Restaurant technology platform Toast (NYSE: TOST) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 25.1% year on year to $1.63 billion. Its GAAP profit of $0.16 per share was 27.7% above analysts’ consensus estimates.

Is now the time to buy Toast? Find out by accessing our full research report, it’s free for active Edge members.

Toast (TOST) Q3 CY2025 Highlights:

- Revenue: $1.63 billion vs analyst estimates of $1.59 billion (25.1% year-on-year growth, 3% beat)

- EPS (GAAP): $0.16 vs analyst estimates of $0.13 (27.7% beat)

- Adjusted EBITDA: $176 million vs analyst estimates of $149.5 million (10.8% margin, 17.8% beat)

- EBITDA guidance for the full year is $615 million at the midpoint, above analyst estimates of $587.9 million

- Operating Margin: 5.1%, up from 2.6% in the same quarter last year

- Free Cash Flow Margin: 9.4%, down from 13.4% in the previous quarter

- Annual Recurring Revenue: $2 million vs analyst estimates of $2 billion (99.9% year-on-year decline, 99.9% miss)

- Market Capitalization: $20.82 billion

Company Overview

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE: TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

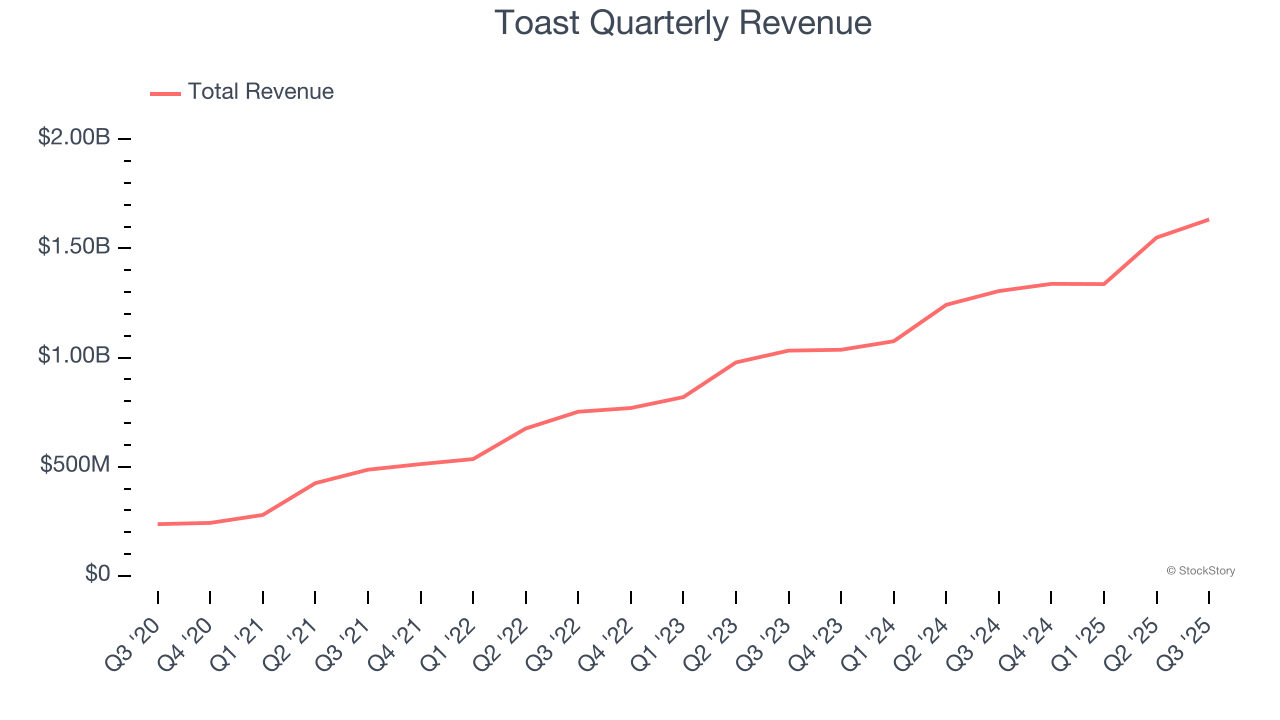

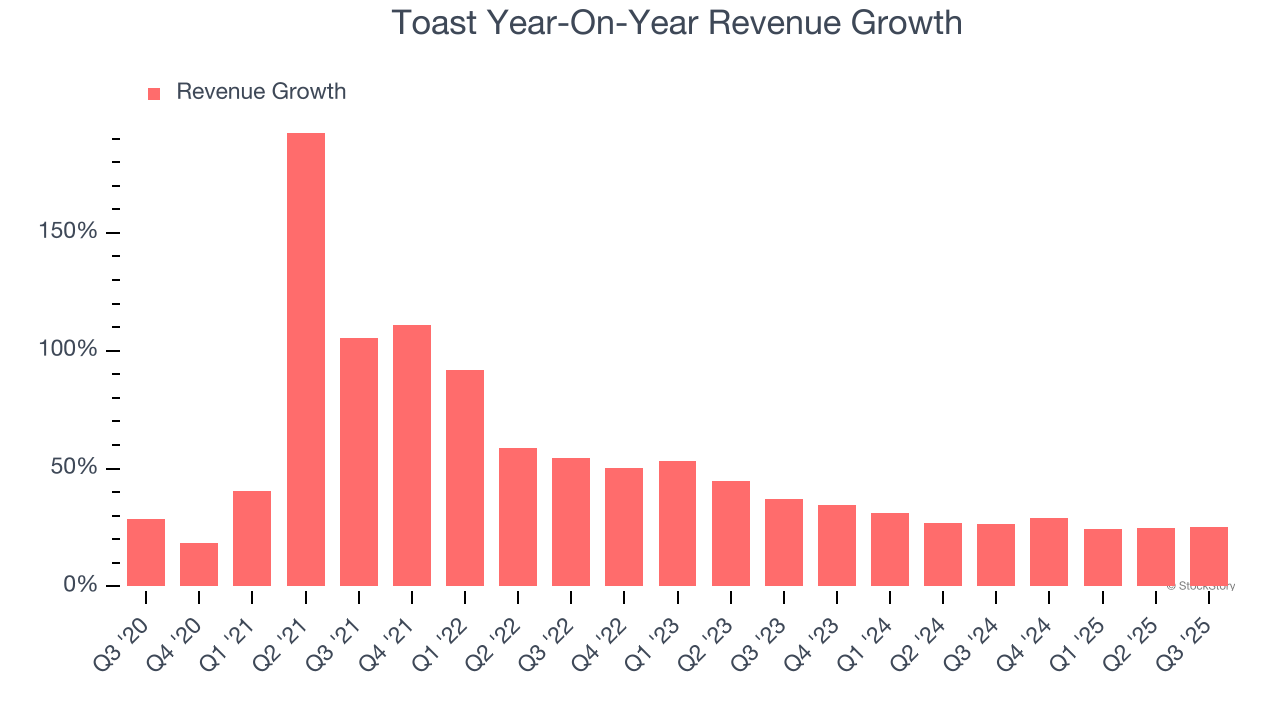

