While the S&P 500 is up 19.8% since May 2025, Charles Schwab (currently trading at $93.32 per share) has lagged behind, posting a return of 11.9%. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy SCHW? Or are investors better off allocating their money elsewhere?

Why Do Investors Watch SCHW Stock?

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE: SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Three Positive Attributes:

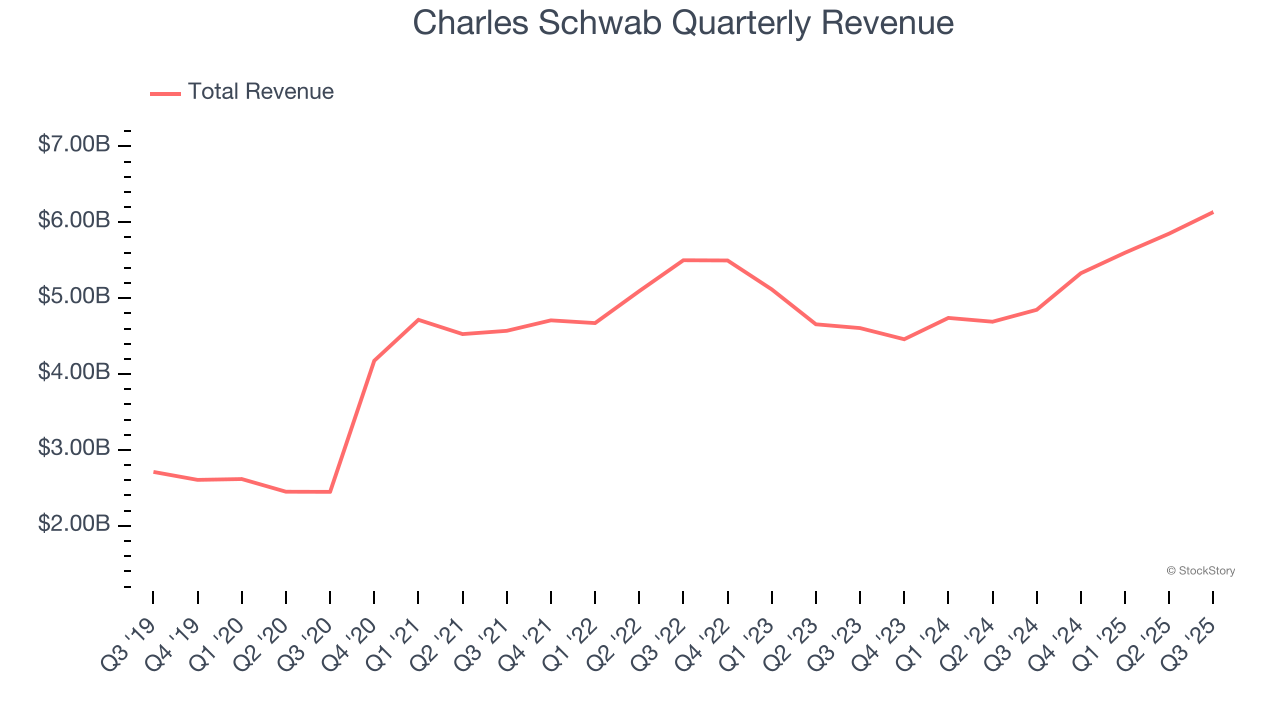

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, Charles Schwab’s revenue grew at an impressive 17.8% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

