Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Red Robin (NASDAQ: RRGB) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 2.4% on average since the latest earnings results.

Red Robin (NASDAQ: RRGB)

Known for its bottomless steak fries, Red Robin (NASDAQ: RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

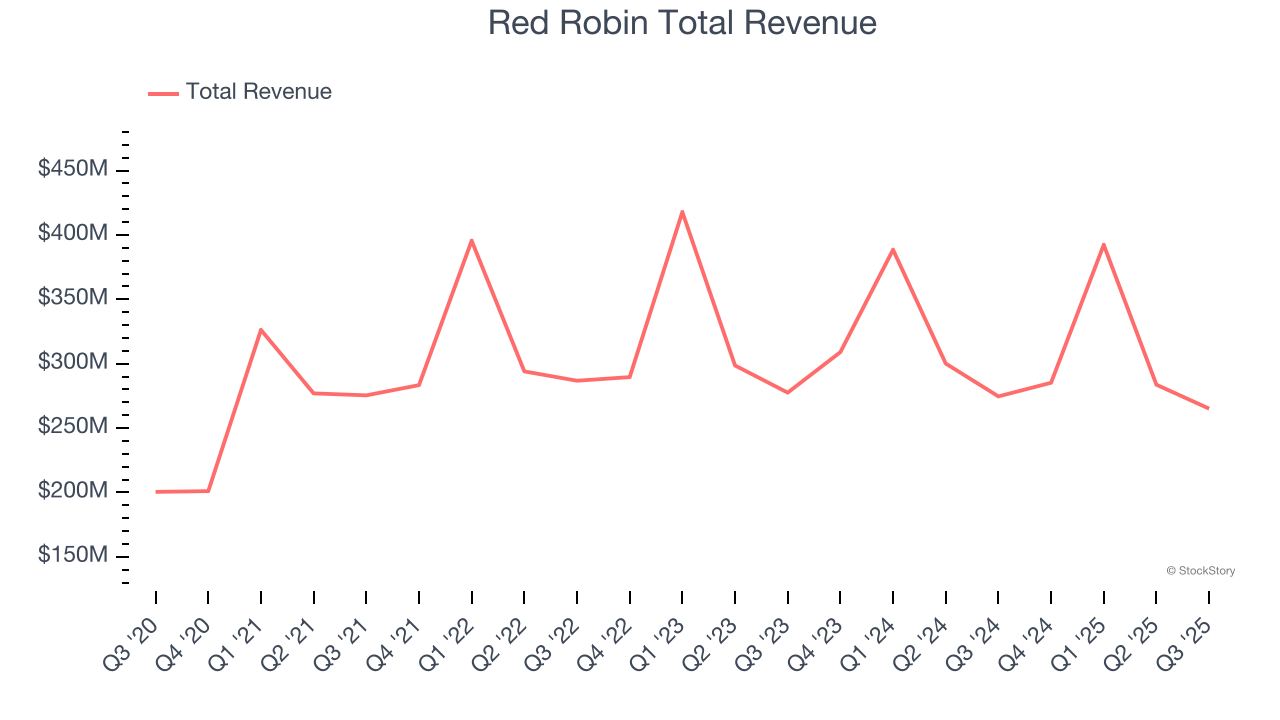

Red Robin reported revenues of $265.1 million, down 3.5% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Dave Pace, Red Robin's President and Chief Executive Officer said, "We began to quickly see results from our First Choice plan as our Big YUMMM promotion performed above expectations and helped deliver a sequential traffic improvement of approximately 250 basis points from the second quarter with particular resonance during mid-week dining and lunch dayparts."

Red Robin pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 8.8% since reporting and currently trades at $4.29.

Is now the time to buy Red Robin? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Bloomin' Brands (NASDAQ: BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Bloomin' Brands reported revenues of $928.8 million, down 10.6% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.2% since reporting. It currently trades at $6.73.

Is now the time to buy Bloomin' Brands? Access our full analysis of the earnings results here, it’s free for active Edge members.

Denny's (NASDAQ: DENN)

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $113.2 million, up 1.3% year on year, falling short of analysts’ expectations by 3.2%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and EBITDA estimates.

Interestingly, the stock is up 49.1% since the results and currently trades at $6.14.

Read our full analysis of Denny’s results here.

Dine Brands (NYSE: DIN)

Operating a franchise model, Dine Brands (NYSE: DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $216.2 million, up 10.8% year on year. This number missed analysts’ expectations by 1.7%. It was a softer quarter as it also recorded a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

The stock is up 7.6% since reporting and currently trades at $26.50.

Read our full, actionable report on Dine Brands here, it’s free for active Edge members.

The Cheesecake Factory (NASDAQ: CAKE)

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ: CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

The Cheesecake Factory reported revenues of $907.2 million, up 4.8% year on year. This result came in 0.5% below analysts' expectations. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a slight miss of analysts’ same-store sales estimates.

The stock is down 15.7% since reporting and currently trades at $45.87.

Read our full, actionable report on The Cheesecake Factory here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.