Digital storytelling platform WEBTOON (NASDAQ: WBTN) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 8.7% year on year to $378 million. Next quarter’s revenue guidance of $335 million underwhelmed, coming in 15.8% below analysts’ estimates. Its GAAP loss of $0.09 per share was 23.9% above analysts’ consensus estimates.

Is now the time to buy WEBTOON? Find out by accessing our full research report, it’s free for active Edge members.

WEBTOON (WBTN) Q3 CY2025 Highlights:

- Revenue: $378 million vs analyst estimates of $382.2 million (8.7% year-on-year growth, 1.1% miss)

- EPS (GAAP): -$0.09 vs analyst estimates of -$0.12 (23.9% beat)

- Adjusted EBITDA: $5.12 million vs analyst estimates of $5.58 million (1.4% margin, 8.3% miss)

- Revenue Guidance for Q4 CY2025 is $335 million at the midpoint, below analyst estimates of $397.8 million

- EBITDA guidance for Q4 CY2025 is -$4 million at the midpoint, below analyst estimates of $12.06 million

- Operating Margin: -3.9%, down from -2.3% in the same quarter last year

- Free Cash Flow Margin: 3.1%, up from 0.1% in the same quarter last year

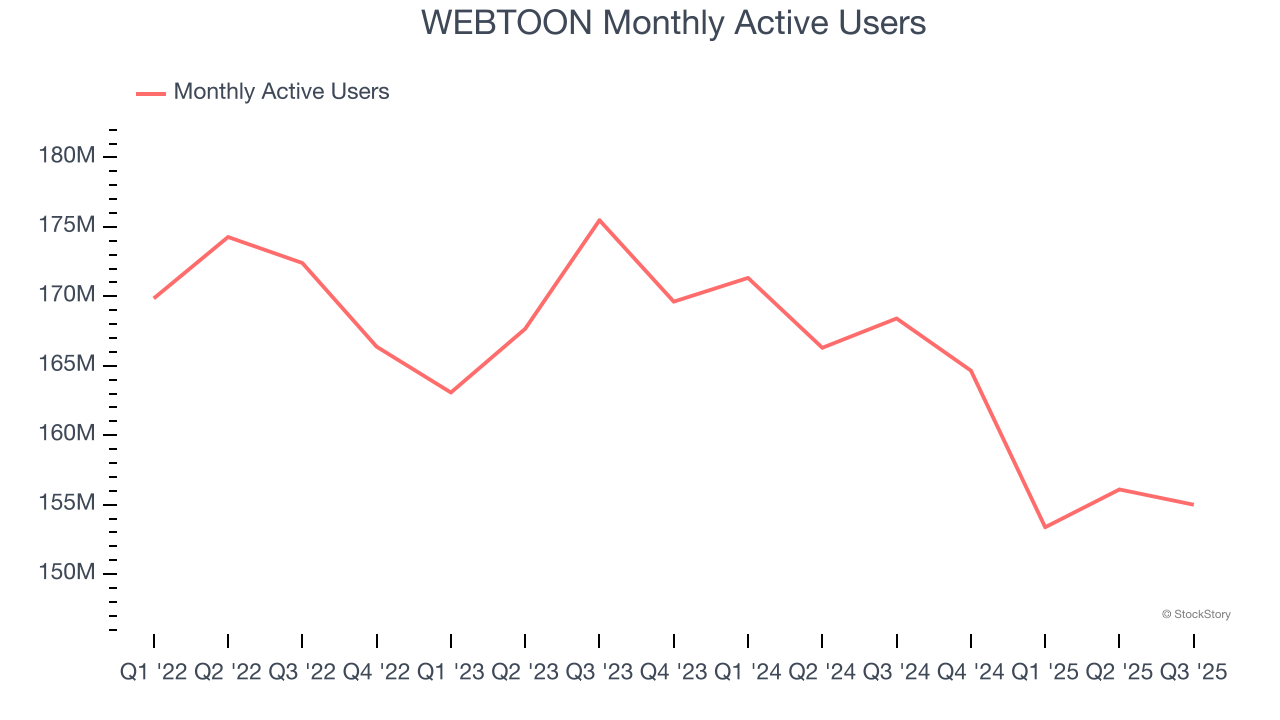

- Monthly Active Users: 155 million, down 13.41 million year on year

- Market Capitalization: $2.15 billion

Junkoo Kim, Founder and CEO, said, “We are pleased to deliver another quarter that showcased the progress we have made driving product improvements on our platform and providing a greater diversity of content. We achieved Adjusted EBITDA above the midpoint of our guidance and total revenue was up 9.1% on a constant currency basis, driven by constant currency growth in Paid Content and IP Adaptations."

Company Overview

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ: WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

Revenue Growth

A company’s top-line performance is one signal of its overall business quality. Strong growth can indicate it’s riding a successful new product or emerging trend.

