The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how healthcare providers & services stocks fared in Q3, starting with McKesson (NYSE: MCK).

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

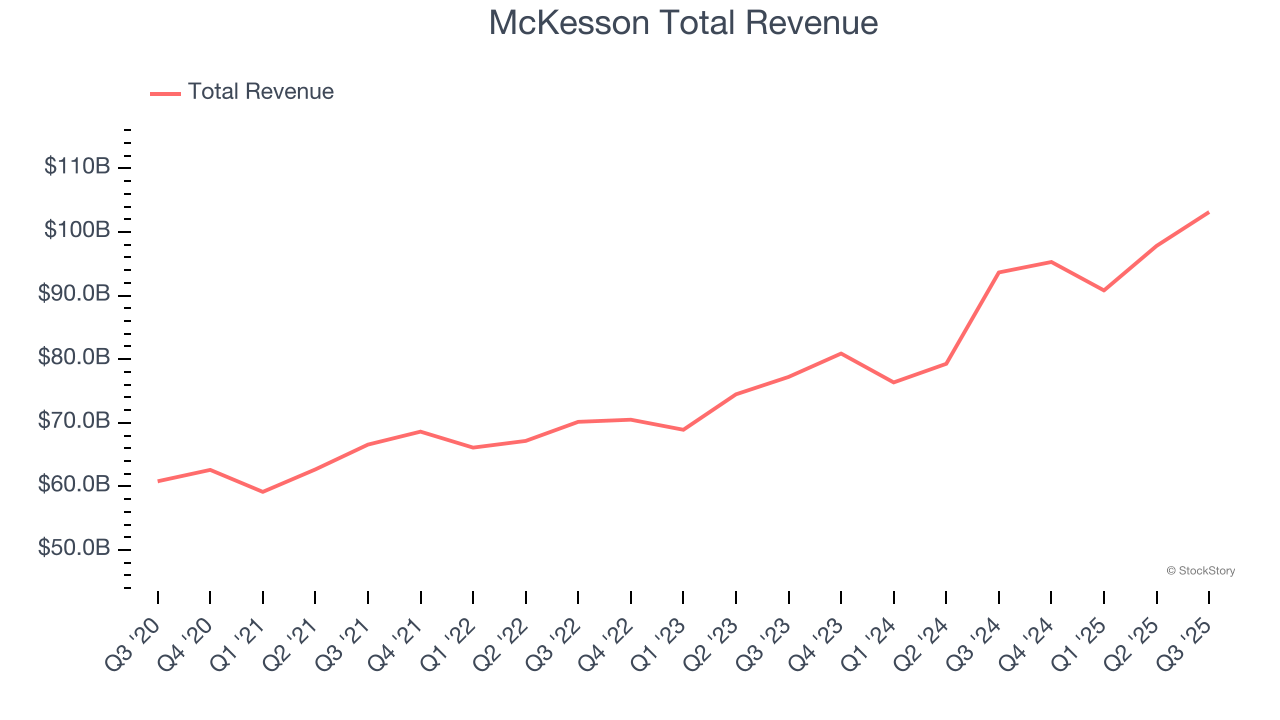

McKesson (NYSE: MCK)

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE: MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

McKesson reported revenues of $103.2 billion, up 10.1% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a slight miss of analysts’ revenue estimates.

Interestingly, the stock is up 1.3% since reporting and currently trades at $856.55.

Is now the time to buy McKesson? Access our full analysis of the earnings results here, it’s free for active Edge members.

