Over the past six months, Lake City Bank’s shares (currently trading at $56.41) have posted a disappointing 7.9% loss, well below the S&P 500’s 13% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the drawdown, is now the time to buy LKFN? Find out in our full research report, it’s free for active Edge members.

Why Does Lake City Bank Spark Debate?

Dating back to 1872 and deeply rooted in Indiana's communities, Lakeland Financial Corporation (NASDAQ: LKFN) operates Lake City Bank, providing commercial and consumer banking services throughout Northern and Central Indiana.

Two Positive Attributes:

1. EPS Surges Higher Over the Last Two Years

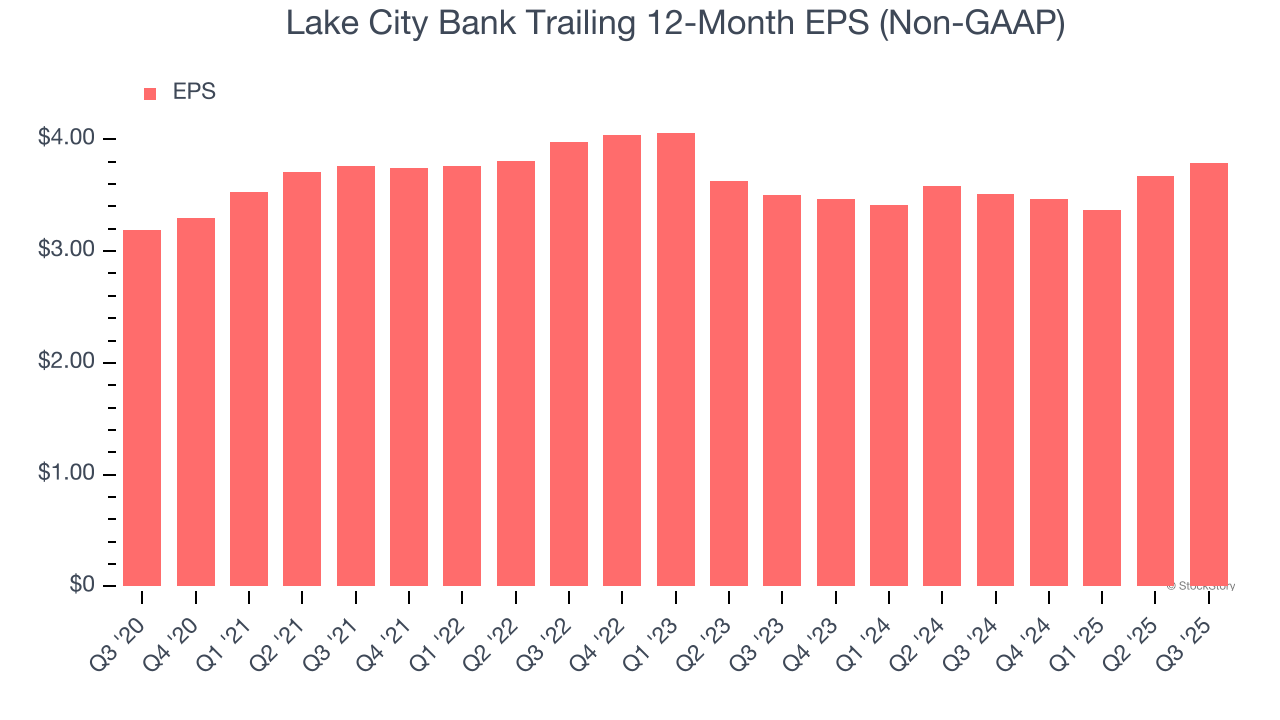

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Lake City Bank’s spectacular 4.1% annual EPS growth over the last two years aligns with its revenue trend. This tells us its incremental sales were profitable.

