Wrapping up Q3 earnings, we look at the numbers and key takeaways for the life insurance stocks, including Corebridge Financial (NYSE: CRBG) and its peers.

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

The 15 life insurance stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 4.9%.

While some life insurance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.6% since the latest earnings results.

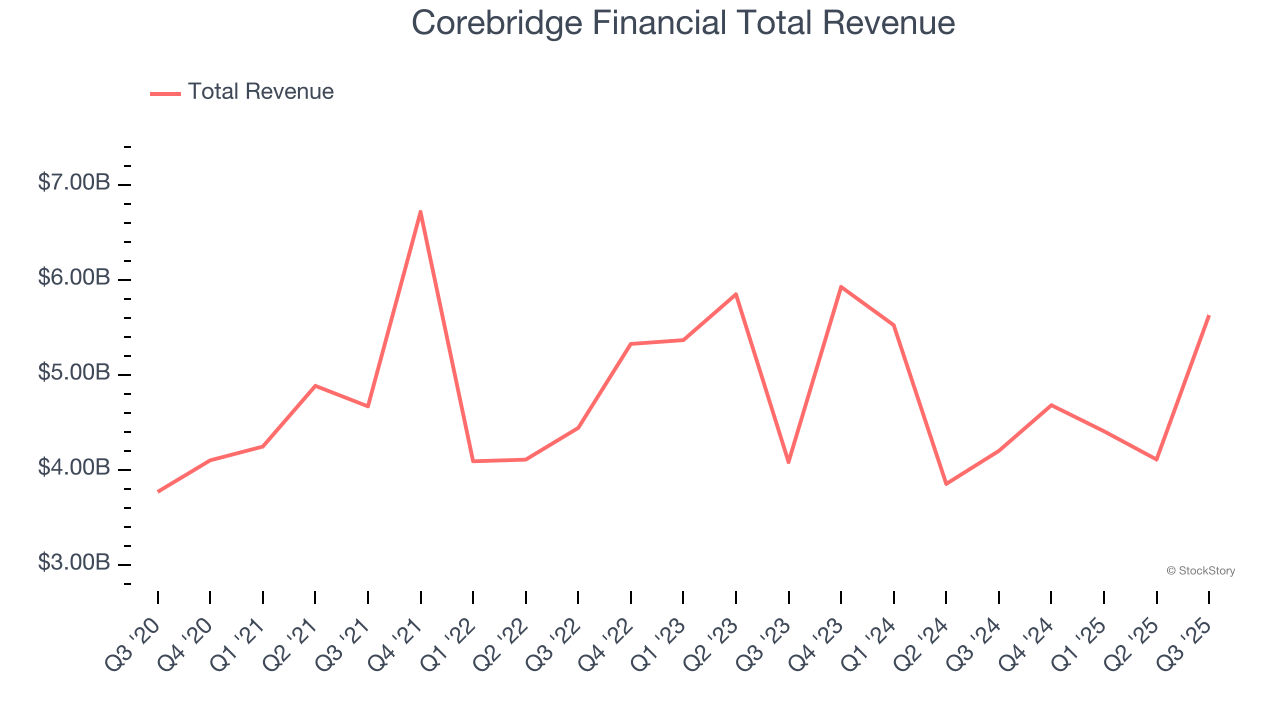

Corebridge Financial (NYSE: CRBG)

Spun off from insurance giant AIG in 2022 to focus on the growing retirement market, Corebridge Financial (NYSE: CRBG) provides retirement solutions, annuities, life insurance, and institutional risk management products in the United States.

Corebridge Financial reported revenues of $5.63 billion, up 34% year on year. This print exceeded analysts’ expectations by 49.7%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS estimates.

Corebridge Financial pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 0.9% since reporting and currently trades at $27.76.

Read our full report on Corebridge Financial here, it’s free for active Edge members.