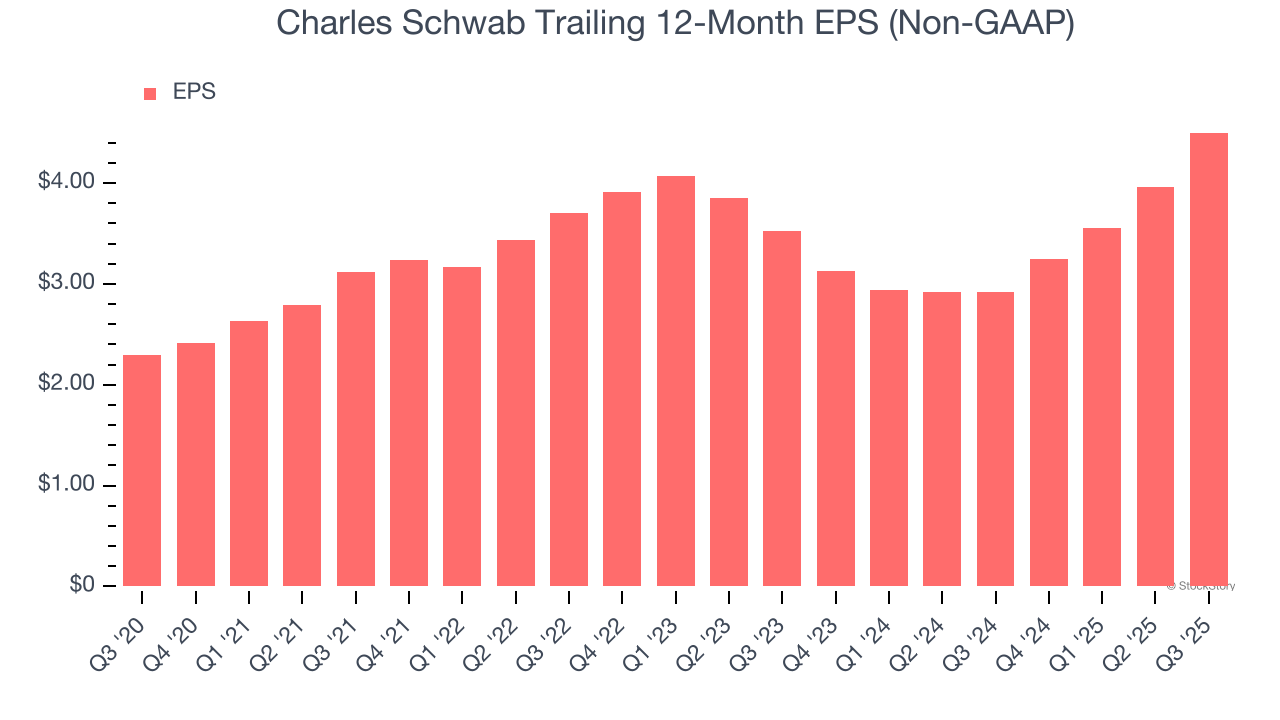

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Charles Schwab’s EPS grew at a solid 14.5% compounded annual growth rate over the last five years. This performance was better than most financials businesses.

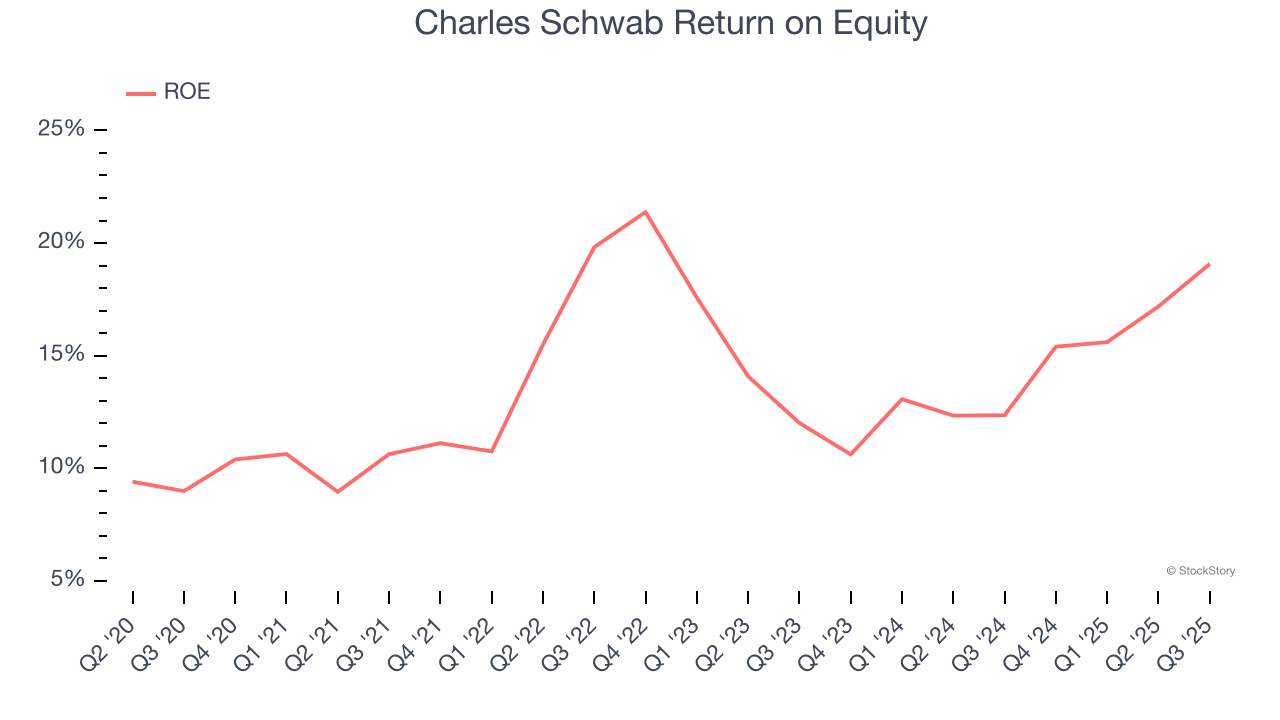

3. Market-Beating ROE Showcases Attractive Growth Opportunities

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Charles Schwab has averaged an ROE of 13.9%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Charles Schwab has a decent competitive moat.

Final Judgment

There are definitely things to like about Charles Schwab. With its shares lagging the market recently, the stock trades at 17.3× forward P/E (or $93.32 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Charles Schwab

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.