Cybersecurity software provider Rapid7 (NASDAQ: RPD) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 1.5% year on year to $218 million. On the other hand, next quarter’s revenue guidance of $215 million was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.57 per share was 24.9% above analysts’ consensus estimates.

Is now the time to buy Rapid7? Find out by accessing our full research report, it’s free for active Edge members.

Rapid7 (RPD) Q3 CY2025 Highlights:

- Revenue: $218 million vs analyst estimates of $215.9 million (1.5% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.57 vs analyst estimates of $0.46 (24.9% beat)

- Adjusted Operating Income: $36.91 million vs analyst estimates of $30.21 million (16.9% margin, 22.2% beat)

- Revenue Guidance for Q4 CY2025 is $215 million at the midpoint, below analyst estimates of $217.9 million

- Management raised its full-year Adjusted EPS guidance to $2.05 at the midpoint, a 4.6% increase

- Operating Margin: 2.7%, down from 6% in the same quarter last year

- Free Cash Flow Margin: 13.8%, down from 19.7% in the previous quarter

- Customers: 11,618, down from 11,643 in the previous quarter

- Annual Recurring Revenue: $837.7 million vs analyst estimates of $840.8 million (1.8% year-on-year growth, in line)

- Market Capitalization: $1.21 billion

"We ended the third quarter with $838 million in ARR as our AI-driven Command Platform continues to gain market validation," said Corey Thomas, CEO of Rapid7.

Company Overview

With its name inspired by the need for quick responses to cyber threats, Rapid7 (NASDAQ: RPD) provides cybersecurity software and services that help organizations detect vulnerabilities, monitor threats, and respond to security incidents.

