Although Photronics (currently trading at $22.48 per share) has gained 7.4% over the last six months, it has trailed the S&P 500’s 16.4% return during that period. This may have investors wondering how to approach the situation.

Is now the time to buy Photronics, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Photronics Not Exciting?

We're swiping left on Photronics for now. Here are three reasons there are better opportunities than PLAB and a stock we'd rather own.

1. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Photronics’s revenue to stall, close to its 6.8% annualized growth for the past five years. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

2. Low Gross Margin Reveals Weak Structural Profitability

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Photronics’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 36.2% gross margin over the last two years. Said differently, Photronics had to pay a chunky $63.82 to its suppliers for every $100 in revenue.

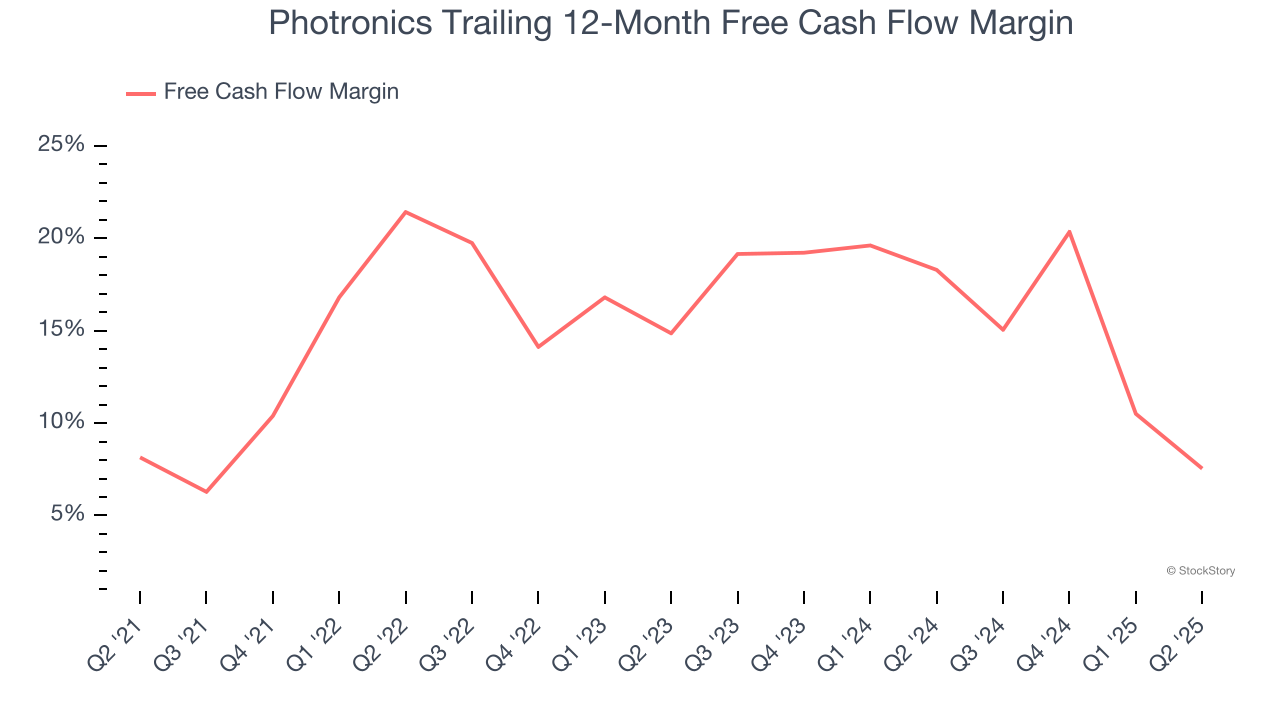

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Photronics has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 13%, subpar for a semiconductor business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Photronics to make large cash investments in working capital and capital expenditures.

Final Judgment

Photronics isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 11.6× forward P/E (or $22.48 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.