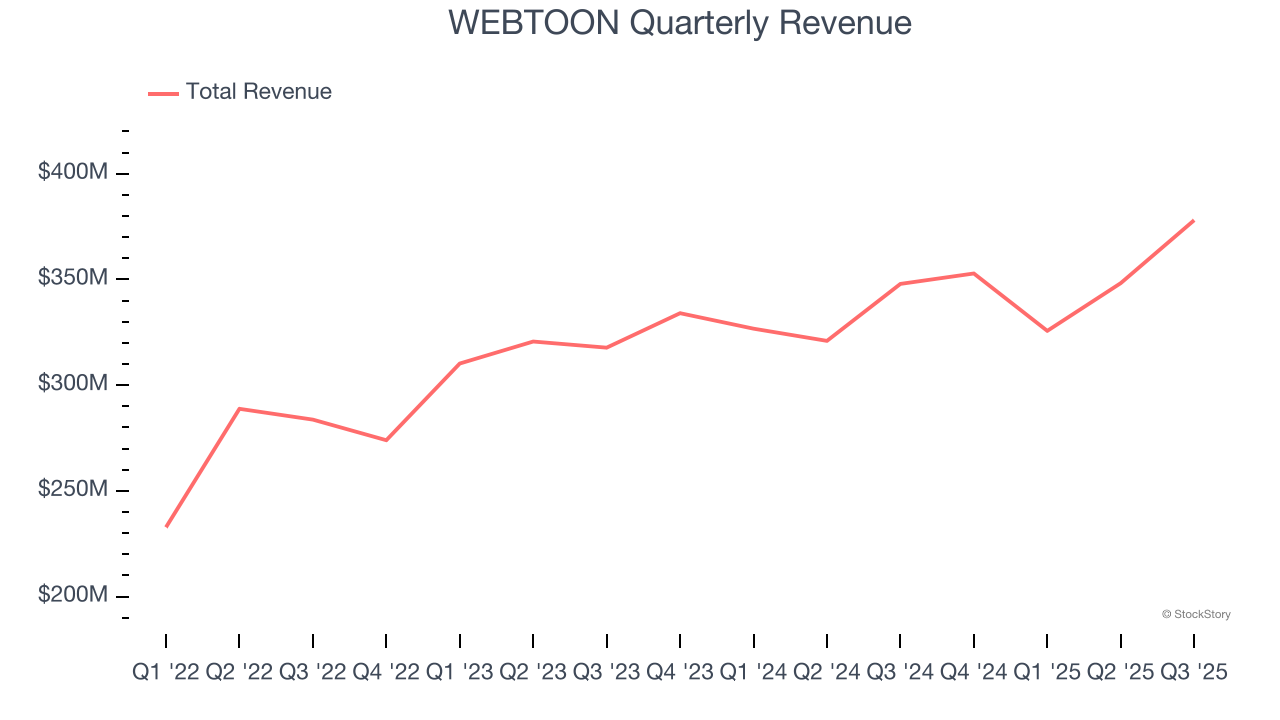

With $1.40 billion in revenue over the past 12 months, WEBTOON is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

We can dig further into the company’s revenue dynamics by analyzing its number of monthly active users, which reached 155 million in the latest quarter. Over the last two years, WEBTOON’s monthly active users averaged 3.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, WEBTOON’s revenue grew by 8.7% year on year to $378 million, missing Wall Street’s estimates. Company management is currently guiding for a 5.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will spur better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

