Pet food company Freshpet (NASDAQ: FRPT) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 14% year on year to $288.8 million. Its GAAP profit of $1.86 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Freshpet? Find out by accessing our full research report, it’s free for active Edge members.

Freshpet (FRPT) Q3 CY2025 Highlights:

- Revenue: $288.8 million vs analyst estimates of $284.1 million (14% year-on-year growth, 1.7% beat)

- EPS (GAAP): $1.86 vs analyst estimates of $0.42 (significant beat due to $77.9 million tax benefit)

- Adjusted EBITDA: $54.61 million vs analyst estimates of $52.95 million (18.9% margin, 3.1% beat)

- EBITDA guidance for the full year is $192.5 million at the midpoint, below analyst estimates of $193.9 million

- Operating Margin: 8.6%, up from 4.7% in the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 8.7% in the same quarter last year

- Organic Revenue rose 14% year on year vs analyst estimates of 12.4% growth (163.4 basis point beat)

- Sales Volumes rose 12.9% year on year (26.1% in the same quarter last year)

- Market Capitalization: $2.4 billion

"We are quickly adjusting to the new economic reality and remain one of the best performing pet food businesses—with strong financial and operational results and category-leading growth," commented Billy Cyr, Freshpet’s Chief Executive Officer.

Company Overview

Standing out from typical processed pet foods, Freshpet (NASDAQ: FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

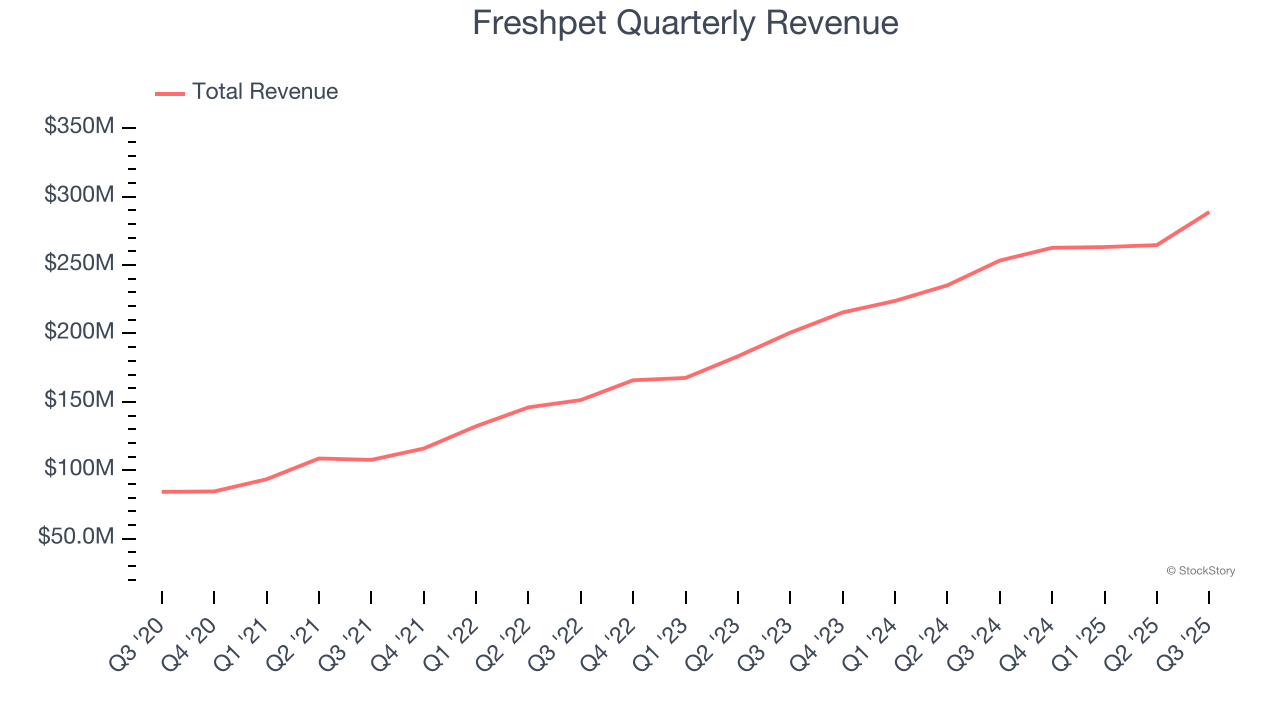

With $1.08 billion in revenue over the past 12 months, Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, Freshpet’s sales grew at an exceptional 25.6% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Freshpet reported year-on-year revenue growth of 14%, and its $288.8 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market is baking in success for its products.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Volume Growth