Revenue Growth

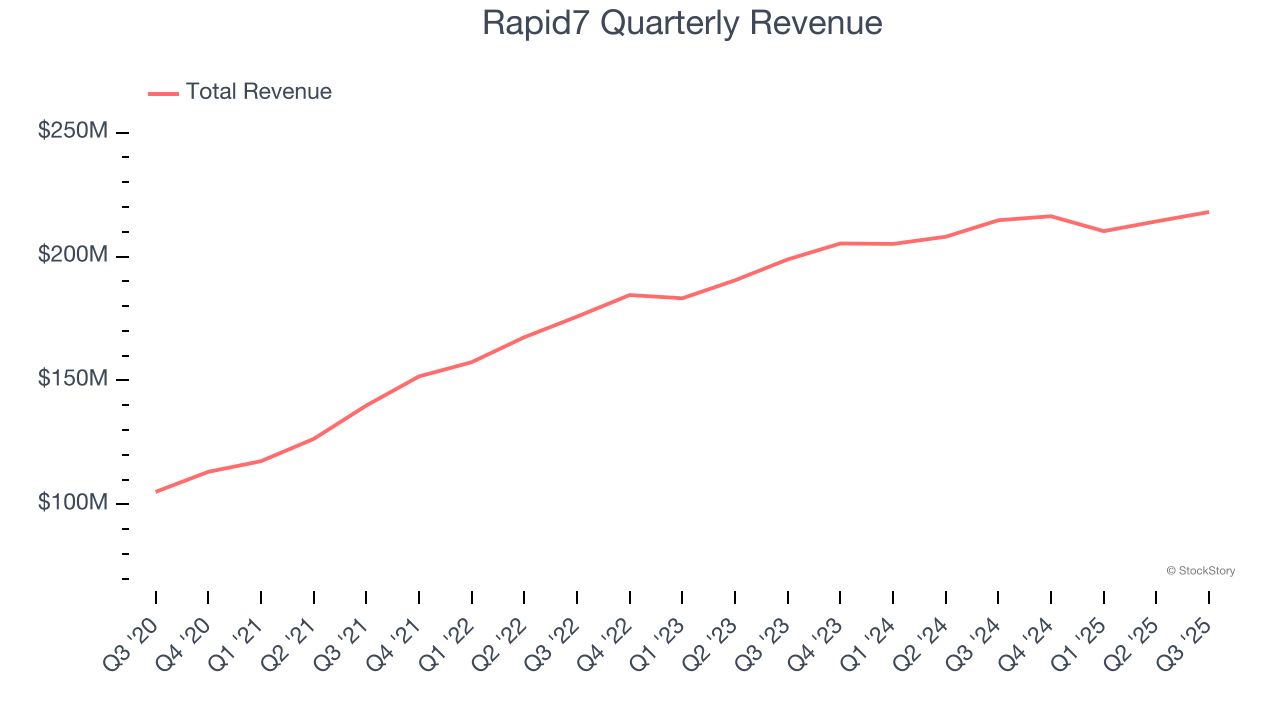

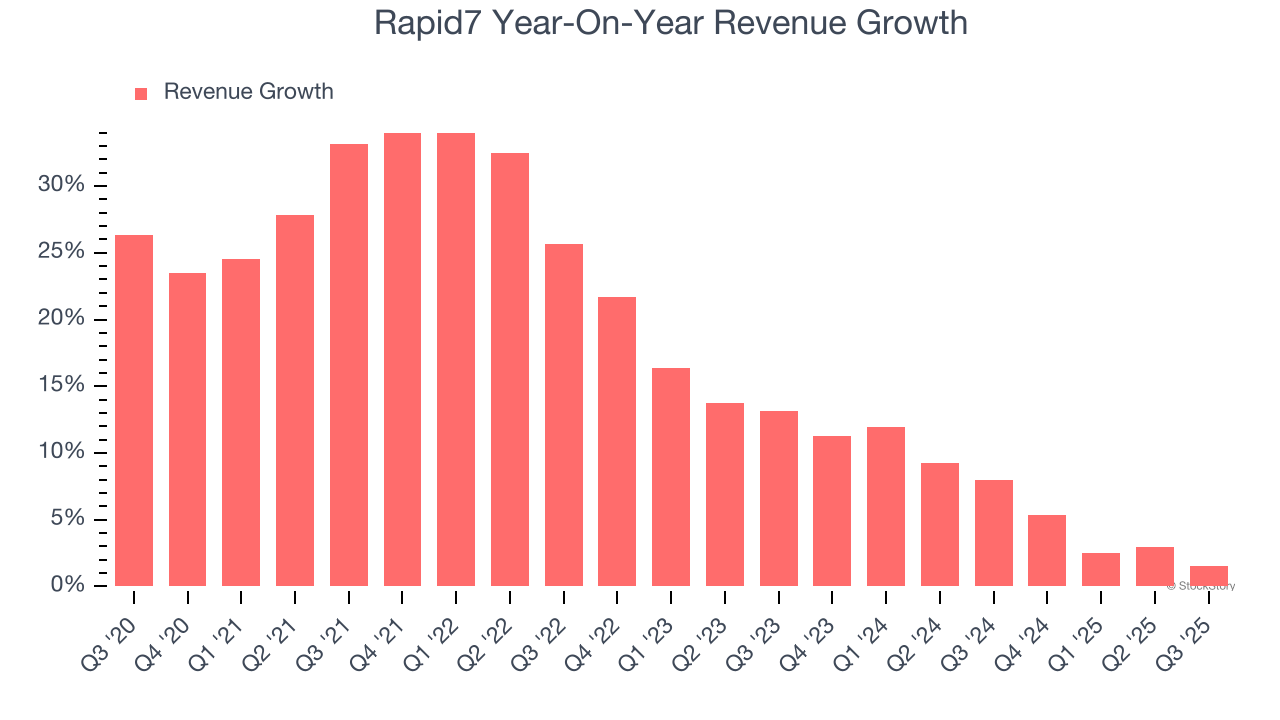

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Rapid7 grew its sales at a 17.1% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Rapid7’s recent performance shows its demand has slowed as its annualized revenue growth of 6.5% over the last two years was below its five-year trend.

This quarter, Rapid7 reported modest year-on-year revenue growth of 1.5% but beat Wall Street’s estimates by 0.9%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

