Consumer products giant Clorox (NYSE: CLX) announced better-than-expected revenue in Q3 CY2025, but sales fell by 18.9% year on year to $1.43 billion. Its non-GAAP profit of $0.85 per share was 9.2% above analysts’ consensus estimates.

Is now the time to buy Clorox? Find out by accessing our full research report, it’s free for active Edge members.

Clorox (CLX) Q3 CY2025 Highlights:

- Revenue: $1.43 billion vs analyst estimates of $1.40 billion (18.9% year-on-year decline, 2% beat)

- Adjusted EPS: $0.85 vs analyst estimates of $0.78 (9.2% beat)

- Management reiterated its full-year Adjusted EPS guidance of $6.13 at the midpoint

- Operating Margin: 7.5%, down from 17.4% in the same quarter last year

- Organic Revenue fell 17% year on year vs analyst estimates of 18.2% declines (116.4 basis point beat)

- Market Capitalization: $13.75 billion

"This quarter's ERP launch marks a significant milestone in our transformation journey, empowering faster execution, greater productivity, and deeper insights — all aimed at delivering superior value to our consumers," said Chair and CEO Linda Rendle "As with any rollout of this scale, we experienced some temporary disruptions that affected our market share.

Company Overview

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE: CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $6.77 billion in revenue over the past 12 months, Clorox is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Clorox to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

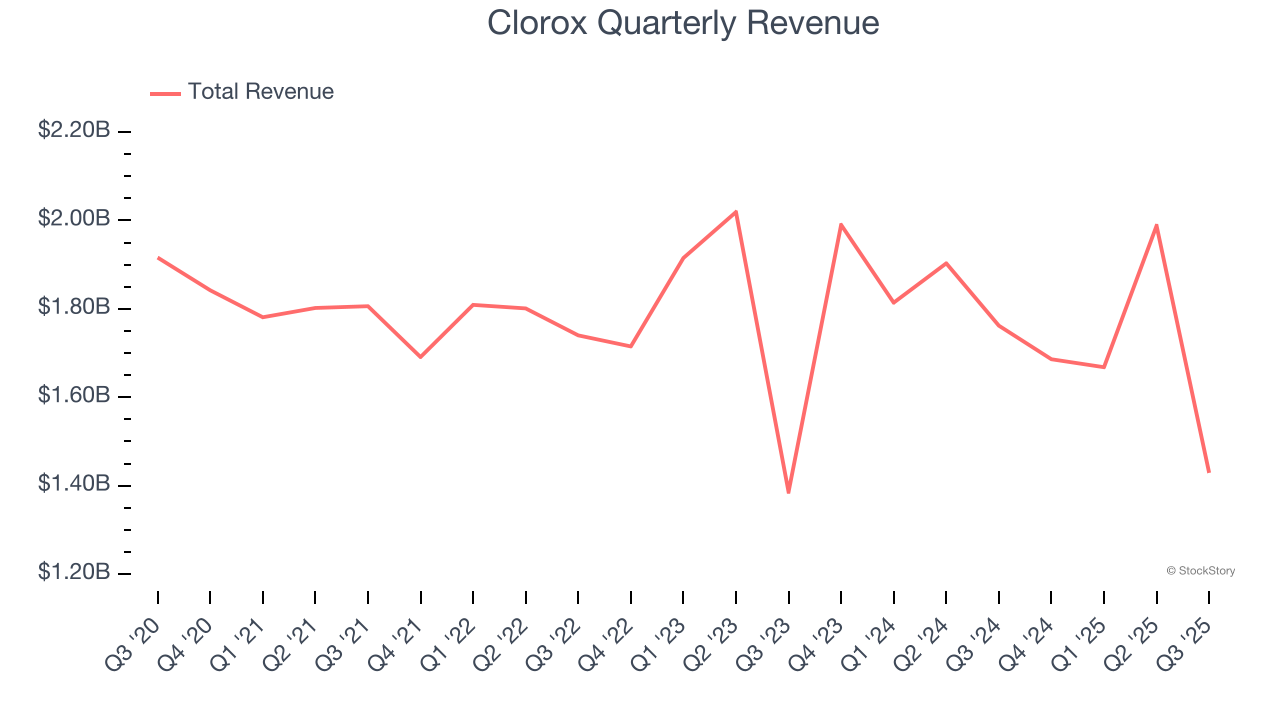

As you can see below, Clorox’s demand was weak over the last three years. Its sales fell by 1.3% annually, a poor baseline for our analysis.

