Expeditors’s 22.7% return over the past six months has outpaced the S&P 500 by 9%, and its stock price has climbed to $139.22 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Expeditors, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Expeditors Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Expeditors for now. Here are three reasons there are better opportunities than EXPD and a stock we'd rather own.

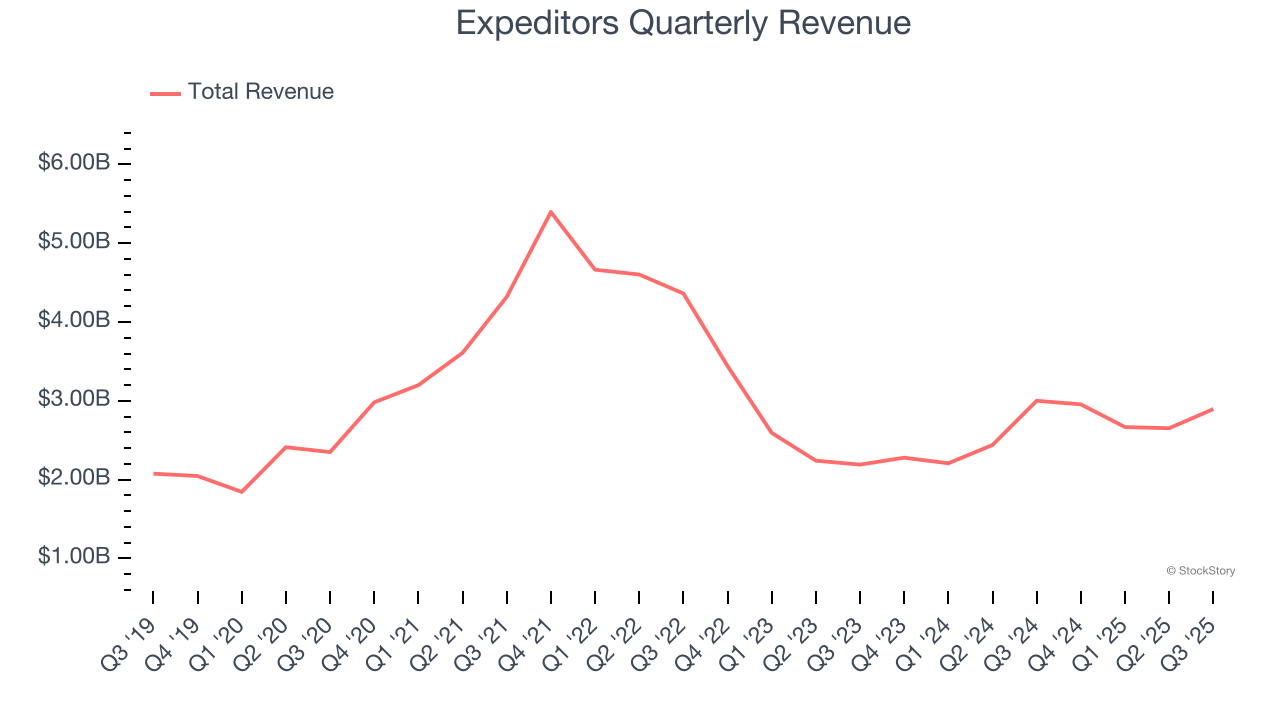

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Expeditors grew its sales at a tepid 5.2% compounded annual growth rate. This was below our standard for the industrials sector.

