report on Best Buy here, it’s free for active Edge members.

Sportsman's Warehouse (NASDAQ: SPWH)

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ: SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $293.9 million, up 1.8% year on year. This print beat analysts’ expectations by 0.8%. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The stock is up 8.4% since reporting and currently trades at $3.24.

Read our full, actionable report on Sportsman's Warehouse here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.