Let’s dig into the relative performance of Gorman-Rupp (NYSE: GRC) and its peers as we unravel the now-completed Q3 gas and liquid handling earnings season.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 11 gas and liquid handling stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

Gorman-Rupp (NYSE: GRC)

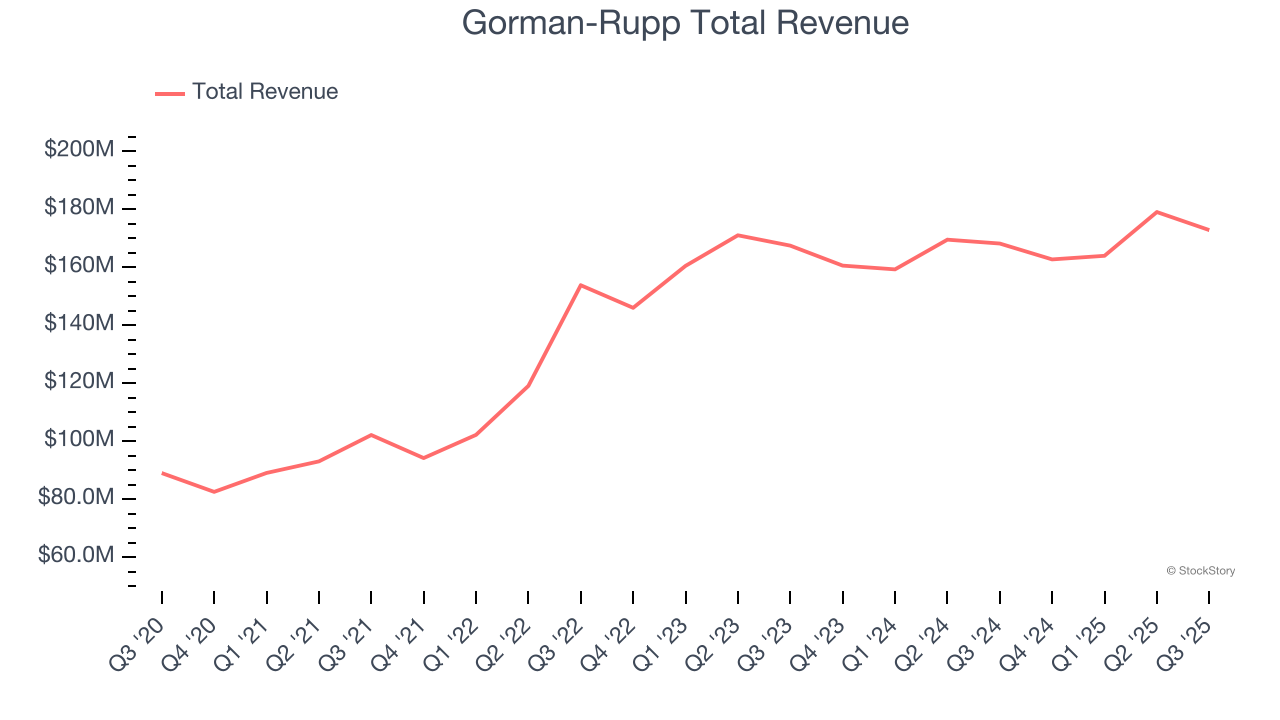

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE: GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

Gorman-Rupp reported revenues of $172.8 million, up 2.8% year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a slight miss of analysts’ revenue estimates.

Scott A. King, President and CEO, commented, “During the quarter we made the decision to close two of our smaller facilities that primarily served the agriculture market and to transition a third facility to support both the expansion of our data center driven HVAC business and continued growth in the municipal and fire markets.”

Gorman-Rupp delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 8.7% since reporting and currently trades at $44.82.

Is now the time to buy Gorman-Rupp? Access our full analysis of the earnings results here, it’s free for active Edge members.

