Global insurance giant AIG (NYSE: AIG) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 6.3% year on year to $7.18 billion. Its non-GAAP profit of $2.20 per share was 28.5% above analysts’ consensus estimates.

Is now the time to buy AIG? Find out by accessing our full research report, it’s free for active Edge members.

AIG (AIG) Q3 CY2025 Highlights:

Company Overview

With roots dating back to 1919 when it began as a small insurance agency in Shanghai, China, AIG (NYSE: AIG) is a global insurance organization that provides commercial and personal insurance solutions to businesses and individuals across more than 200 countries.

Revenue Growth

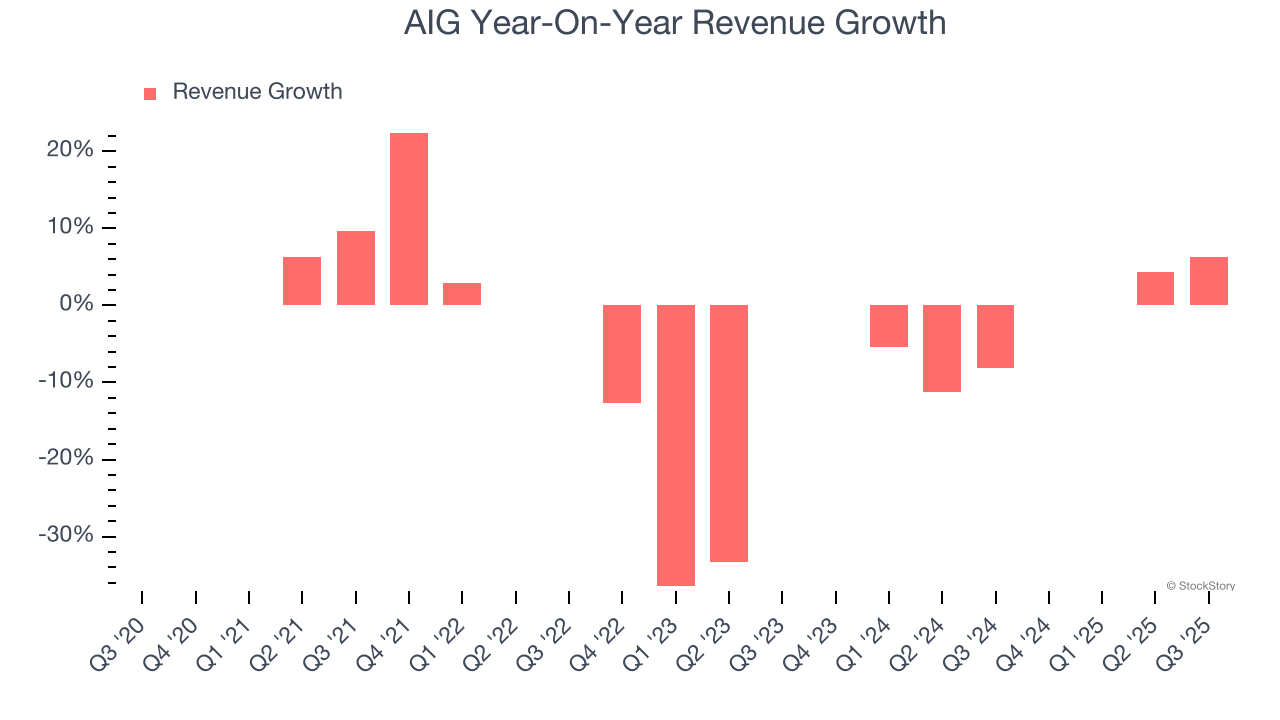

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, AIG’s demand was weak and its revenue declined by 9.7% per year. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. AIG’s annualized revenue declines of 10.4% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, AIG reported year-on-year revenue growth of 6.3%, and its $7.18 billion of revenue exceeded Wall Street’s estimates by 5.1%.