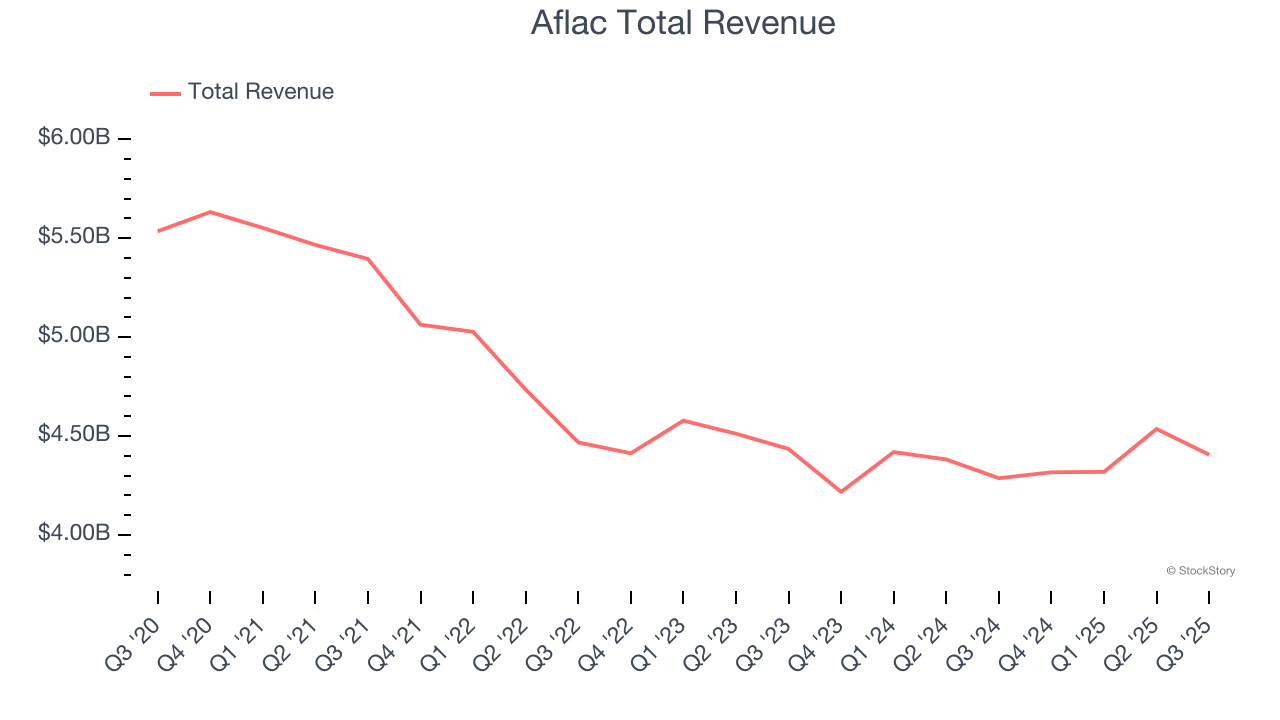

Best Q3: Aflac (NYSE: AFL)

Known for its iconic duck mascot that has quacked "Aflac!" in commercials since 2000, Aflac (NYSE: AFL) provides supplemental health and life insurance policies that pay cash benefits directly to policyholders for expenses not covered by their primary insurance.

Aflac reported revenues of $4.41 billion, up 2.8% year on year, falling short of analysts’ expectations by 0.9%. However, the business still had a very strong quarter with a solid beat of analysts’ book value per share estimates and a beat of analysts’ EPS estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $109.80.

Is now the time to buy Aflac? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Brighthouse Financial (NASDAQ: BHF)

Spun off from MetLife in 2017 to focus specifically on retail financial products, Brighthouse Financial (NASDAQ: BHF) provides annuity contracts and life insurance products designed to help individuals protect wealth, generate income, and transfer assets.

Brighthouse Financial reported revenues of $2.17 billion, flat year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net premiums earned estimates.

The stock is flat since the results and currently trades at $65.54.

Read our full analysis of Brighthouse Financial’s results here.

Horace Mann Educators (NYSE: HMN)

Founded in 1945 and named after the 19th-century education reformer known as the "father of American public education," Horace Mann Educators (NYSE: HMN) is an insurance company that specializes in providing auto, property, life, and retirement products tailored for educators and other public service employees.

Horace Mann Educators reported revenues of $438.5 million, up 6.4% year on year. This number beat analysts’ expectations by 0.9%. Aside from that, it was a satisfactory quarter as it also recorded a beat of analysts’ EPS estimates but a significant miss of analysts’ book value per share estimates.

The stock is up 1.5% since reporting and currently trades at $45.94.

Read our full, actionable report on Horace Mann Educators here, it’s free for active Edge members.

CNO Financial Group (NYSE: CNO)

Rebranded from Conseco in 2010 to signal a fresh start after navigating financial challenges, CNO Financial Group (NYSE: CNO) develops and markets health insurance, annuities, and life insurance products primarily targeting middle-income pre-retirees and retirees.

CNO Financial Group reported revenues of $964.9 million, up 2.5% year on year. This result was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a significant miss of analysts’ book value per share estimates.

The stock is flat since reporting and currently trades at $39.29.

Read our full, actionable report on CNO Financial Group here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.