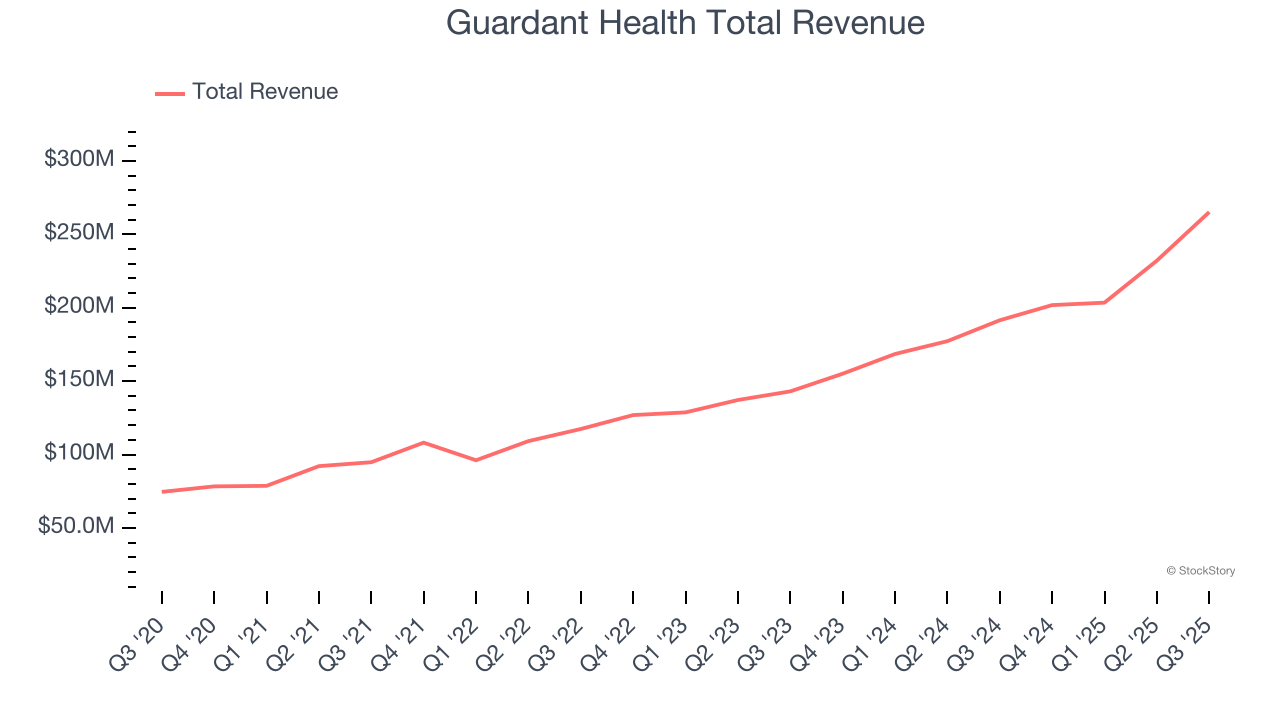

Best Q3: Guardant Health (NASDAQ: GH)

Pioneering the field of "liquid biopsy" with technology that can identify cancer-specific genetic mutations from a simple blood draw, Guardant Health (NASDAQ: GH) develops blood tests that detect and monitor cancer by analyzing tumor DNA in the bloodstream, helping doctors make treatment decisions without invasive biopsies.

Guardant Health reported revenues of $265.2 million, up 38.5% year on year, outperforming analysts’ expectations by 12.6%. The business had an incredible quarter with a solid beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Guardant Health pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 36.1% since reporting. It currently trades at $98.36.

Is now the time to buy Guardant Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Brookdale (NYSE: BKD)

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE: BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale reported revenues of $813.2 million, up 3.7% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ revenue estimates.

Interestingly, the stock is up 12.7% since the results and currently trades at $10.29.

Read our full analysis of Brookdale’s results here.

Alignment Healthcare (NASDAQ: ALHC)

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Alignment Healthcare reported revenues of $993.7 million, up 43.5% year on year. This print topped analysts’ expectations by 1.2%. Overall, it was a strong quarter as it also recorded a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The company added 5,900 customers to reach a total of 229,600. The stock is down 4.1% since reporting and currently trades at $16.48.

Read our full, actionable report on Alignment Healthcare here, it’s free for active Edge members.

Encompass Health (NYSE: EHC)

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE: EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

Encompass Health reported revenues of $1.48 billion, up 9.4% year on year. This result met analysts’ expectations. Taking a step back, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but a slight miss of analysts’ same-store sales estimates.

The stock is down 8% since reporting and currently trades at $115.60.

Read our full, actionable report on Encompass Health here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.