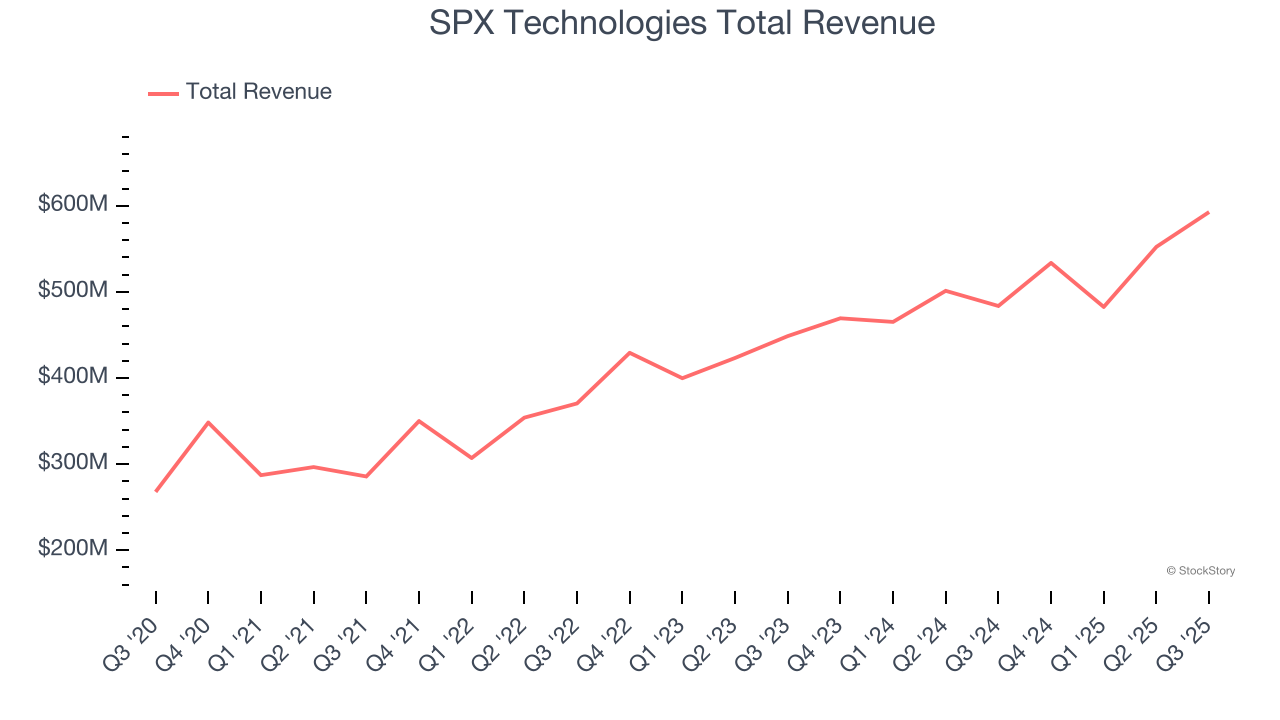

Best Q3: SPX Technologies (NYSE: SPXC)

With roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE: SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets.

SPX Technologies reported revenues of $592.8 million, up 22.6% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 10.3% since reporting. It currently trades at $219.23.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Graco (NYSE: GGG)

Founded in 1926, Graco (NYSE: GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $543.4 million, up 4.7% year on year, falling short of analysts’ expectations by 3%. It was a softer quarter as it posted a miss of analysts’ revenue estimates.

Interestingly, the stock is up 1.1% since the results and currently trades at $82.52.

Read our full analysis of Graco’s results here.

Chart (NYSE: GTLS)

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE: GTLS) provides equipment to store and transport gasses.

Chart reported revenues of $1.10 billion, up 3.6% year on year. This number lagged analysts' expectations by 6.3%. Overall, it was a slower quarter as it also logged a significant miss of analysts’ revenue and EBITDA estimates.

Chart had the weakest performance against analyst estimates among its peers. The stock is up 1.9% since reporting and currently trades at $203.50.

Read our full, actionable report on Chart here, it’s free for active Edge members.

Helios (NYSE: HLIO)

Founded on the principle of treating others as one wants to be treated, Helios (NYSE: HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Helios reported revenues of $220.3 million, up 13.3% year on year. This result topped analysts’ expectations by 3.7%. It was a very strong quarter as it also recorded an impressive beat of analysts’ organic revenue and adjusted operating income estimates.

Helios pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 6.2% since reporting and currently trades at $53.12.

Read our full, actionable report on Helios here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.