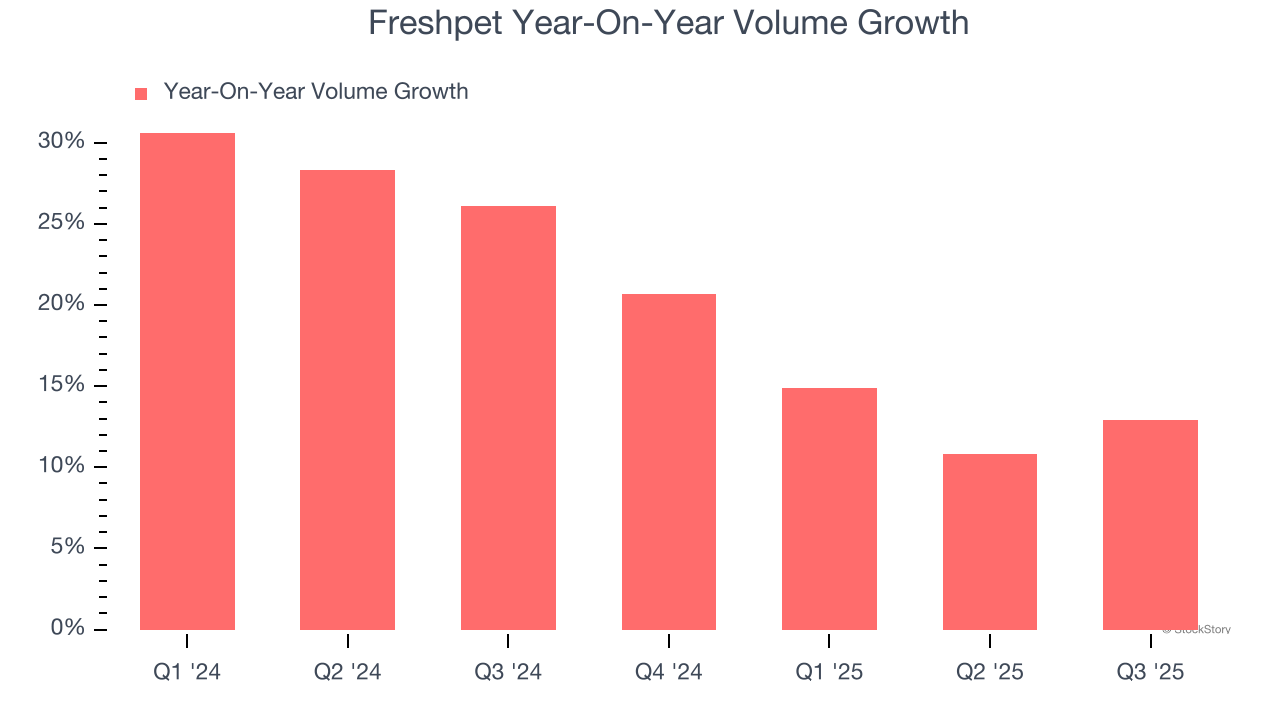

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Freshpet’s average quarterly volume growth of 20.6% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Freshpet’s Q3 2025, sales volumes jumped 12.9% year on year. This result shows the business is staying on track, but the deceleration suggests growth is getting harder to come by.

Key Takeaways from Freshpet’s Q3 Results

It was good to see Freshpet beat analysts’ revenue and EPS expectations this quarter on solid volume growth. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 6.8% to $52.55 immediately following the results.

Indeed, Freshpet had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.