This quarter, Clorox’s revenue fell by 18.9% year on year to $1.43 billion but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products will not lead to better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

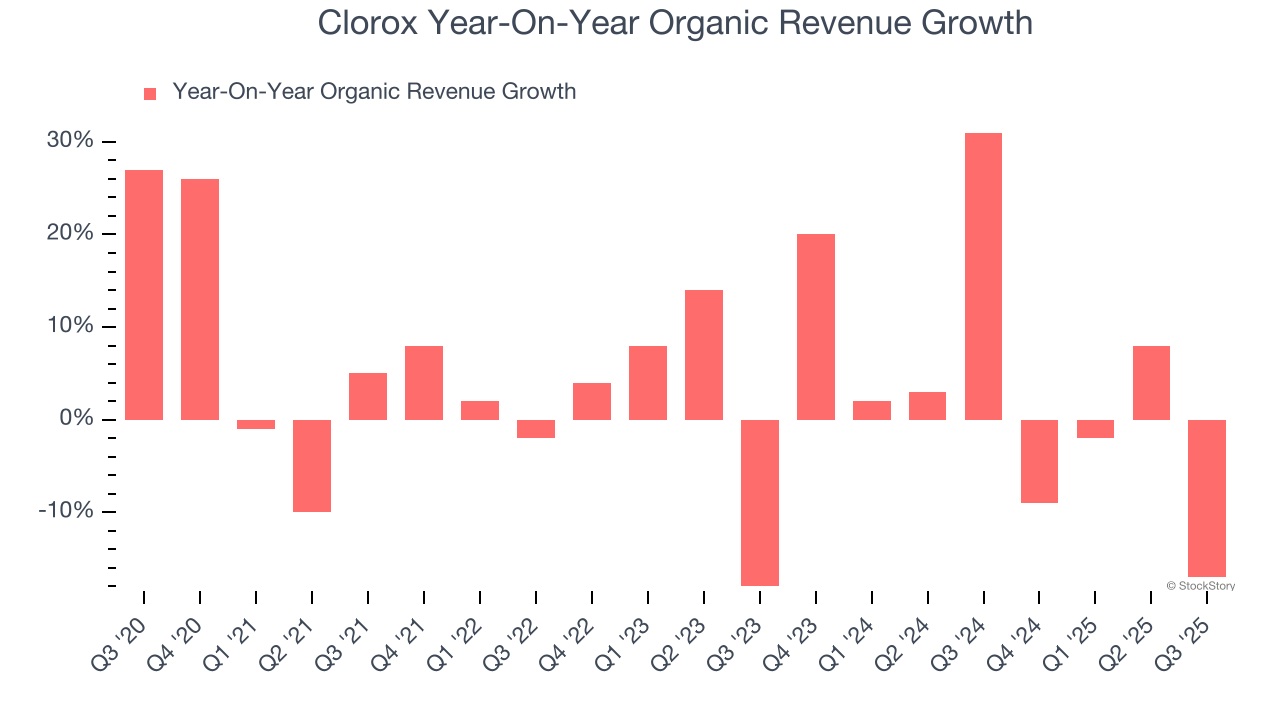

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Clorox’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.5% year on year.

In the latest quarter, Clorox’s organic sales fell by 17% year on year. This decline was a reversal from its historical levels. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Clorox’s Q3 Results

It was encouraging to see Clorox beat analysts’ revenue expectations this quarter on slightly higher-than-expected organic revenue growth. Moving down the income statement, EPS beat by a pretty convincing amount. Overall, this print had some key positives. The stock traded up 3.2% to $112.51 immediately after reporting.

Clorox may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.