E-commerce platform Shopify (NYSE: SHOP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 31.5% year on year to $2.84 billion. On top of that, next quarter’s revenue guidance ($3.59 billion at the midpoint) was surprisingly good and 3.1% above what analysts were expecting. Its GAAP profit of $0.20 per share was 21.4% below analysts’ consensus estimates.

Is now the time to buy Shopify? Find out by accessing our full research report, it’s free for active Edge members.

Shopify (SHOP) Q3 CY2025 Highlights:

- Revenue: $2.84 billion vs analyst estimates of $2.76 billion (31.5% year-on-year growth, 3.1% beat)

- GMV: $92.0 billion vs analyst estimates of $89.2 billion (32.0% year-on-year growth, 3.1% beat)

- EPS (GAAP): $0.20 vs analyst expectations of $0.25 (21.4% miss)

- Operating Profit: $343 million (12.1% margin, 21.2% year-on-year growth, 2.6% beat)

- Revenue Guidance for Q4 CY2025 is $3.59 billion at the midpoint, above analyst estimates of $3.48 billion

- Operating Margin: 12.1%, down from 13.1% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 15.7% in the previous quarter

- Market Capitalization: $224.8 billion

Company Overview

Starting with just three people selling snowboards online in 2004, Shopify (NYSE: SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Shopify grew its sales at an excellent 34.2% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Shopify’s annualized revenue growth of 26.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Shopify reported wonderful year-on-year revenue growth of 31.5%, and its $2.84 billion of revenue exceeded Wall Street’s estimates by 3.1%. Company management is currently guiding for a 27.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.8% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and implies the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Gross Merchandise Value

GMV, or gross merchandise value, is the total value of goods and services sold on Shopify’s platform. This is the number from which the company will ultimately collect fees (usually called a take rate), and the higher it is, the higher the switching costs, enabling Shopify to monetize in additional ways (like subscription revenue for more services).

Shopify’s GMV punched in at $92.01 billion in Q3, and over the last four quarters, its growth was fantastic as it averaged 27.8% year-on-year increases. This alternate topline metric grew slower than total sales, meaning its revenue from adjacent products such as merchant loans and AI-driven inventory management software outpaced its transaction fees. This signals the company is locking its customers further into its platform and mining them for profits.

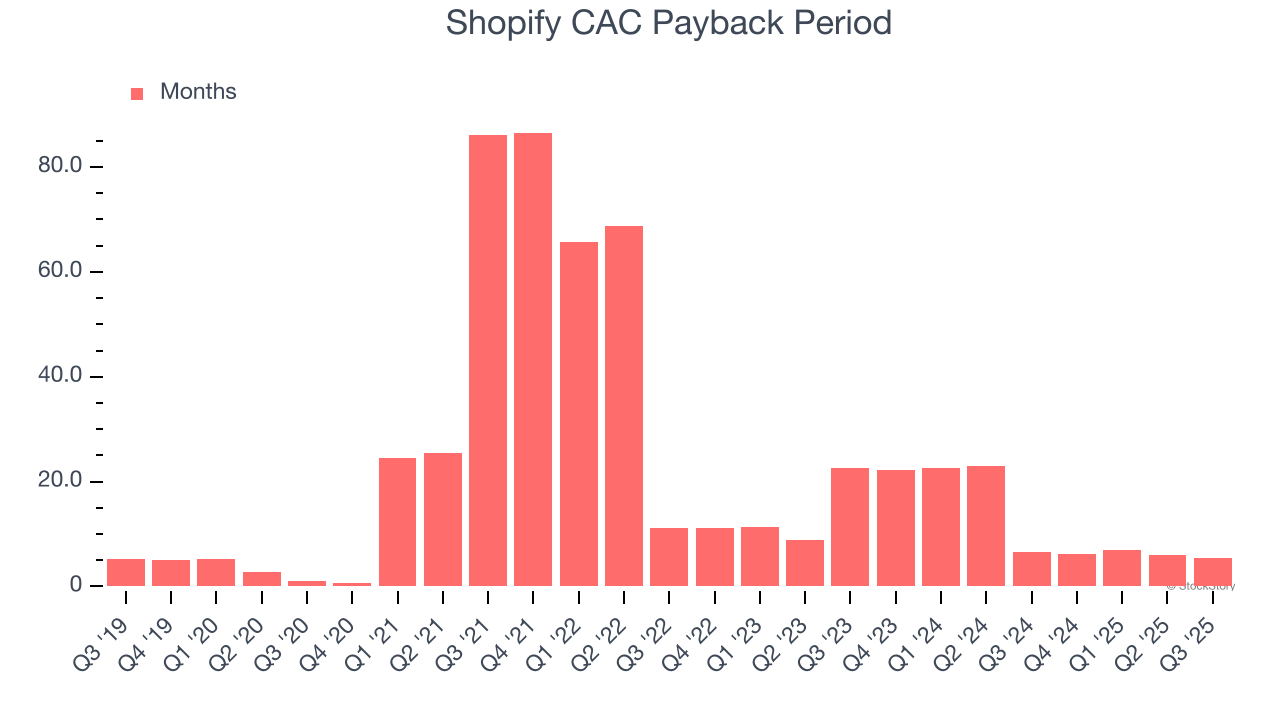

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Shopify more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Shopify’s Q3 Results

We enjoyed seeing Shopify beat analysts’ gross merchandise volume expectations this quarter. This led to beats on the revenue and operating profit lines. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 3.5% to $166.53 immediately after reporting.

So should you invest in Shopify right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.