Personal care and home fragrance retailer Bath & Body Works (NYSE: BBWI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales flat year on year at $1.59 billion. Its GAAP profit of $0.37 per share was 5.9% below analysts’ consensus estimates.

Is now the time to buy Bath and Body Works? Find out by accessing our full research report, it’s free for active Edge members.

Bath and Body Works (BBWI) Q3 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.63 billion (flat year on year, 2.5% miss)

- EPS (GAAP): $0.37 vs analyst expectations of $0.39 (5.9% miss)

- EPS (GAAP) guidance for the full year is $2.83 at the midpoint, missing analyst estimates by 16.1%

- Operating Margin: 10.1%, down from 13.5% in the same quarter last year

- Locations: 2,478 at quarter end, up from 2,395 in the same quarter last year

- Market Capitalization: $4.34 billion

Daniel Heaf, chief executive officer of Bath & Body Works, commented, “Today, we are excited to announce a comprehensive transformation plan to revitalize Bath & Body Works across brand, product, and marketplace. This plan, the Consumer First Formula, focuses our investments in our four largest revenue driving opportunities - creating disruptive and innovative product, reigniting our brand, winning in the marketplace, and operating with speed and efficiency. These initiatives aim to attract new, younger consumers to the brand and unlock our next era of growth.”

Company Overview

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

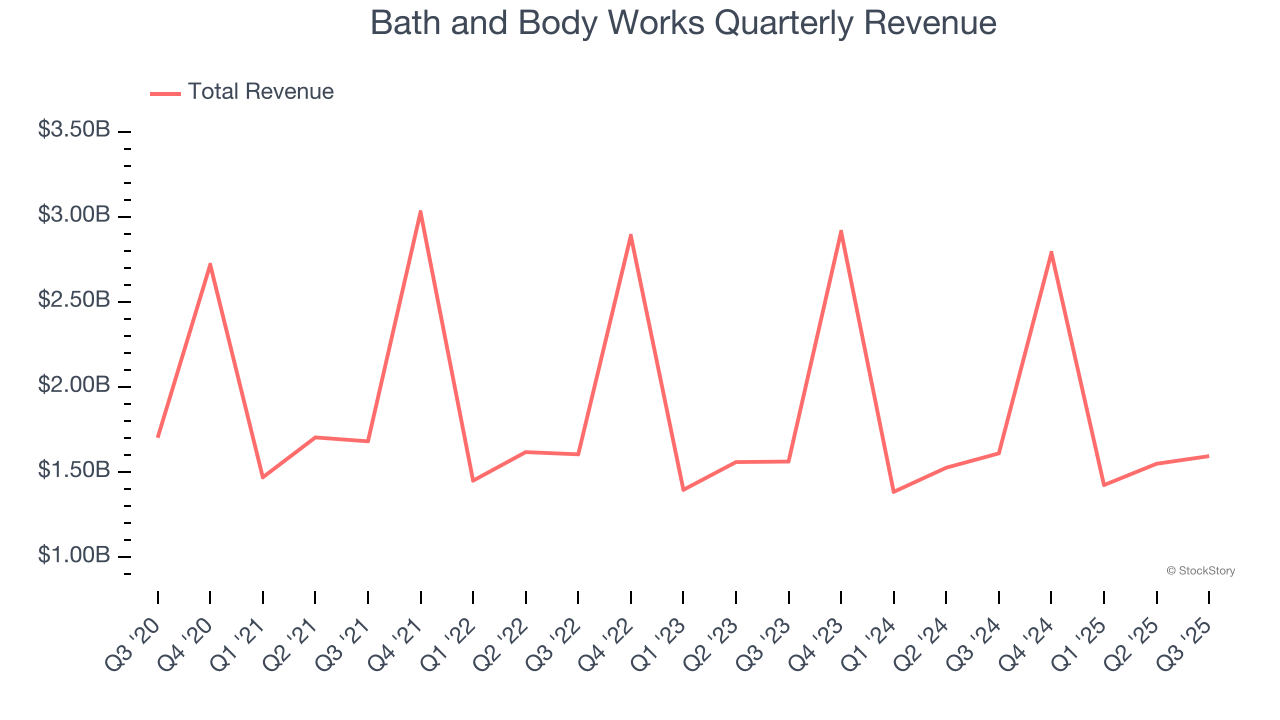

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $7.36 billion in revenue over the past 12 months, Bath and Body Works is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Bath and Body Works grew its sales at a tepid 6.1% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Bath and Body Works missed Wall Street’s estimates and reported a rather uninspiring 1% year-on-year revenue decline, generating $1.59 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and indicates its products will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Store Performance