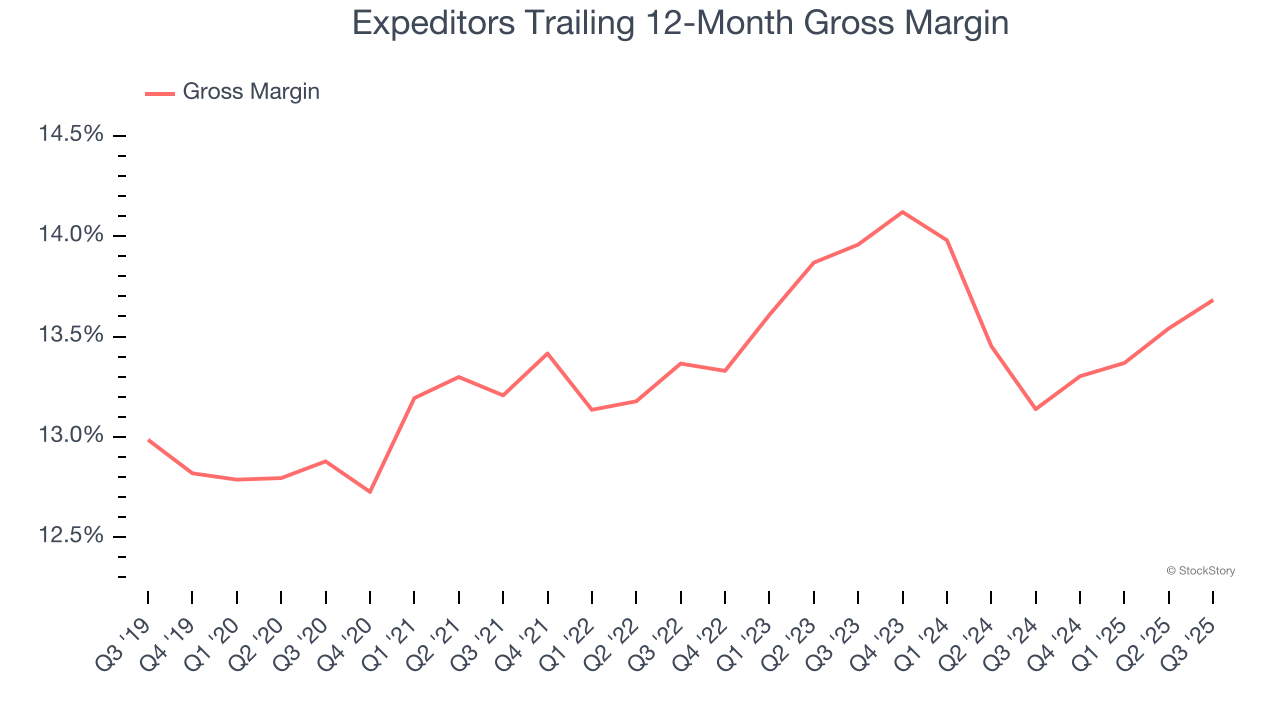

2. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Expeditors has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.4% gross margin over the last five years. Said differently, Expeditors had to pay a chunky $86.55 to its suppliers for every $100 in revenue.

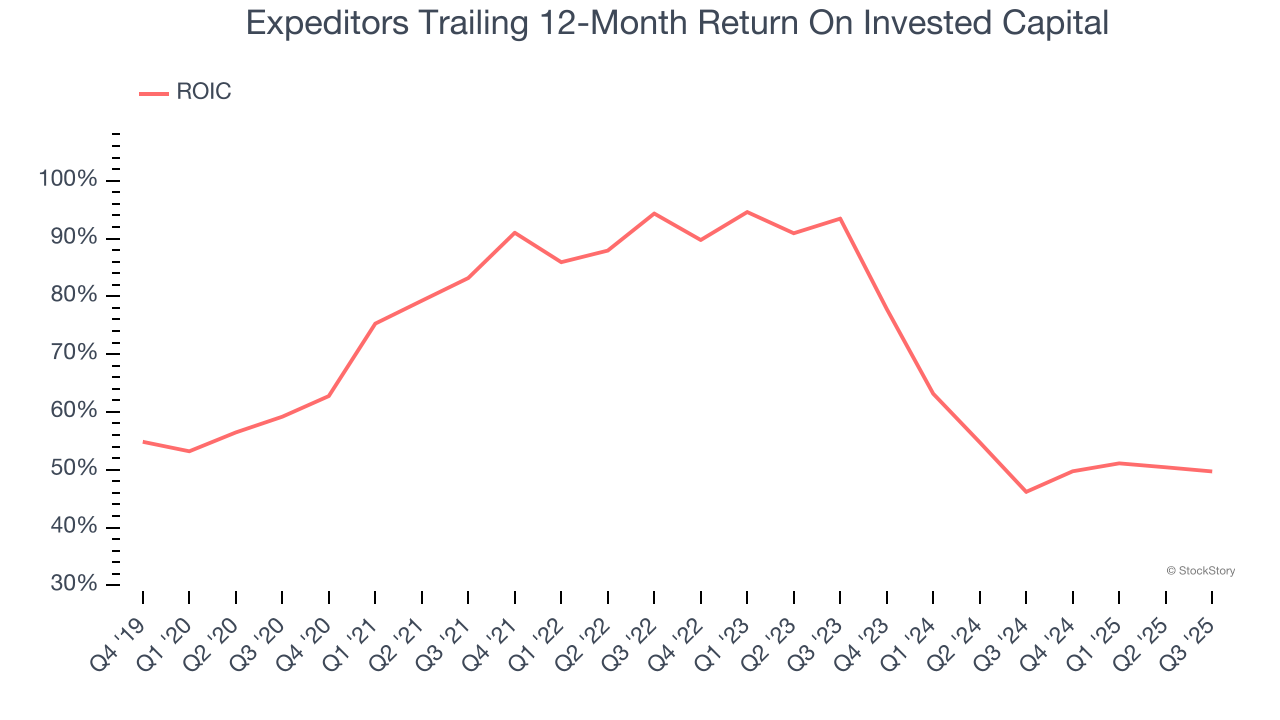

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Expeditors’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Expeditors’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 23.8× forward P/E (or $139.22 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Expeditors

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.