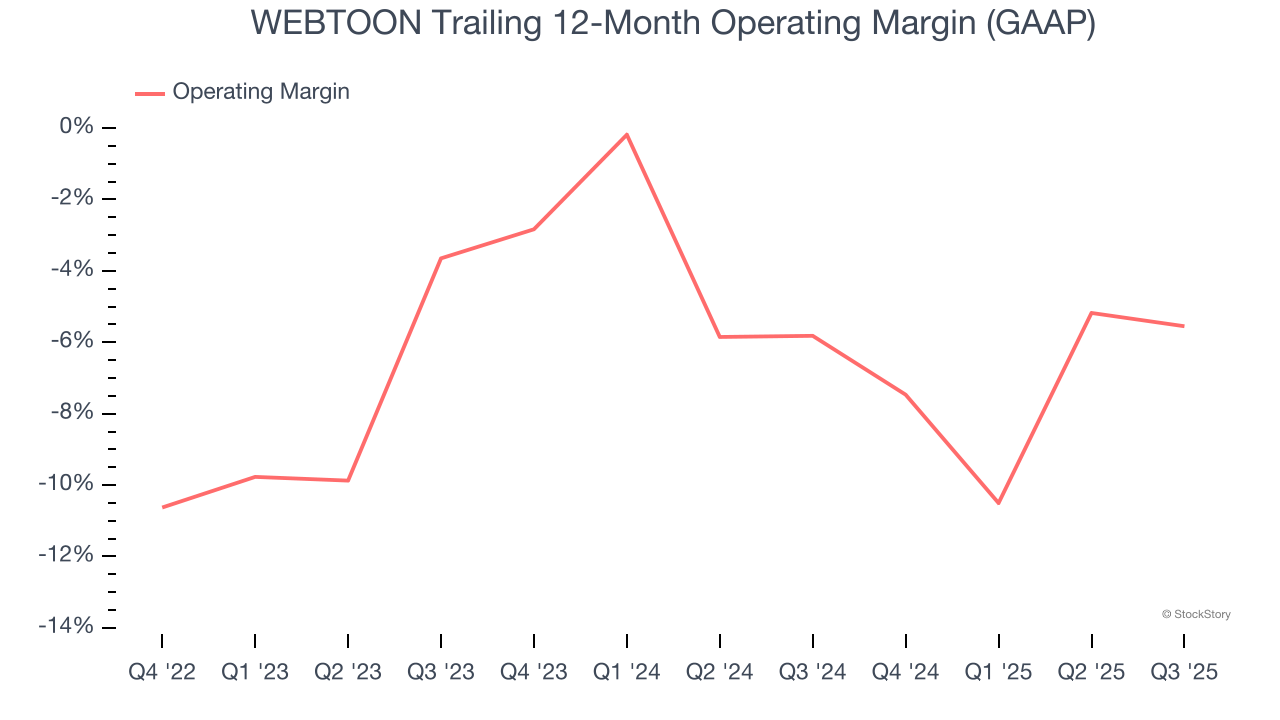

WEBTOON’s high expenses have contributed to an average operating margin of negative 6.3% over the last four years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, WEBTOON’s operating margin rose by 7.9 percentage points over the last four years. Still, it will take much more for the company to reach long-term profitability.

WEBTOON’s operating margin was negative 3.9% this quarter.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

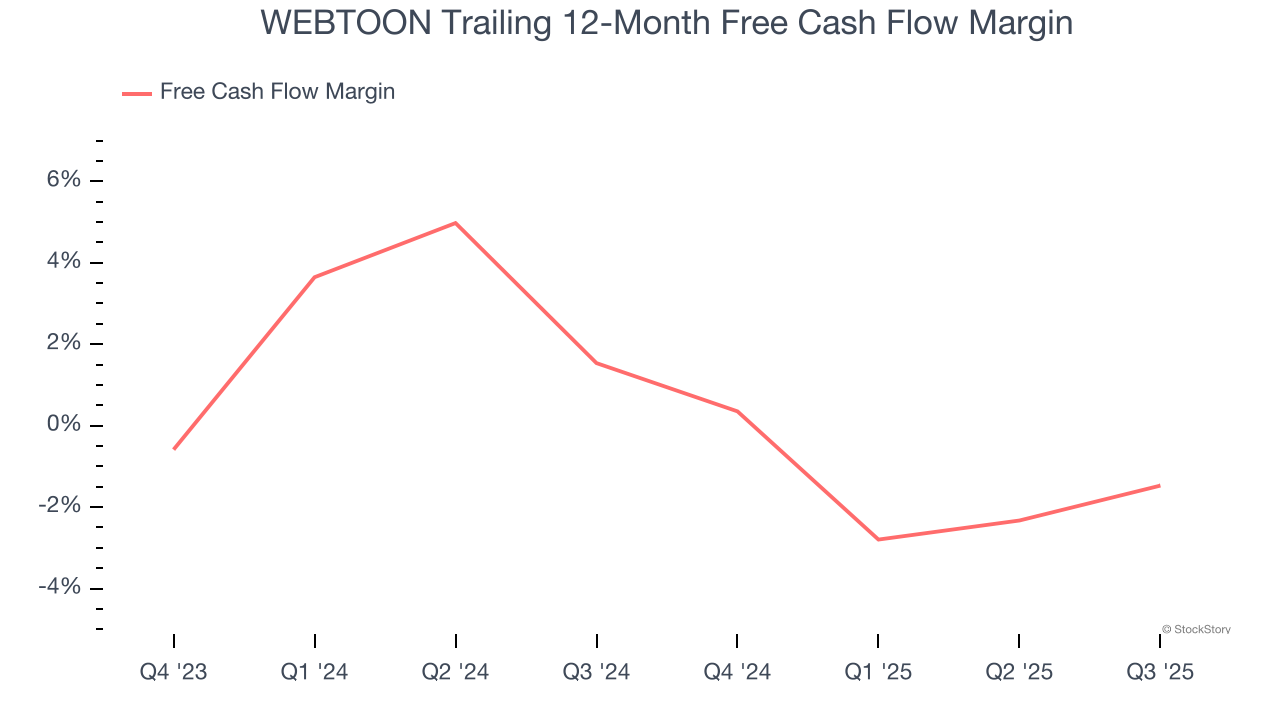

WEBTOON broke even from a free cash flow perspective over the last three years, giving the company limited opportunities to return capital to shareholders.

WEBTOON’s free cash flow clocked in at $11.84 million in Q3, equivalent to a 3.1% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year. Its cash profitability was also above its three-year level, and we hope the company can build on this trend.

Key Takeaways from WEBTOON’s Q3 Results

It was good to see WEBTOON beat analysts’ EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 18.3% to $13.75 immediately after reporting.

WEBTOON’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.