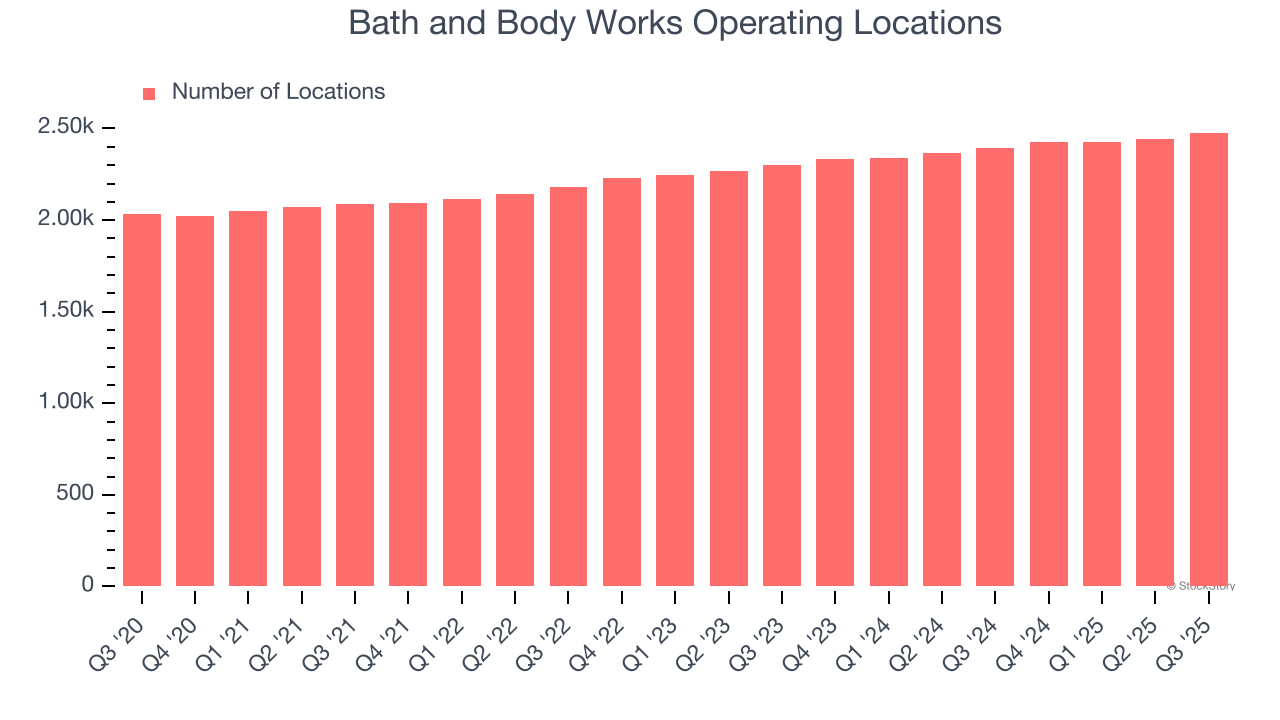

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Bath and Body Works operated 2,478 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 3.9% annual growth, much faster than the broader consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

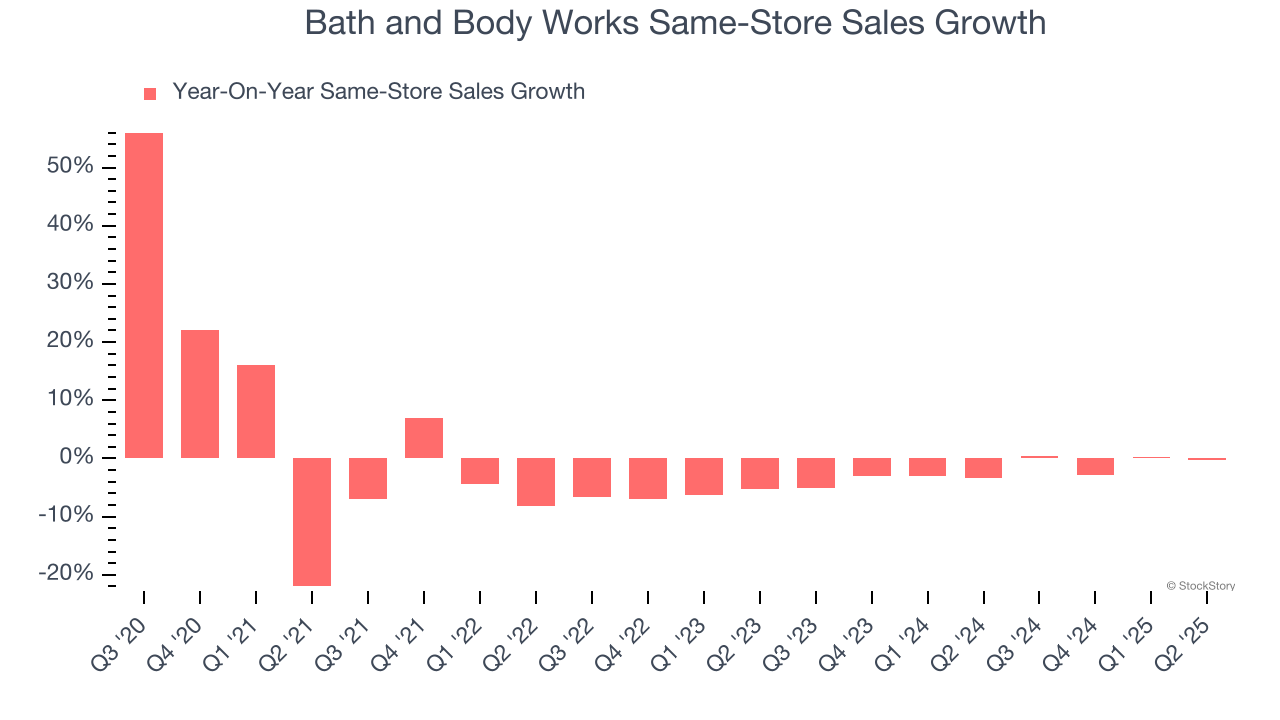

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Bath and Body Works’s demand has been shrinking over the last two years as its same-store sales have averaged 1.7% annual declines. This performance is concerning - it shows Bath and Body Works artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Bath and Body Works reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Bath and Body Works’s Q3 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 16.1% to $17.66 immediately following the results.

Bath and Body Works’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.