As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the it services & consulting industry, including Accenture (NYSE: ACN) and its peers.

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

The 8 it services & consulting stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

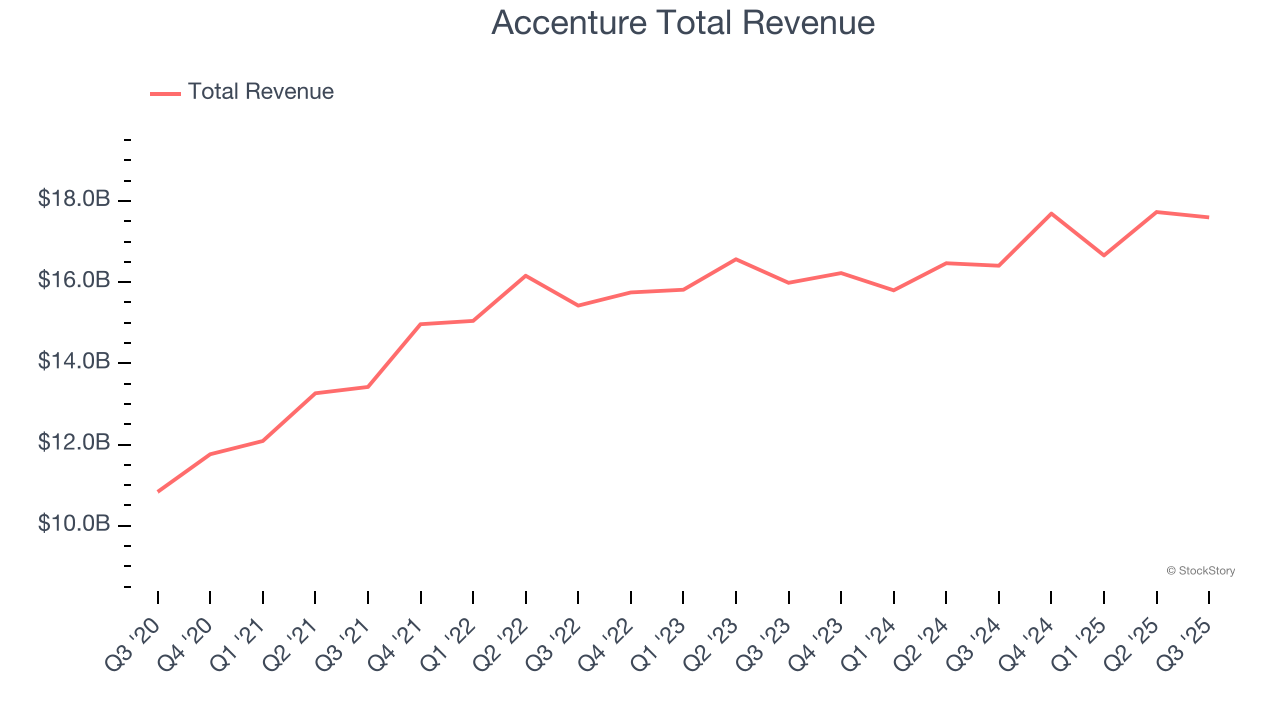

Accenture (NYSE: ACN)

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE: ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Accenture reported revenues of $17.6 billion, up 7.3% year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a mixed quarter for the company with a narrow beat of analysts’ revenue estimates but a slight miss of analysts’ full-year EPS guidance estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $242.05.

Is now the time to buy Accenture? Access our full analysis of the earnings results here, it’s free for active Edge members.