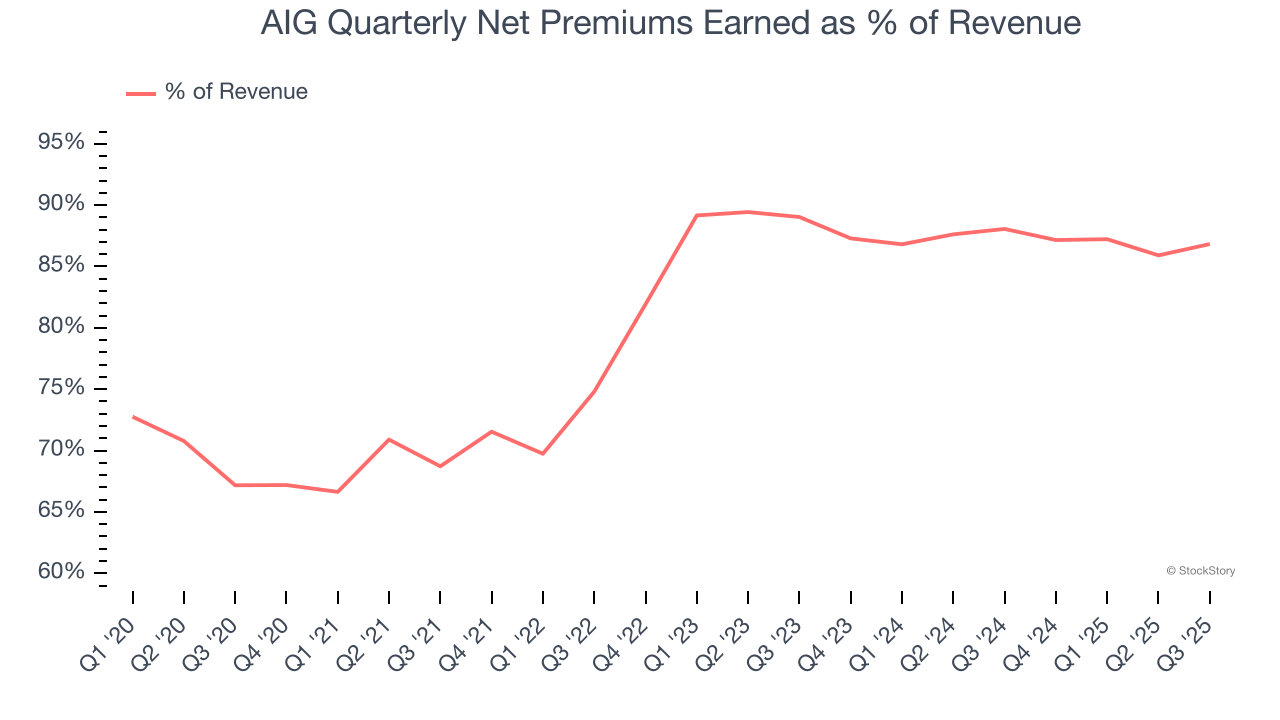

Net premiums earned made up 78.7% of the company’s total revenue during the last five years, meaning insurance operations are AIG’s largest source of revenue.

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

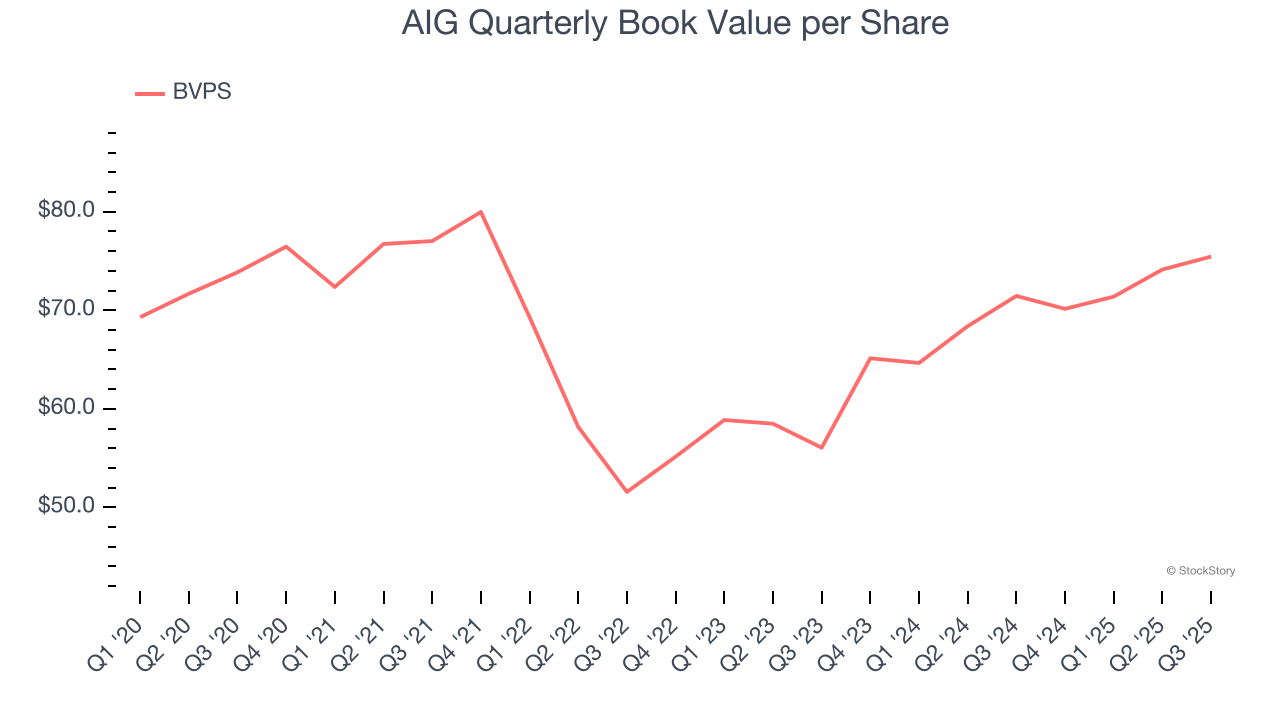

Book Value Per Share (BVPS)

Insurers are balance sheet businesses, collecting premiums upfront and paying out claims over time. Premiums collected but not yet paid out, often referred to as the float, are invested and create an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

AIG’s BVPS was flat over the last five years. However, BVPS growth has accelerated recently, growing by 16% annually over the last two years from $56.06 to $75.45 per share.

Over the next 12 months, Consensus estimates call for AIG’s BVPS to grow by 19.6% to $79.21, elite growth rate.

Key Takeaways from AIG’s Q3 Results

It was good to see AIG beat analysts’ EPS expectations this quarter. We were also excited its net premiums earned outperformed Wall Street’s estimates by a wide margin. On the other hand, its book value per share missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $81 immediately after reporting.

AIG had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.