Since May 2025, Old National Bank has been in a holding pattern, posting a small return of 3.5% while floating around $21.80. The stock also fell short of the S&P 500’s 15.6% gain during that period.

Is now the time to buy Old National Bank, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Old National Bank Not Exciting?

We're cautious about Old National Bank. Here are three reasons why ONB doesn't excite us and a stock we'd rather own.

1. Lackluster Revenue Growth

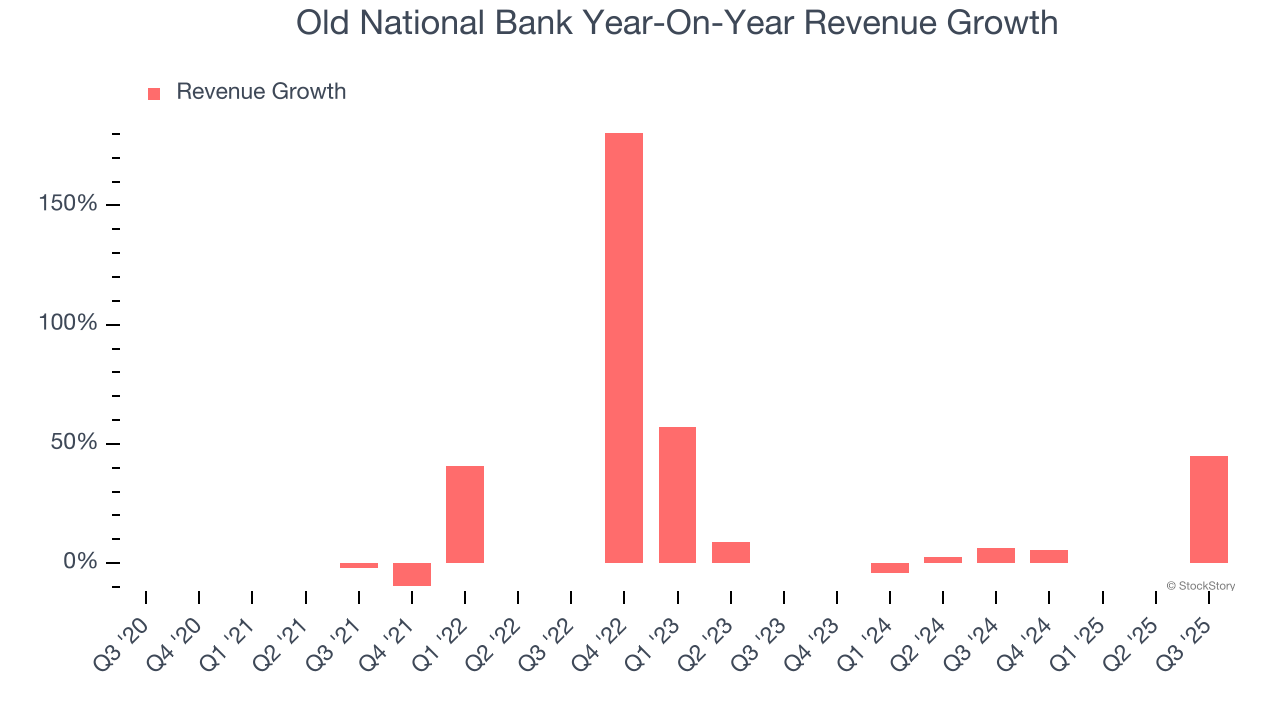

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Old National Bank’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 9.5% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. EPS Barely Growing