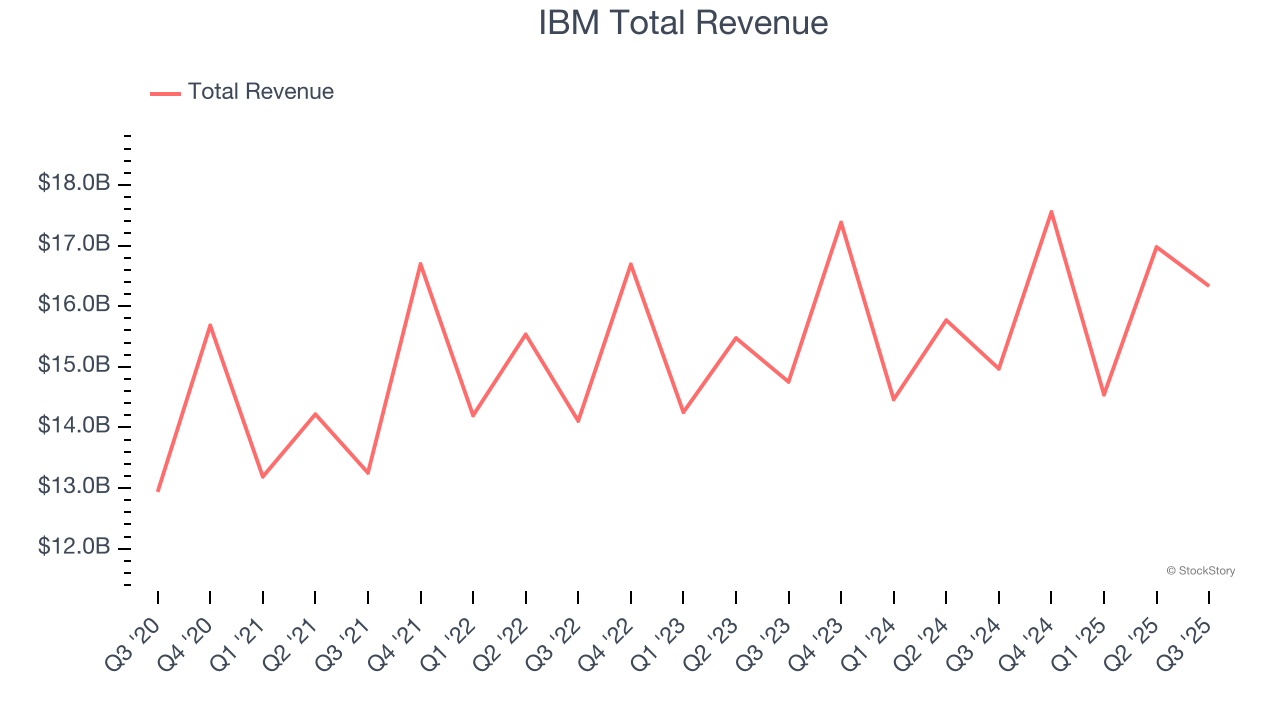

Best Q3: IBM (NYSE: IBM)

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE: IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IBM reported revenues of $16.33 billion, up 9.1% year on year, outperforming analysts’ expectations by 1.4%. The business had a very strong quarter with a solid beat of analysts’ operating income and EPS estimates.

IBM scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $291.74.

Is now the time to buy IBM? Access our full analysis of the earnings results here, it’s free for active Edge members.

Grid Dynamics (NASDAQ: GDYN)

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics reported revenues of $104.2 million, up 19.1% year on year, in line with analysts’ expectations. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and EPS in line with analysts’ estimates.

Interestingly, the stock is up 7% since the results and currently trades at $8.13.

Read our full analysis of Grid Dynamics’s results here.

EPAM (NYSE: EPAM)

Founded in 1993 during the early days of offshore software development, EPAM Systems (NYSE: EPAM) provides digital engineering, cloud, and AI transformation services to help global enterprises and startups modernize their technology systems and create digital products.

EPAM reported revenues of $1.39 billion, up 19.4% year on year. This number topped analysts’ expectations by 1.4%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EPS guidance for next quarter estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

EPAM achieved the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 14.4% since reporting and currently trades at $184.12.

Read our full, actionable report on EPAM here, it’s free for active Edge members.

Gartner (NYSE: IT)

With over 2,500 research experts guiding organizations through complex technology landscapes, Gartner (NYSE: IT) provides research, advisory services, and conferences that help executives make better decisions about technology and other business priorities.

Gartner reported revenues of $1.52 billion, up 2.7% year on year. This result was in line with analysts’ expectations. It was a strong quarter as it also recorded a beat of analysts’ EPS estimates and revenue in line with analysts’ estimates.

The stock is down 8% since reporting and currently trades at $226.13.

Read our full, actionable report on Gartner here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.