Sleep Number’s stock price has taken a beating over the past six months, shedding 57.3% of its value and falling to $3.88 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Sleep Number, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Sleep Number Will Underperform?

Despite the more favorable entry price, we're cautious about Sleep Number. Here are three reasons why SNBR doesn't excite us and a stock we'd rather own.

1. Flat Same-Store Sales Indicate Weak Demand

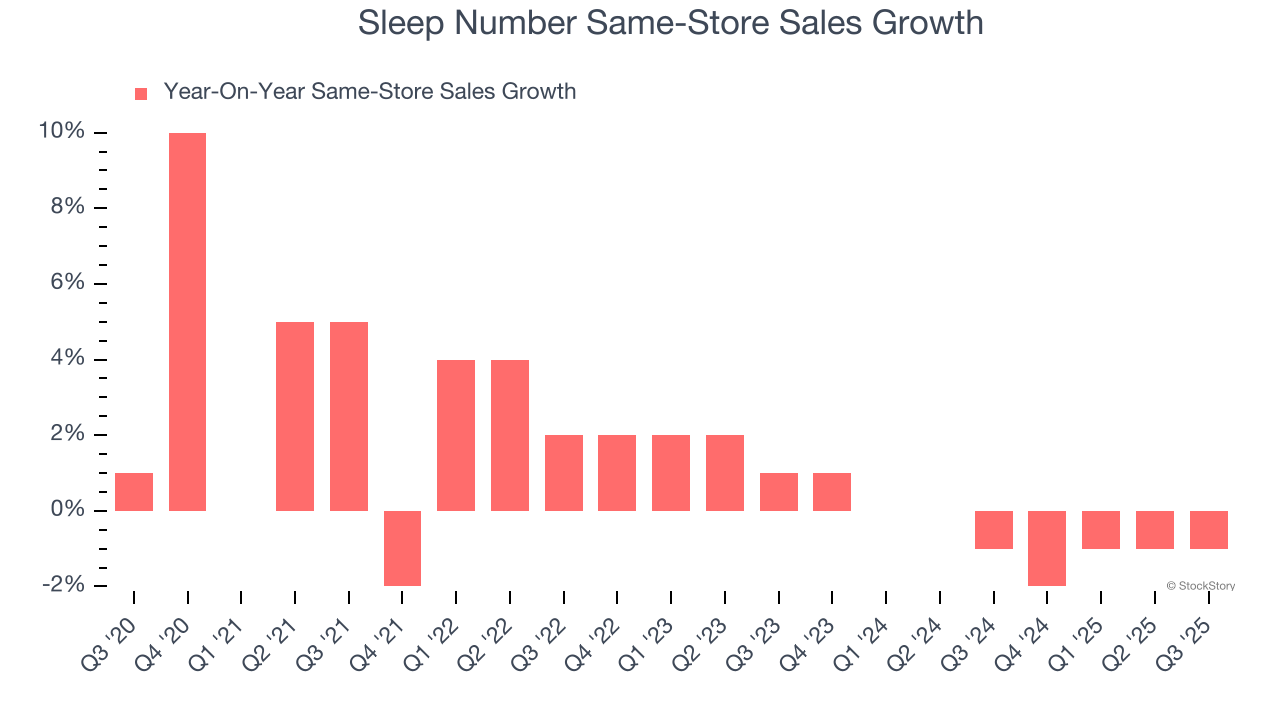

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Sleep Number’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

2. Operating Losses Sound the Alarms

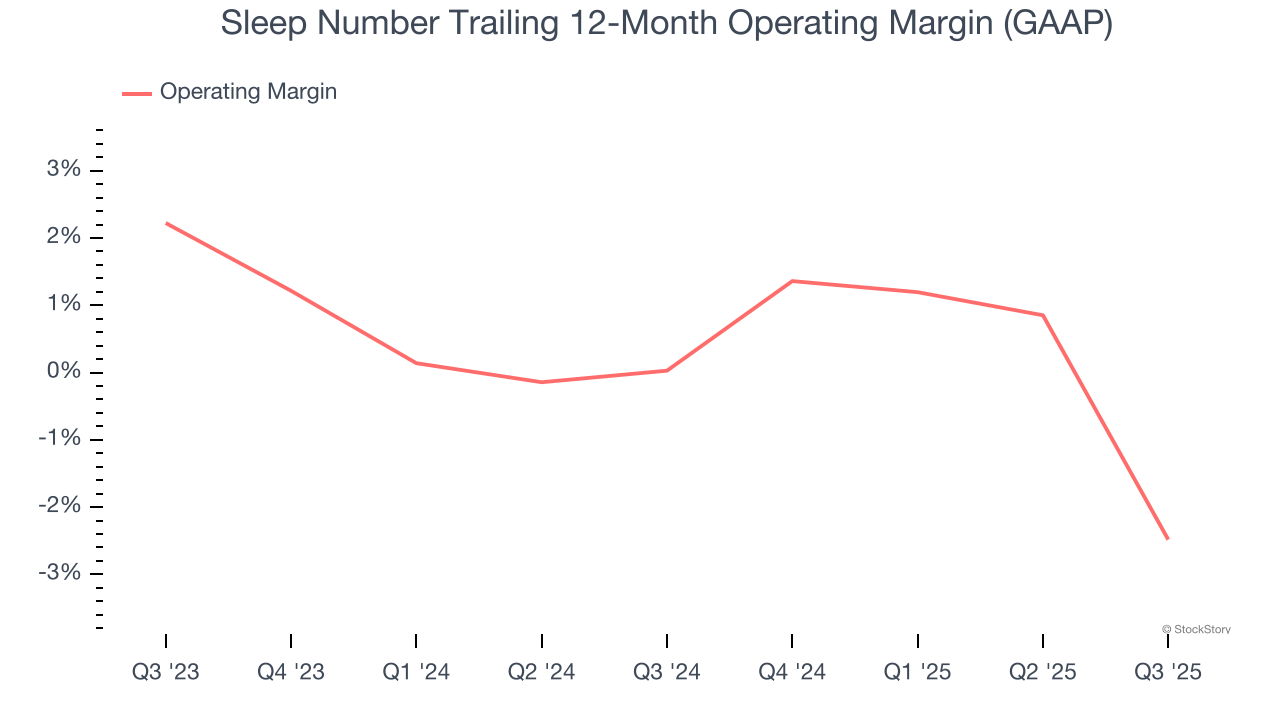

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. Unfortunately, Sleep Number was one of them over the last two years as its high expenses contributed to an average operating margin of negative 1.1%.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Sleep Number burned through $47.02 million of cash over the last year, and its $940.5 million of debt exceeds the $1.26 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Sleep Number’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Sleep Number until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Sleep Number falls short of our quality standards. After the recent drawdown, the stock trades at 1.1× forward EV-to-EBITDA (or $3.88 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Sleep Number

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.