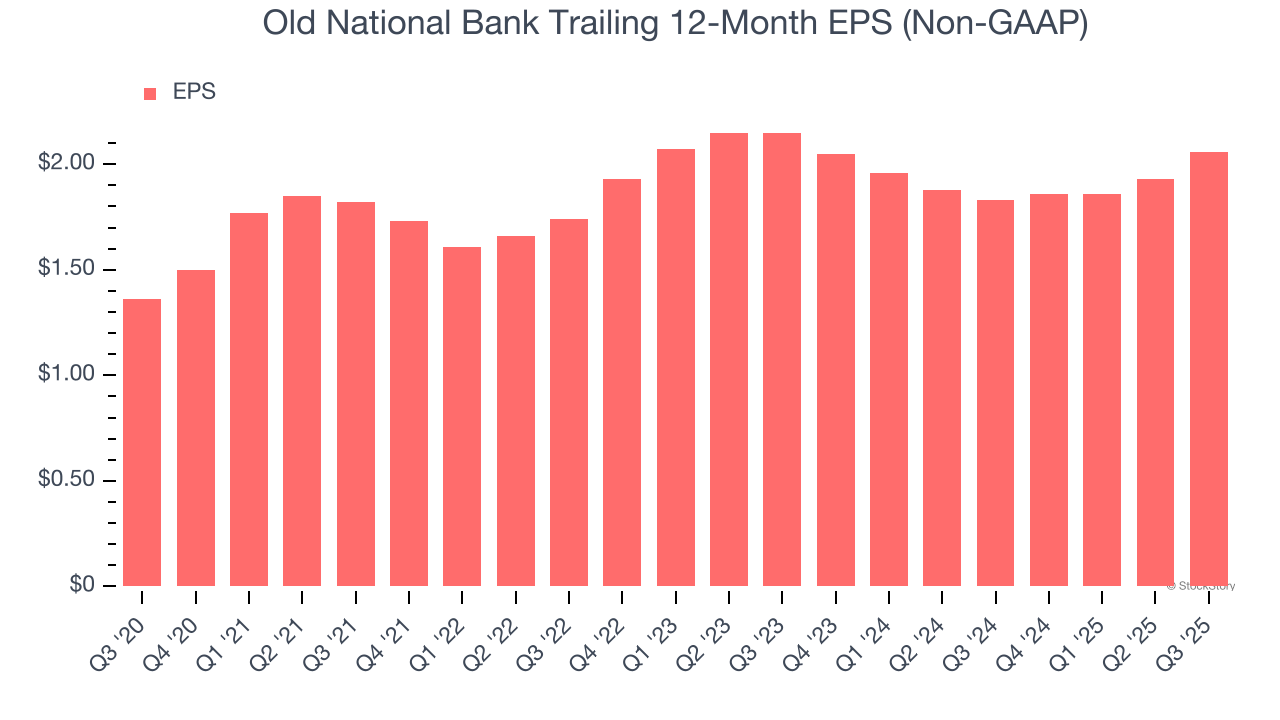

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Old National Bank’s EPS grew at an unimpressive 8.7% compounded annual growth rate over the last five years, lower than its 23.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Growing TBVPS Reflects Strong Asset Base

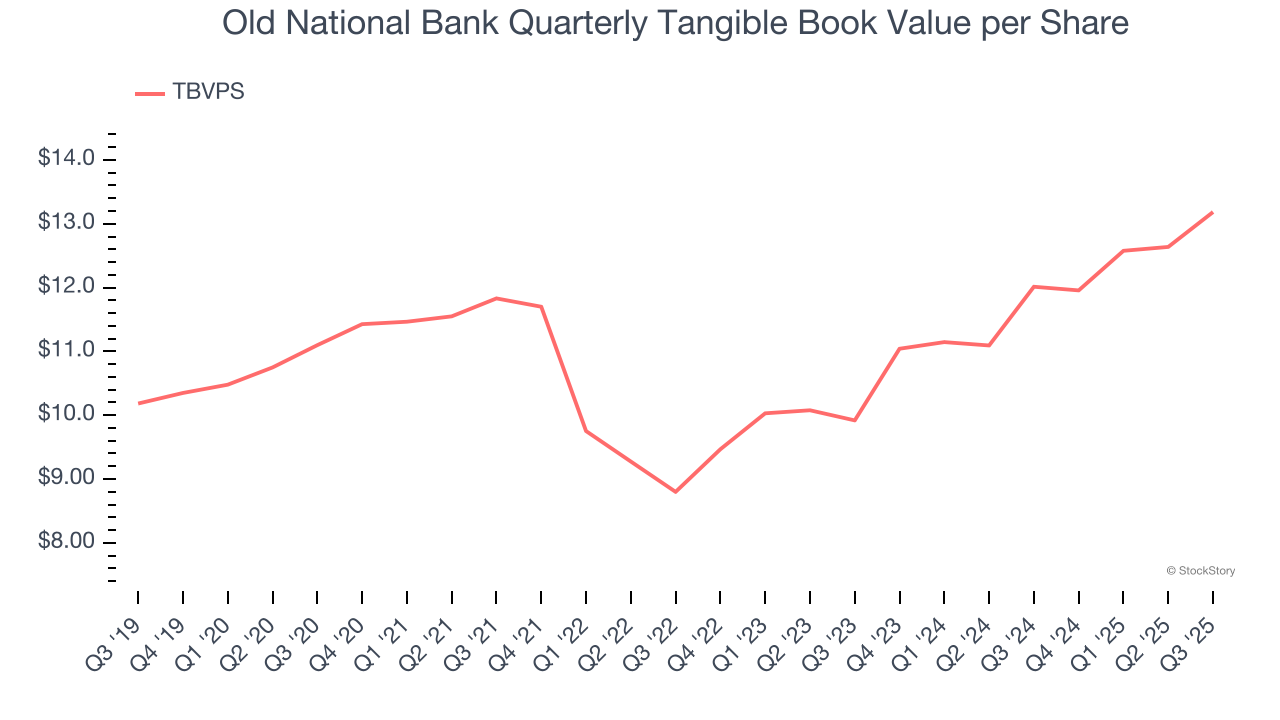

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Although Old National Bank’s TBVPS increased by a meager 3.5% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at an impressive 15.3% annual clip over the past two years (from $9.92 to $13.18 per share).

Final Judgment

Old National Bank’s business quality ultimately falls short of our standards. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $21.80 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Old National Bank

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.