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Toast’s 49.5% annualized revenue growth over the last five years was incredible. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Toast’s annualized revenue growth of 27.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Toast reported robust year-on-year revenue growth of 25.1%, and its $1.63 billion of revenue topped Wall Street estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 19.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and indicates the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

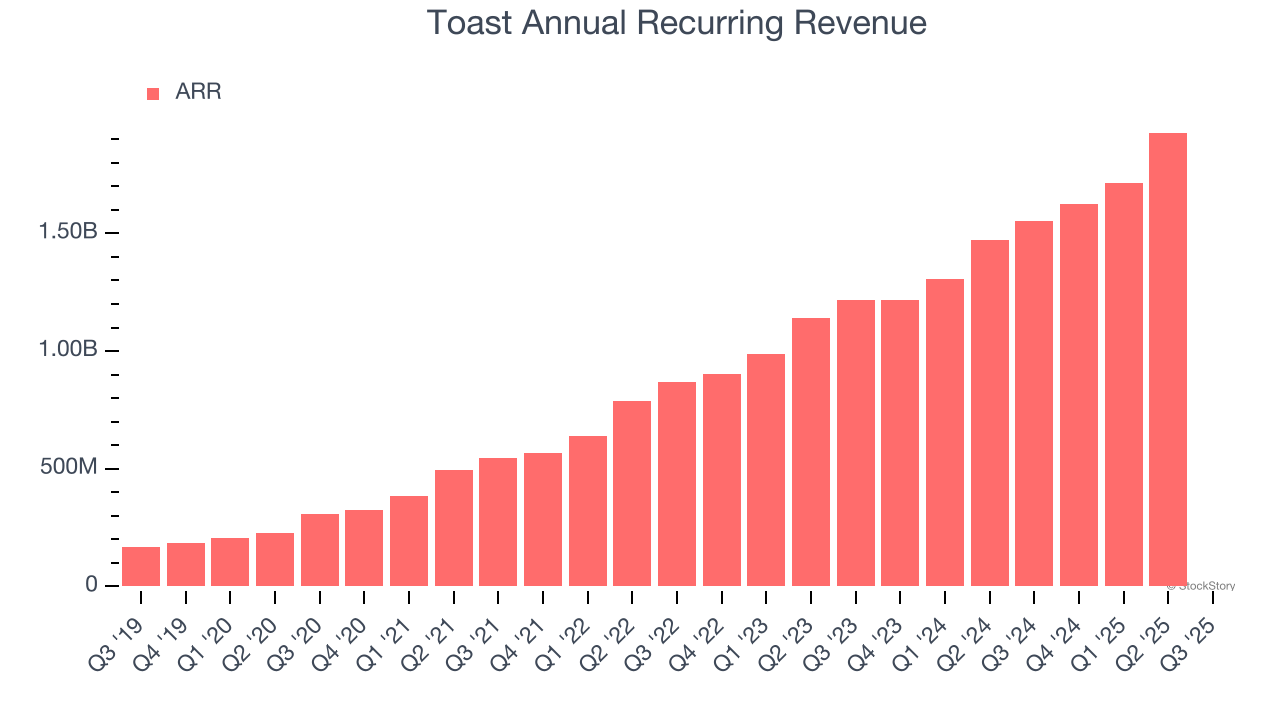

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Toast’s ARR came in at $2 million in Q3, and it averaged 1.1% year-on-year declines over the last four quarters. This alternate topline metric underperformed its total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Toast’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Toast’s products and its peers.

Key Takeaways from Toast’s Q3 Results

We were impressed by how significantly Toast blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its annual recurring revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.1% to $36.78 immediately following the results.

Indeed, Toast had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.