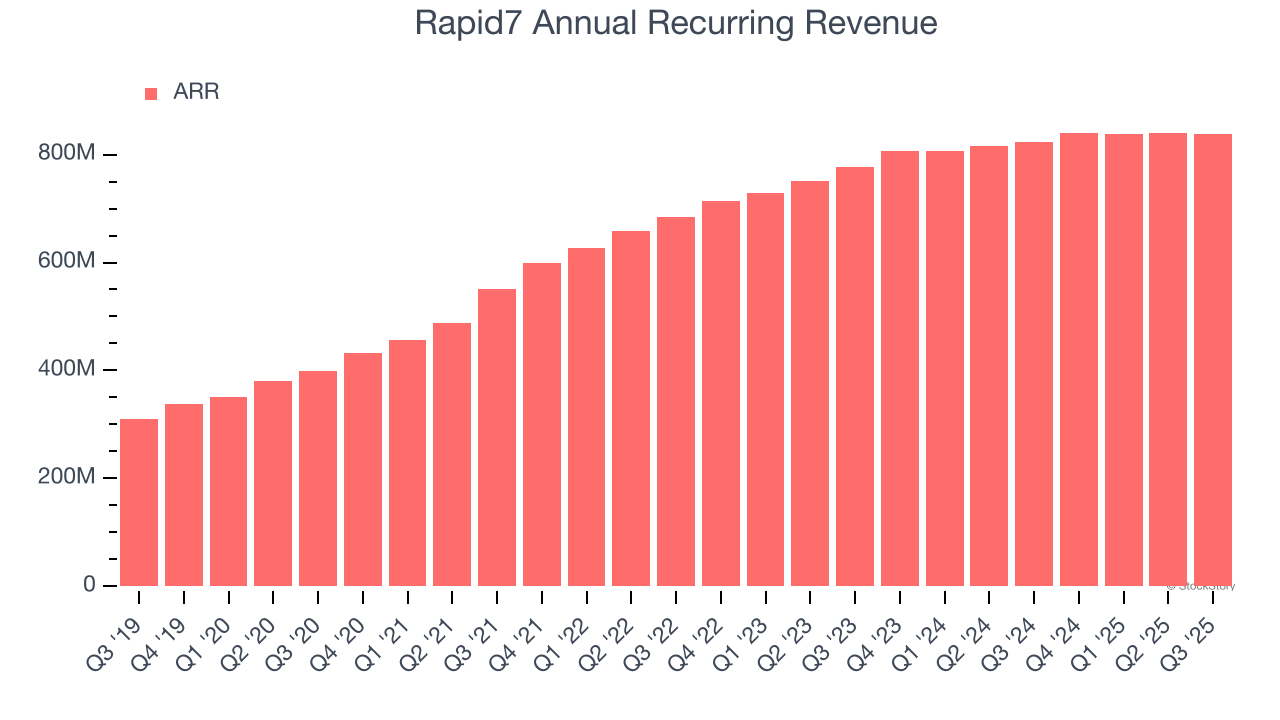

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Rapid7’s ARR came in at $837.7 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 3.2% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

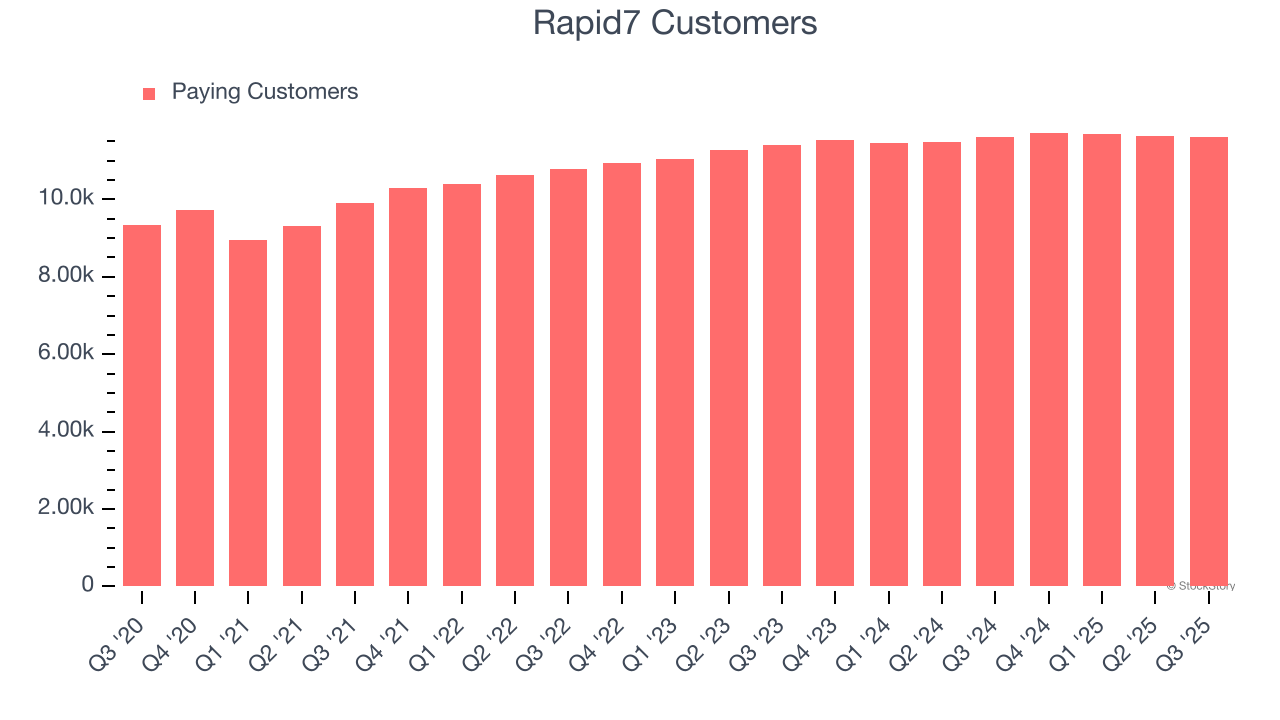

Customer Base

Rapid7 reported 11,618 customers at the end of the quarter, a sequential decrease of 25. That’s better than last quarter but a bit below what we’ve seen over the previous year. Furthermore, the increase wasn’t backed by an equivalent increase in annualized recurring revenue (ARR), so Rapid7 is likely winning disproportionately smaller customers.

Key Takeaways from Rapid7’s Q3 Results

We were impressed by how significantly Rapid7 blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. These guidance misses are weighing on shares, and the stock traded down 5.6% to $16.81 immediately after reporting.

Is Rapid7 an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.