2. Stellar ROE Showcases Lucrative Growth Opportunities

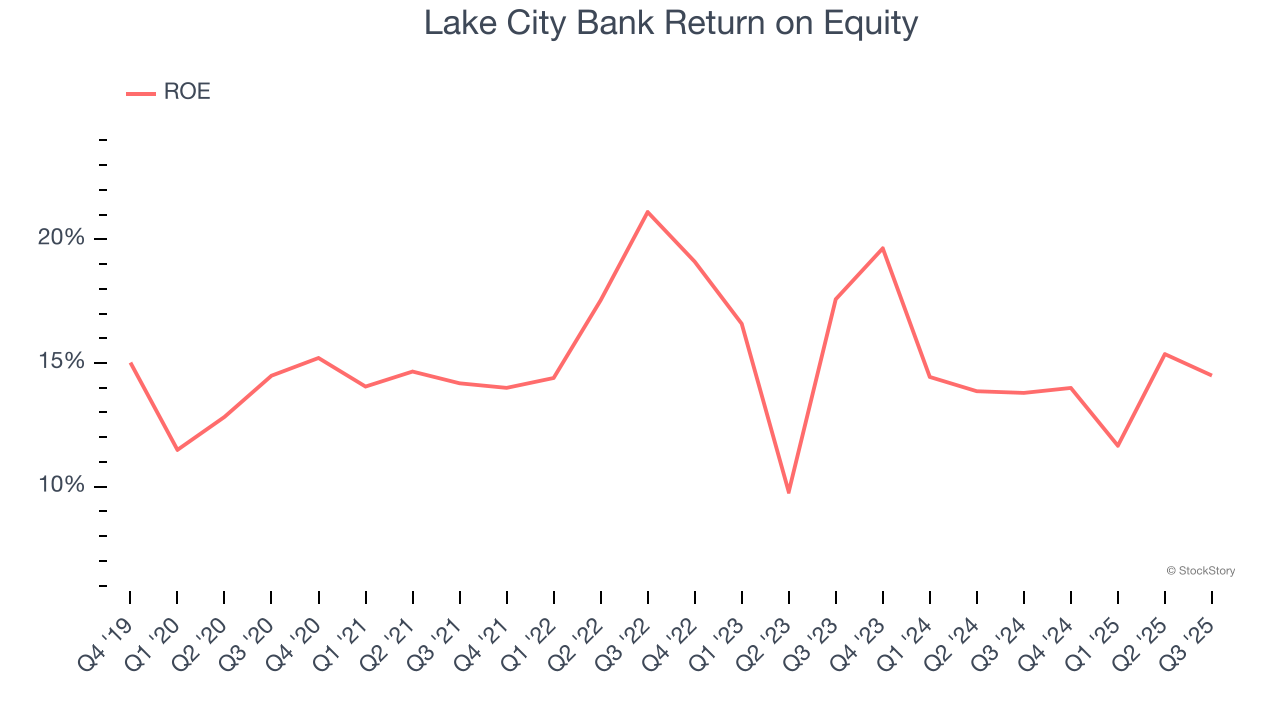

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Lake City Bank has averaged an ROE of 15.3%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Lake City Bank has a strong competitive moat.

One Reason to be Careful:

Net Interest Income Points to Soft Demand

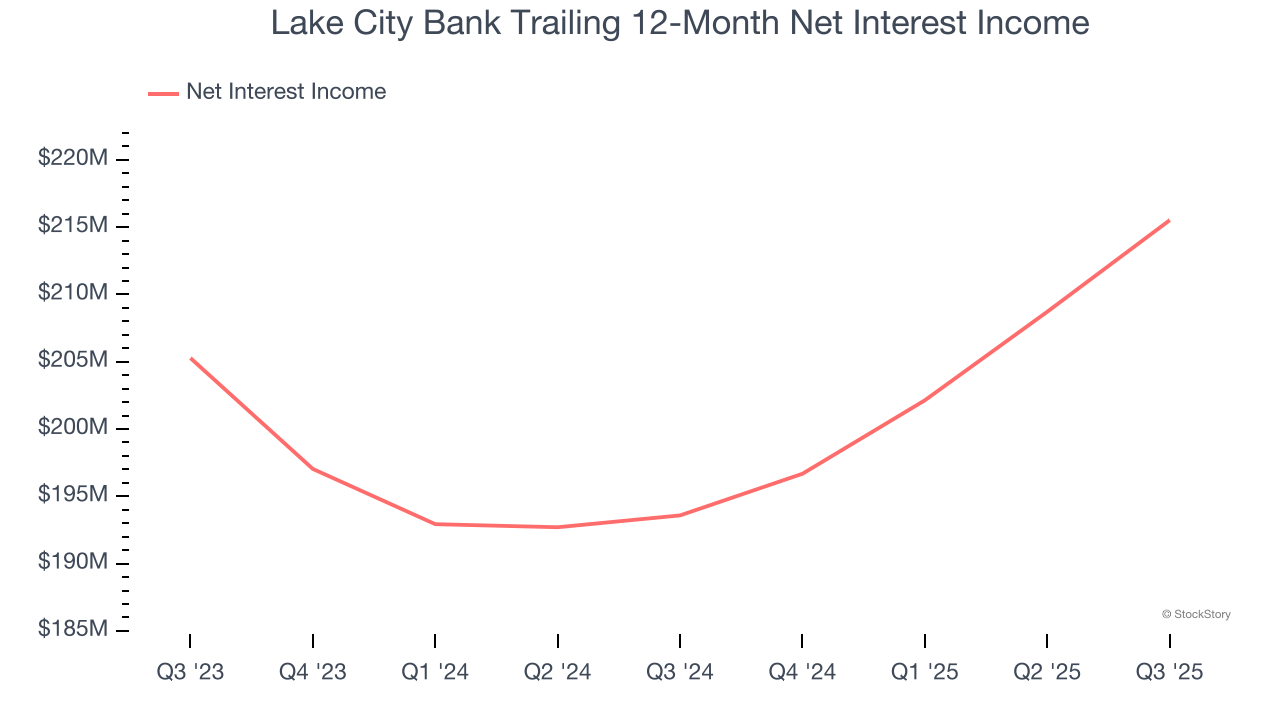

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Lake City Bank’s net interest income has grown at a 6.5% annualized rate over the last five years, slightly worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

Final Judgment

Lake City Bank’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 1.9× forward P/B (or $56.41 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Lake City Bank

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.