Proto Labs trades at $48.99 per share and has stayed right on track with the overall market, gaining 17.7% over the last six months. At the same time, the S&P 500 has returned 15.3%.

Is now the time to buy Proto Labs, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Proto Labs Will Underperform?

We don't have much confidence in Proto Labs. Here are three reasons there are better opportunities than PRLB and a stock we'd rather own.

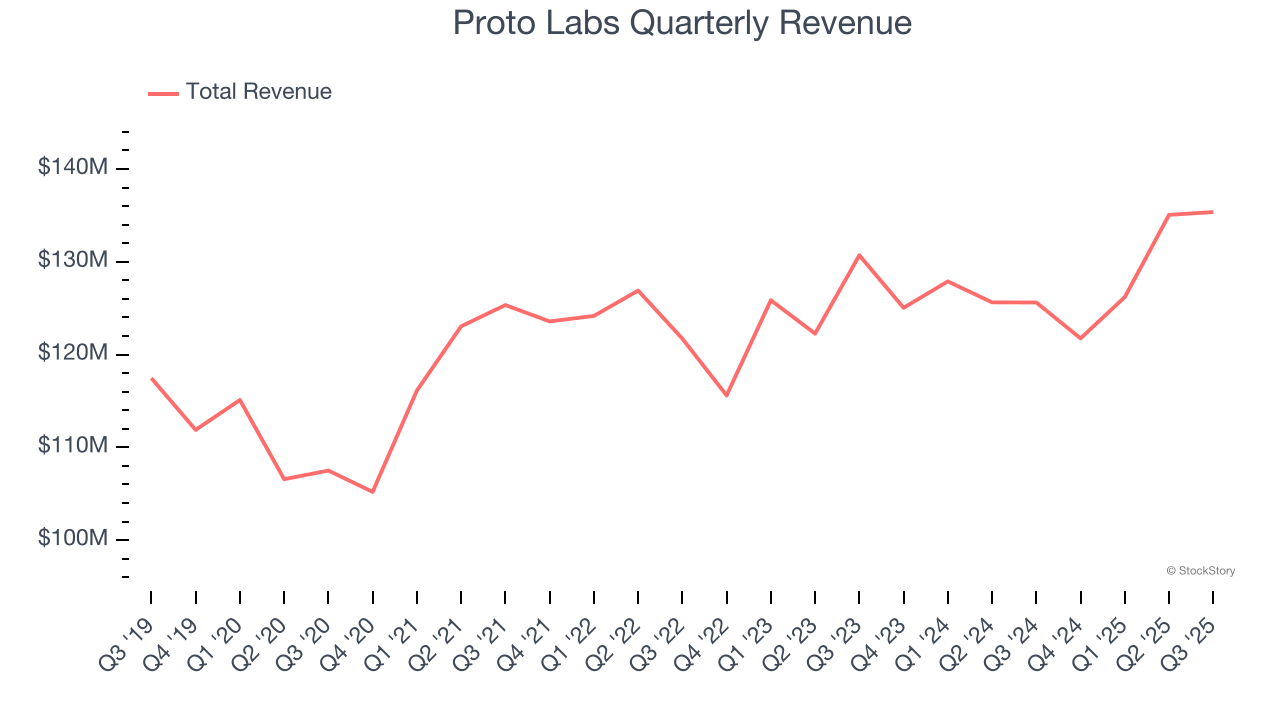

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Proto Labs grew its sales at a sluggish 3.3% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

