As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the office & commercial furniture industry, including MillerKnoll (NASDAQ: MLKN) and its peers.

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

The 4 office & commercial furniture stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.5% since the latest earnings results.

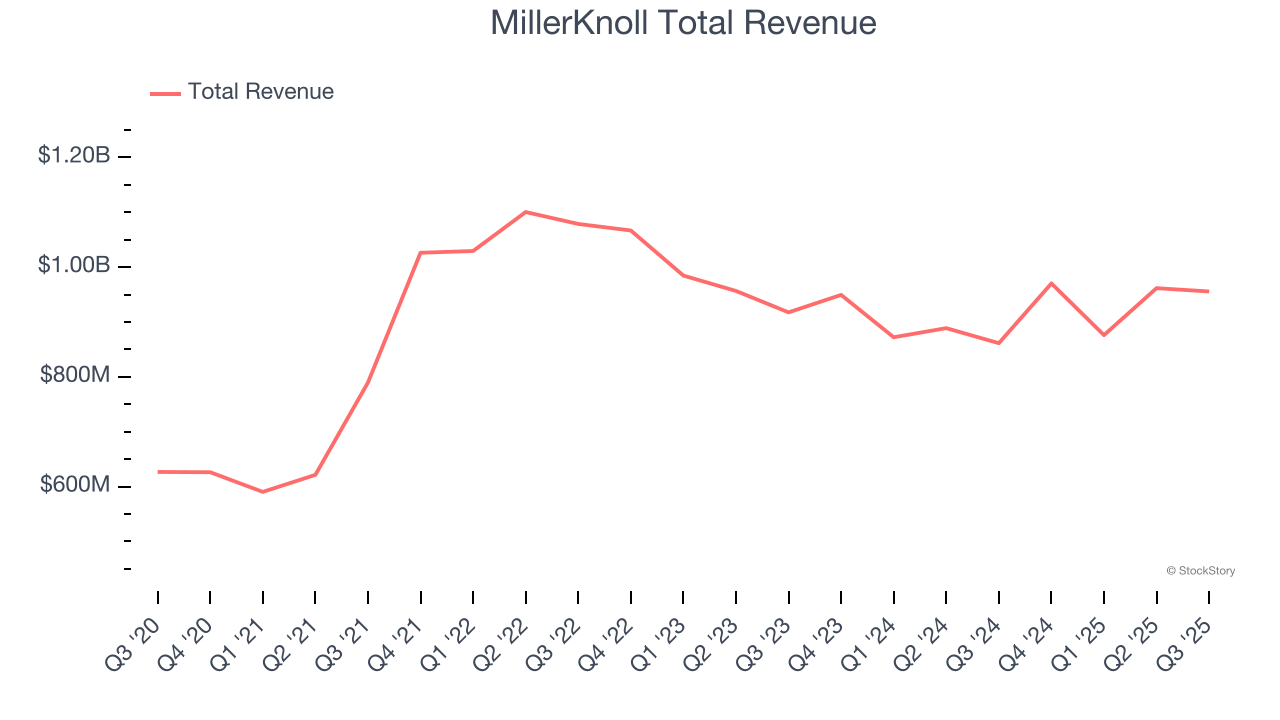

MillerKnoll (NASDAQ: MLKN)

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ: MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

MillerKnoll reported revenues of $955.7 million, up 10.9% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

MillerKnoll pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 19.5% since reporting and currently trades at $15.25.

Is now the time to buy MillerKnoll? Access our full analysis of the earnings results here, it’s free for active Edge members.

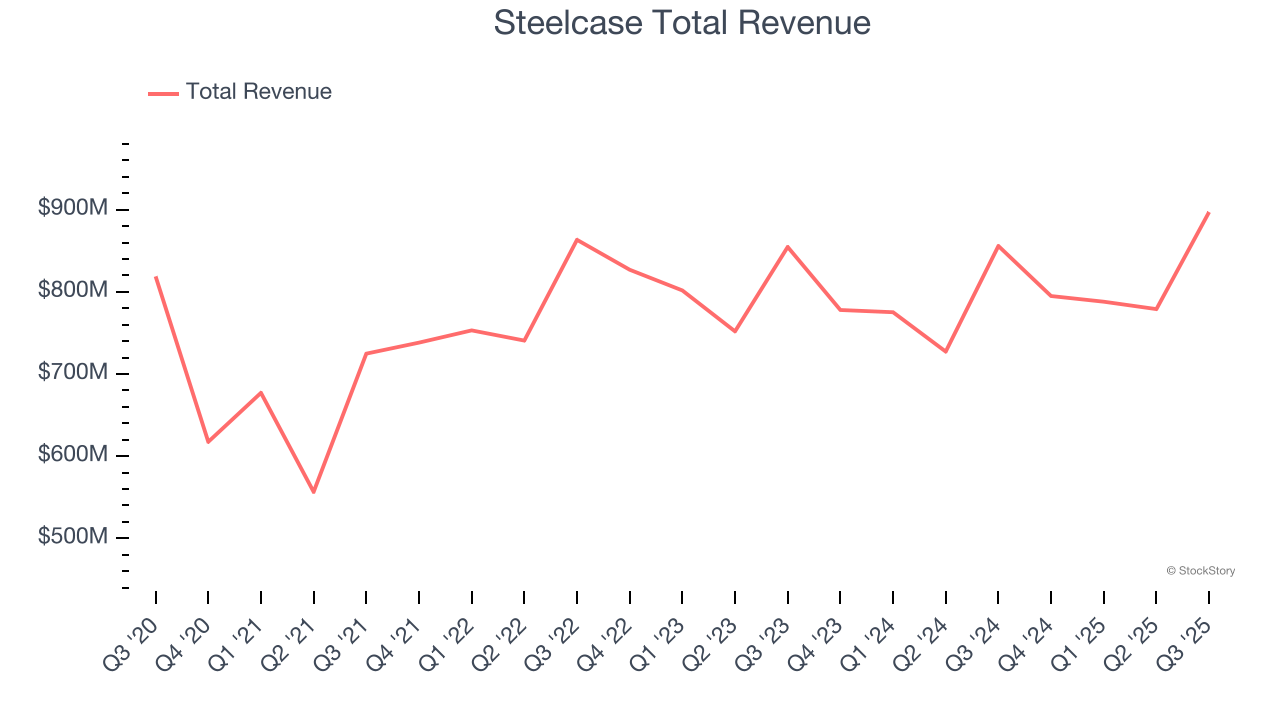

Best Q3: Steelcase (NYSE: SCS)

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE: SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

Steelcase reported revenues of $897.1 million, up 4.8% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.1% since reporting. It currently trades at $15.84.

Is now the time to buy Steelcase? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: HNI (NYSE: HNI)

With roots dating back to 1944 and a significant acquisition of Kimball International in 2023, HNI (NYSE: HNI) manufactures and sells office furniture systems, seating, and storage solutions, as well as residential fireplaces and heating products.

HNI reported revenues of $683.8 million, up 1.7% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and a slight miss of analysts’ revenue estimates.

HNI delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 10.5% since the results and currently trades at $40.22.

Read our full analysis of HNI’s results here.

Interface (NASDAQ: TILE)

Pioneering carbon-neutral flooring since its founding in 1973, Interface (NASDAQ: TILE) is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

Interface reported revenues of $364.5 million, up 5.9% year on year. This print topped analysts’ expectations by 2%. It was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is down 2.9% since reporting and currently trades at $25.87.

Read our full, actionable report on Interface here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.