2. EPS Trending Down

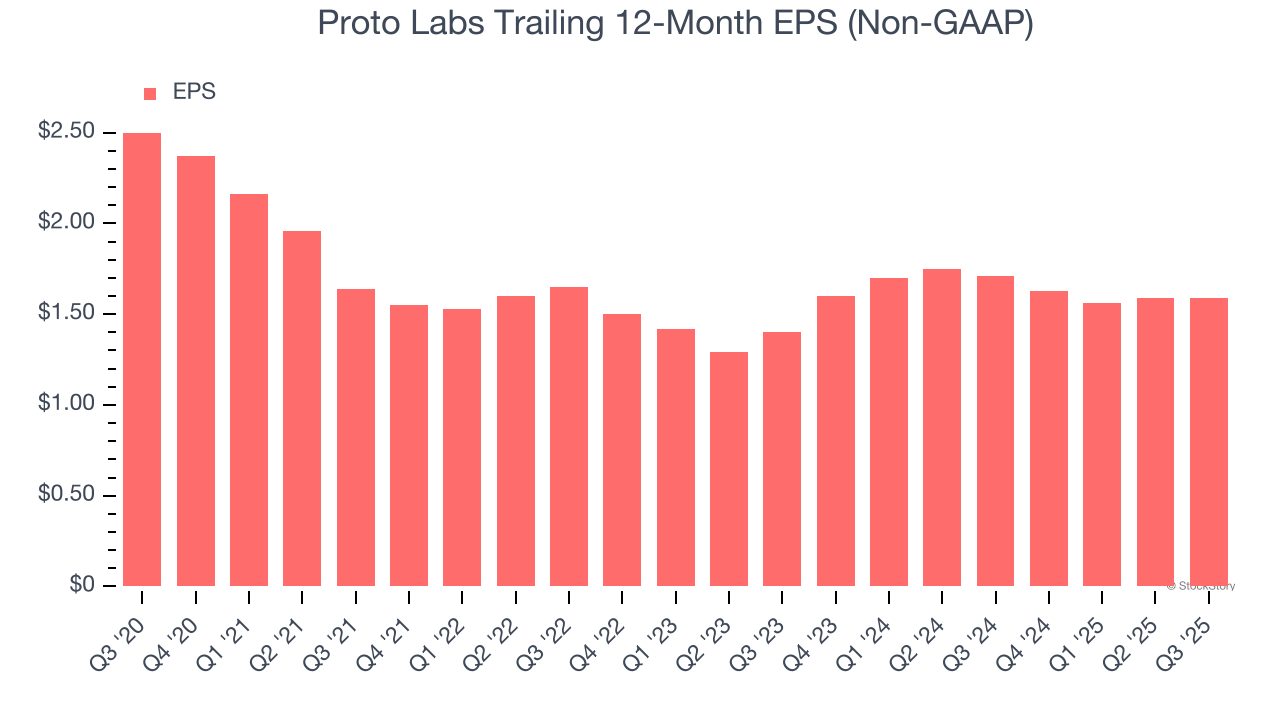

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Proto Labs, its EPS declined by 8.7% annually over the last five years while its revenue grew by 3.3%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Have Lost Money

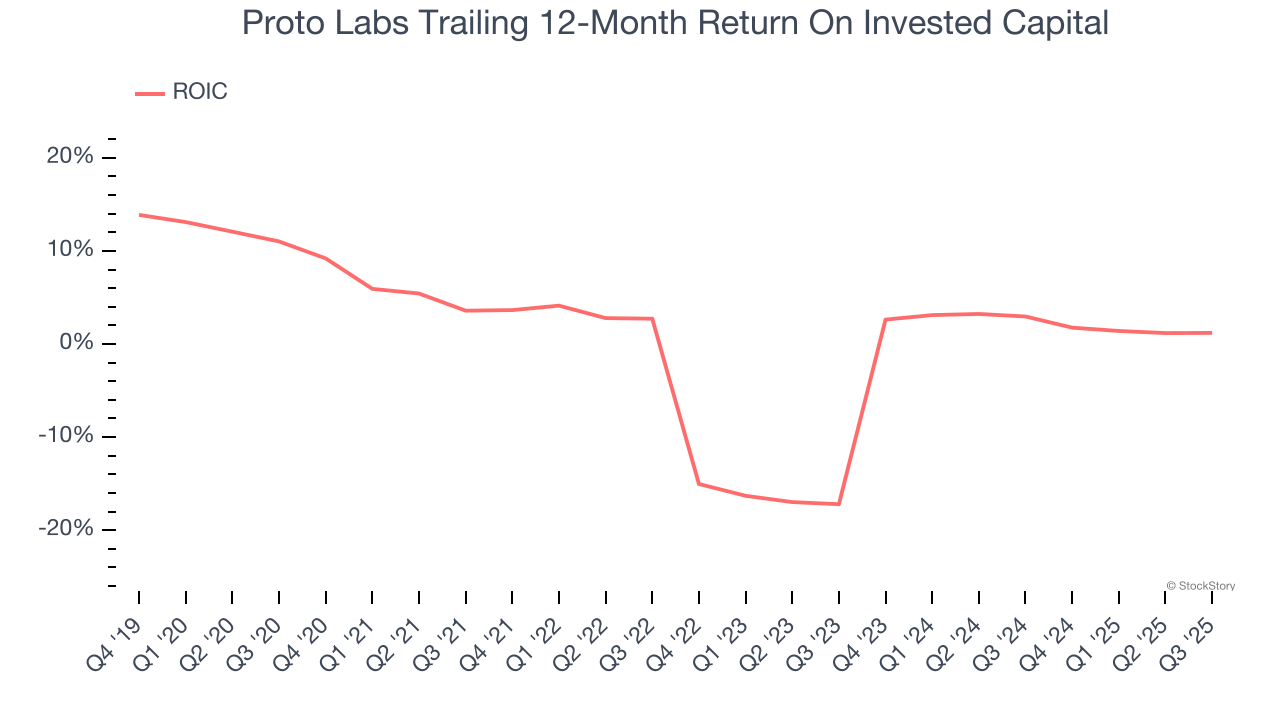

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Proto Labs’s five-year average ROIC was negative 1.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

Final Judgment

We see the value of companies helping their customers, but in the case of Proto Labs, we’re out. That said, the stock currently trades at 30.3× forward P/E (or $48.99 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.